Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Balance Sheet As of December 31, Year 2 begin{tabular}{|l|l|l|} hline Assets & & hline Cash & & hline Accounts receivable & &

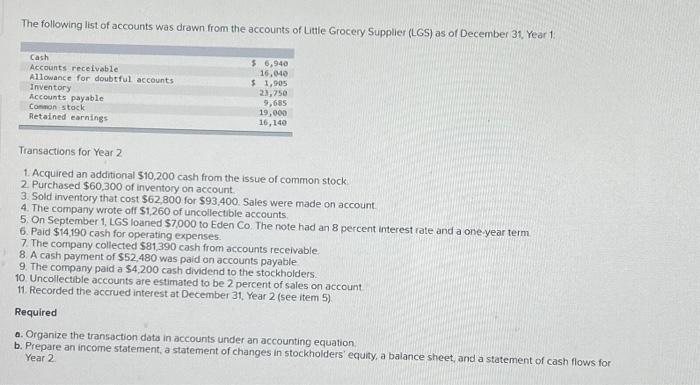

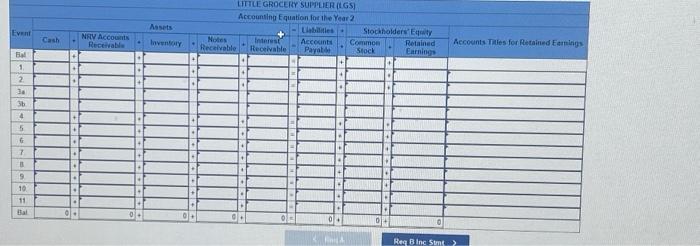

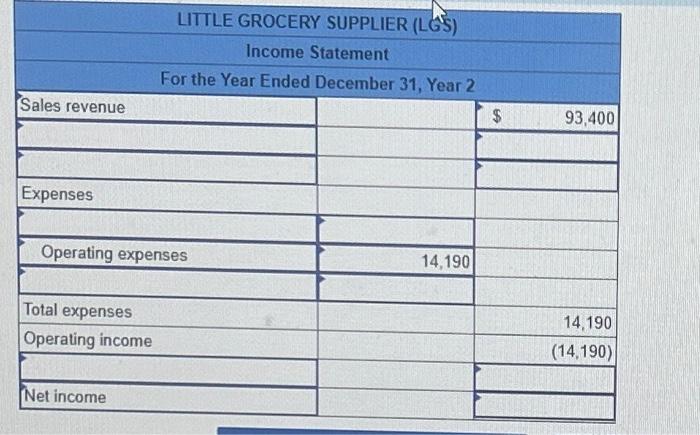

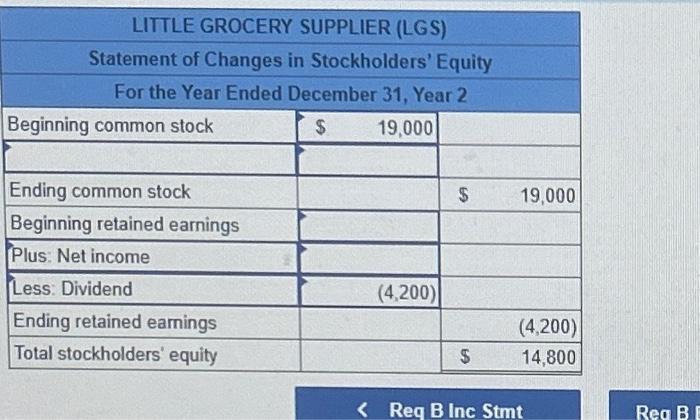

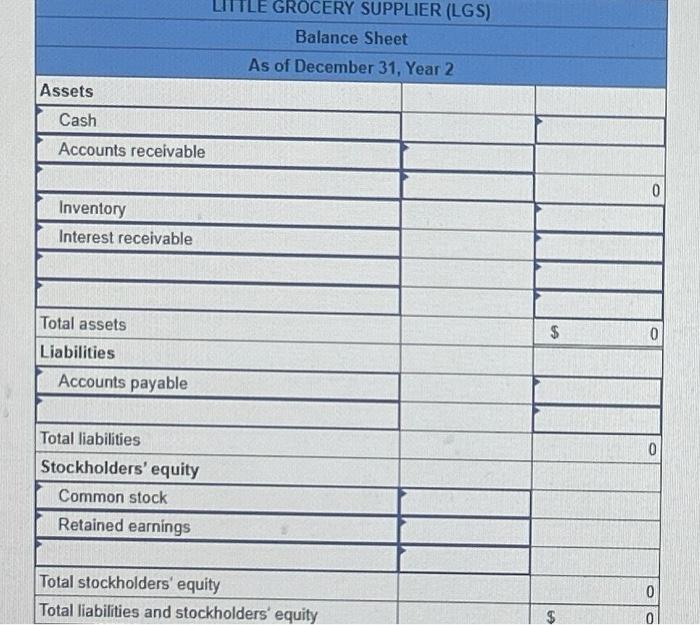

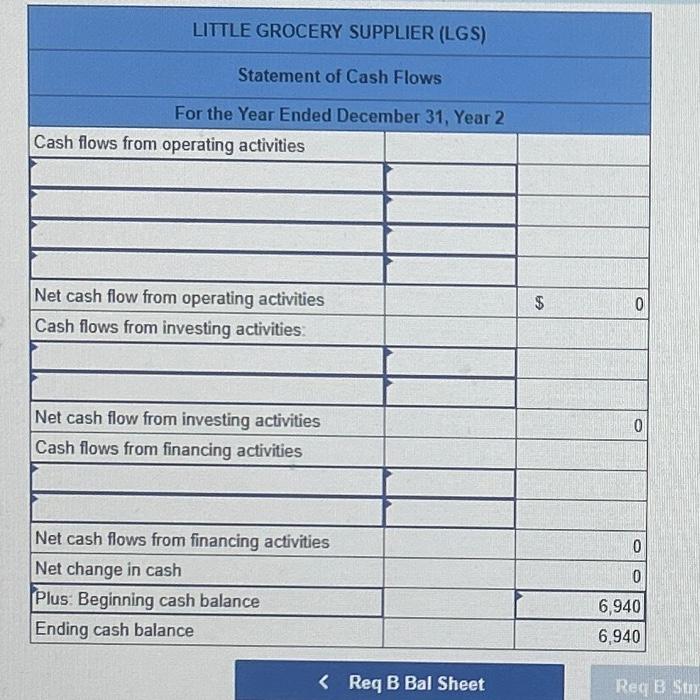

Balance Sheet As of December 31, Year 2 \begin{tabular}{|l|l|l|} \hline Assets & & \\ \hline Cash & & \\ \hline Accounts receivable & & \\ \hline & & \\ \hline Inventory & & \\ \hline Interest receivable & & \\ \hline & & \\ \hline Total assets & & \\ \hline Liabilities & & \\ \hline Accounts payable & & \\ \hline & & \\ \hline Total liabilities & & \\ \hline Stockholders' equity & & \\ \hline Common stock & & \\ \hline Retained earnings & & \\ \hline & & \\ \hline Total stockholders' equity & & \\ \hline Total liabilities and stockholders' equity & & \\ \hline \end{tabular} LITTLE GROCERY SUPPLIER (LGS) Income Statement For the Year Ended December 31, Year 2 \begin{tabular}{|l|r|r|} \hline Sales revenue & & $ \\ \hline & & 93,400 \\ \hline Expenses & & \\ \hline & & \\ \hline Operating expenses & & \\ \hline Total expenses & 14,190 & \\ \hline Operating income & & \\ \hline & & \\ \hline Net income & & 14,190 \\ \hline \end{tabular} The following list of accounts was drawn from the accounts of Littie Grocery Supplier (LGS) as of December 31, Year 1 . Transactions for Year 2 1. Acquired an additional $10,200 cash from the issue of common stock 2. Purchased $60,300 of inventory on account. 