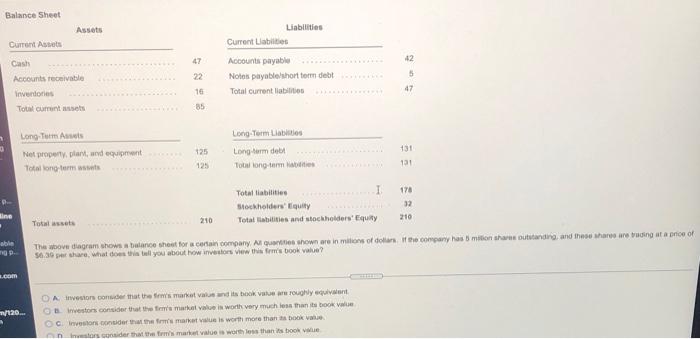

Question: Balance Sheet Assets Liabilities Current abilities Current Assets 47 42 5 Cash Accounts receivable Inverdones Total comune Accounts payable Nos payable short term debit Total

Balance Sheet Assets Liabilities Current abilities Current Assets 47 42 5 Cash Accounts receivable Inverdones Total comune Accounts payable Nos payable short term debit Total current liabilities 22 16 85 47 Long Terms Net property, plant, wederent Total long term w 131 Long Term Liabilities Long-term debt Totulongterm 125 125 131 Total liabilities I Stockholders' Equity Total liabilities and stockholders' Equity 178 32 210 ine Totales 210 able TOP The whow diagram shows a balance sheet for a can company Alerts shown are in milions of dollars the company has milion share outstanding and the shares rebuding at a price of 56.30 per share, what does the tell you about how investors view fris book we? . 120... O A Investors onder that the market value and its book are roughly equivalent O estos consider that the market value is worth very much less than book Consider that the market is worth more than a book Investors consider that was man values worse than is ook

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts