Answered step by step

Verified Expert Solution

Question

1 Approved Answer

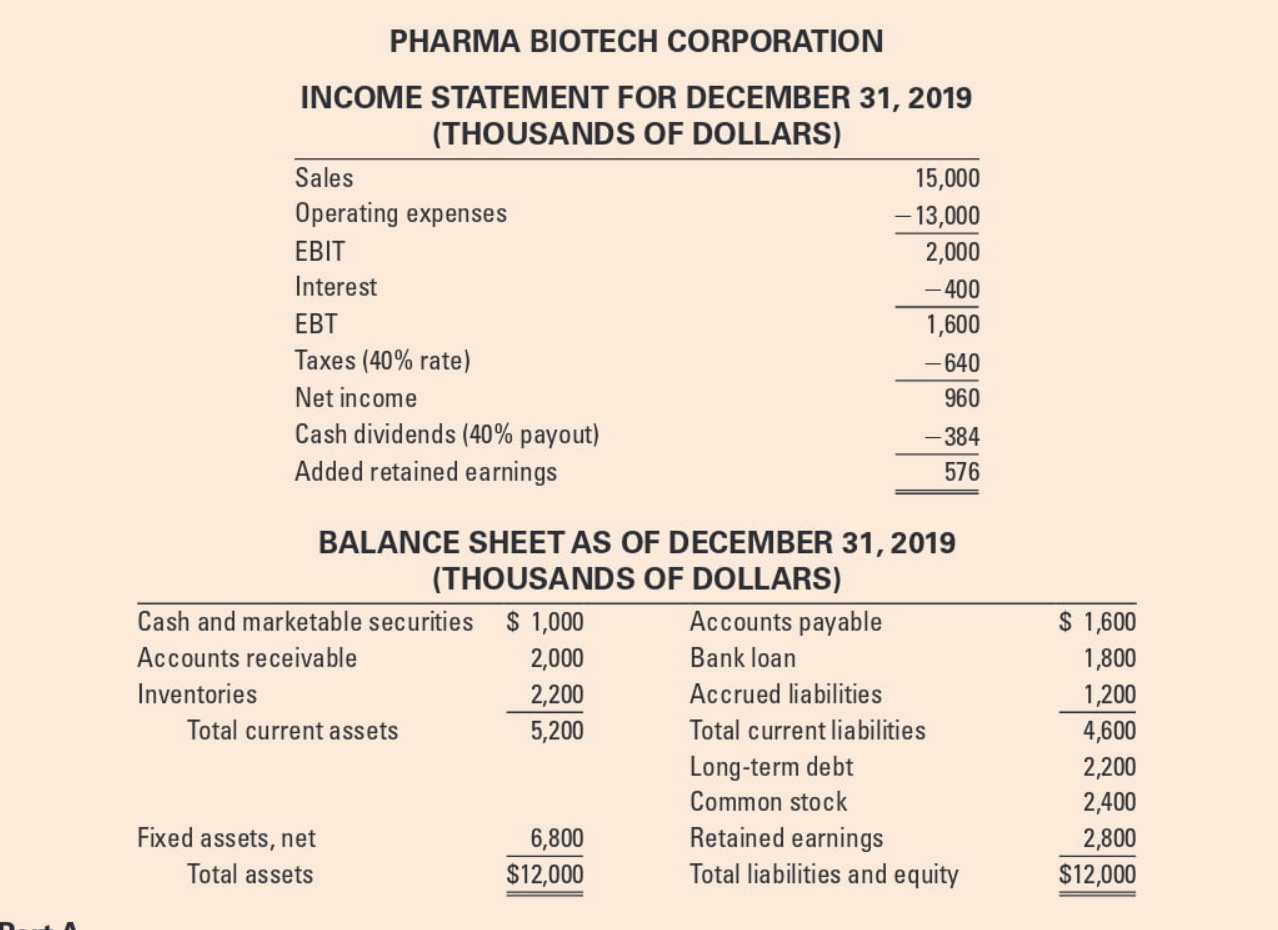

BALANCE SHEET AS OF DECEMBER 31, 2019 (THOUSANDS OF DOLLARS) Pharma Biotech is interested in developing an initial big picture of the size of financing

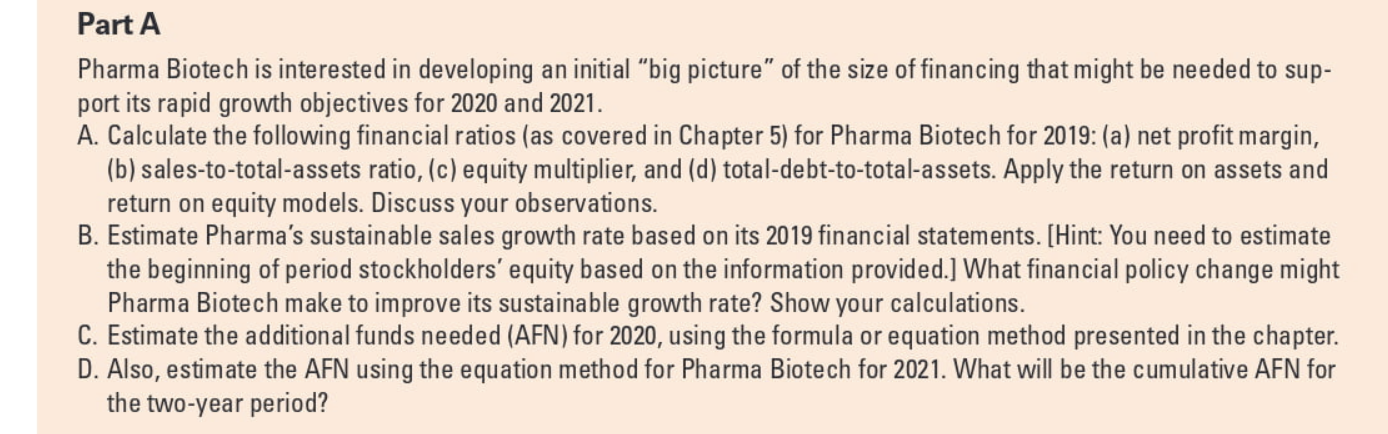

BALANCE SHEET AS OF DECEMBER 31, 2019 (THOUSANDS OF DOLLARS) Pharma Biotech is interested in developing an initial "big picture" of the size of financing that might be needed to support its rapid growth objectives for 2020 and 2021. A. Calculate the following financial ratios (as covered in Chapter 5) for Pharma Biotech for 2019: (a) net profit margin, (b) sales-to-total-assets ratio, (c) equity multiplier, and (d) total-debt-to-total-assets. Apply the return on assets and return on equity models. Discuss your observations. B. Estimate Pharma's sustainable sales growth rate based on its 2019 financial statements. [Hint: You need to estimate the beginning of period stockholders' equity based on the information provided.] What financial policy change might Pharma Biotech make to improve its sustainable growth rate? Show your calculations. C. Estimate the additional funds needed (AFN) for 2020, using the formula or equation method presented in the chapter. D. Also, estimate the AFN using the equation method for Pharma Biotech for 2021. What will be the cumulative AFN for the two-year period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started