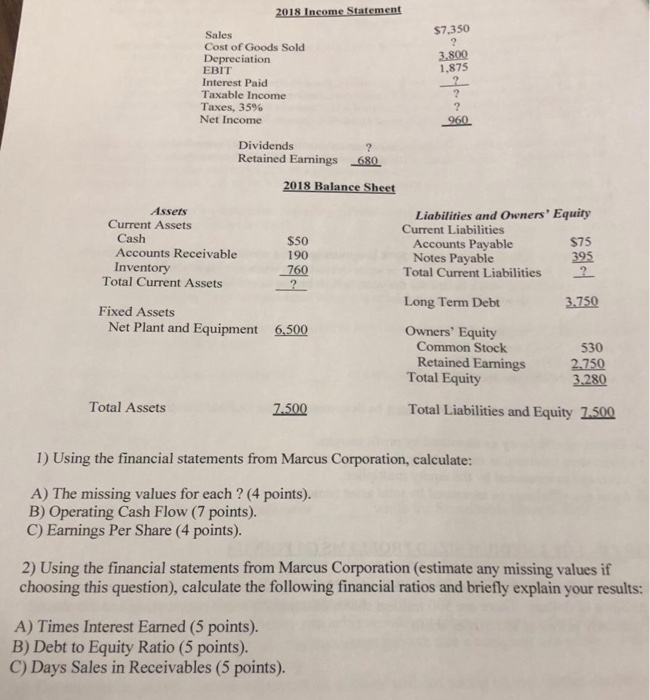

The ollowing are the 2008 financial statements of Marcus Corporation. All amounts are lis milions af doliars. There are 500 milion shares of common stock outstanding and the sl arcmnty riced an $52.50 per share 2018 Income Statement $7,350 Sales Cost of Goods Sold Depreciation EBIT Interest Paid Taxable Income Taxes, 35% Net Income 3,800 1,875 960 Dividends ? Retained Earnings 680 2018 Balance Sheet Assets Liabilities and Owners' Equity Current Liabilities Current Assets Cash Accounts Receivable Inventory Total Current Assets $50 190 760 $75 395 Accounts Payable Notes Payable Total Current Liabilities Long Term Debt 3.750 Fixed Assets Net Plant and Equipment 6.500 Owners' Equity Common Stock Retained Earnings Total Equity 530 2.750 3,280 Total Assets Total Liabilities and Equity 1.500 7.500 1) Using the financial statements from Marcus Corporation, calculate: A) The missing values for each ? (4 points). B) Operating Cash Flow (7 points). C) Earnings Per Share (4 points). 2) Using the financial statements from Marcus Corporation (estimate any missing values if choosing this question), calculate the following financial ratios and briefly explain your results: A) Times Interest Earned (5 points) B) Debt to Equity Ratio (5 points). C) Days Sales in Receivables (5 points). E The ollowing are the 2008 financial statements of Marcus Corporation. All amounts are lis milions af doliars. There are 500 milion shares of common stock outstanding and the sl arcmnty riced an $52.50 per share 2018 Income Statement $7,350 Sales Cost of Goods Sold Depreciation EBIT Interest Paid Taxable Income Taxes, 35% Net Income 3,800 1,875 960 Dividends ? Retained Earnings 680 2018 Balance Sheet Assets Liabilities and Owners' Equity Current Liabilities Current Assets Cash Accounts Receivable Inventory Total Current Assets $50 190 760 $75 395 Accounts Payable Notes Payable Total Current Liabilities Long Term Debt 3.750 Fixed Assets Net Plant and Equipment 6.500 Owners' Equity Common Stock Retained Earnings Total Equity 530 2.750 3,280 Total Assets Total Liabilities and Equity 1.500 7.500 1) Using the financial statements from Marcus Corporation, calculate: A) The missing values for each ? (4 points). B) Operating Cash Flow (7 points). C) Earnings Per Share (4 points). 2) Using the financial statements from Marcus Corporation (estimate any missing values if choosing this question), calculate the following financial ratios and briefly explain your results: A) Times Interest Earned (5 points) B) Debt to Equity Ratio (5 points). C) Days Sales in Receivables (5 points). E