3. Sold inventory that cost $62,800 for $93,400. Sales were made on account. 4. The company wrote off $1,260 of uncollectible accounts 5. On September 1, LGS loaned $7,000 to Eden Co. The note had an 8 percent interest rate and a one-year term. 6. Paid $14,190 cash for operating expenses. 7. The company collected $81,390 cash from accounts receivable: 8. A cash payment of $52,480 was paid on accounts payable 9. The company paid a $4,200 cash dividend to the stockholders. 10 Uncollectible accounts are estimated to be 2 percent of sales on account 11. Recorded the accrued interest at December 31 , Year 2 (see item 5). Required a. Organize the transaction data in accounts under an accounting equation. b. Prepare an income statement, a statement of changes in stockholders' equity, a balance sheet, and a statement of cash flows for Year 2 . \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ LITTLE GROCERY SUPPLIER (LGS) } \\ \hline \multicolumn{4}{|c|}{ Statement of Changes in Stockholders' Equity } \\ \hline \multicolumn{4}{|c|}{ For the Year Ended December 31, Year 2} \\ \hline Beginning common stock & 19,000 & & \\ \hline & & & \\ \hline Ending common stock & & $ & 19,000 \\ \hline Beginning retained earnin & & & \\ \hline Plus: Net income & & & \\ \hline Less: Dividend & (4,200) & & \\ \hline Ending retained earnings & & & (4,200) \\ \hline Total stockholders' equity & & $ & 14,800 \\ \hline \end{tabular}

Balance Sheet As of December 31, Year 2 \begin{tabular}{|l|l|l|} \hline Assets & & \\ \hline Cash & & \\ \hline Accounts receivable & & \\ \hline & & \\ \hline Inventory & & \\ \hline Interest receivable & & \\ \hline & & \\ \hline Total assets & & \\ \hline Liabilities & & \\ \hline Accounts payable & & \\ \hline & & \\ \hline Total liabilities & & \\ \hline Stockholders' equity & & \\ \hline Common stock & & \\ \hline Retained earnings & & \\ \hline & & \\ \hline Total stockholders' equity & & \\ \hline Total liabilities and stockholders' equity & & \\ \hline \end{tabular} LITTLE GROCERY SUPPLIER (LGS) Income Statement For the Year Ended December 31, Year 2 \begin{tabular}{|l|r|r|} \hline Sales revenue & & $ \\ \hline & & 93,400 \\ \hline Expenses & & \\ \hline & & \\ \hline Operating expenses & & \\ \hline Total expenses & 14,190 & \\ \hline Operating income & & \\ \hline & & \\ \hline Net income & & 14,190 \\ \hline \end{tabular} The following list of accounts was drawn from the accounts of Littie Grocery Supplier (LGS) as of December 31, Year 1 . Transactions for Year 2 1. Acquired an additional $10,200 cash from the issue of common stock 2. Purchased $60,300 of inventory on account. 3. Sold inventory that cost $62,800 for $93,400. Sales were made on account. 4. The company wrote off $1,260 of uncollectible accounts 5. On September 1, LGS loaned $7,000 to Eden Co. The note had an 8 percent interest rate and a one-year term. 6. Paid $14,190 cash for operating expenses. 7. The company collected $81,390 cash from accounts receivable: 8. A cash payment of $52,480 was paid on accounts payable 9. The company paid a $4,200 cash dividend to the stockholders. 10 Uncollectible accounts are estimated to be 2 percent of sales on account 11. Recorded the accrued interest at December 31 , Year 2 (see item 5). Required a. Organize the transaction data in accounts under an accounting equation. b. Prepare an income statement, a statement of changes in stockholders' equity, a balance sheet, and a statement of cash flows for Year 2 . \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{ LITTLE GROCERY SUPPLIER (LGS) } \\ \hline \multicolumn{4}{|c|}{ Statement of Changes in Stockholders' Equity } \\ \hline \multicolumn{4}{|c|}{ For the Year Ended December 31, Year 2} \\ \hline Beginning common stock & 19,000 & & \\ \hline & & & \\ \hline Ending common stock & & $ & 19,000 \\ \hline Beginning retained earnin & & & \\ \hline Plus: Net income & & & \\ \hline Less: Dividend & (4,200) & & \\ \hline Ending retained earnings & & & (4,200) \\ \hline Total stockholders' equity & & $ & 14,800 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started