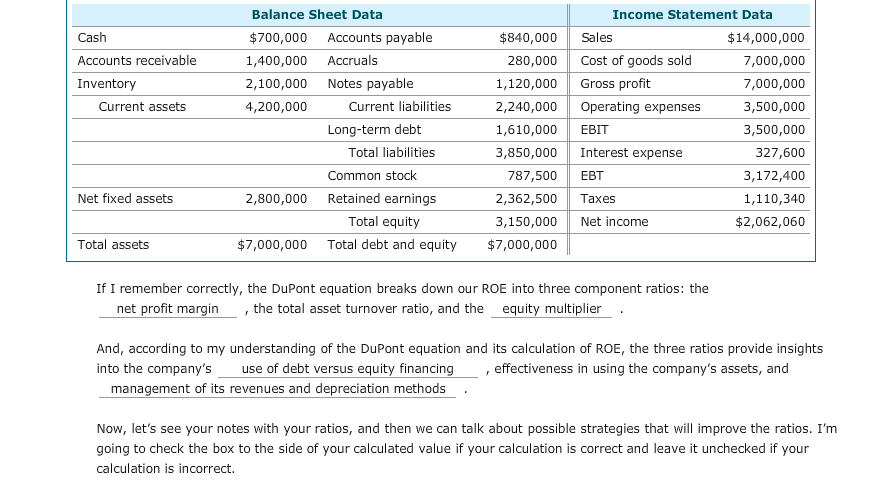

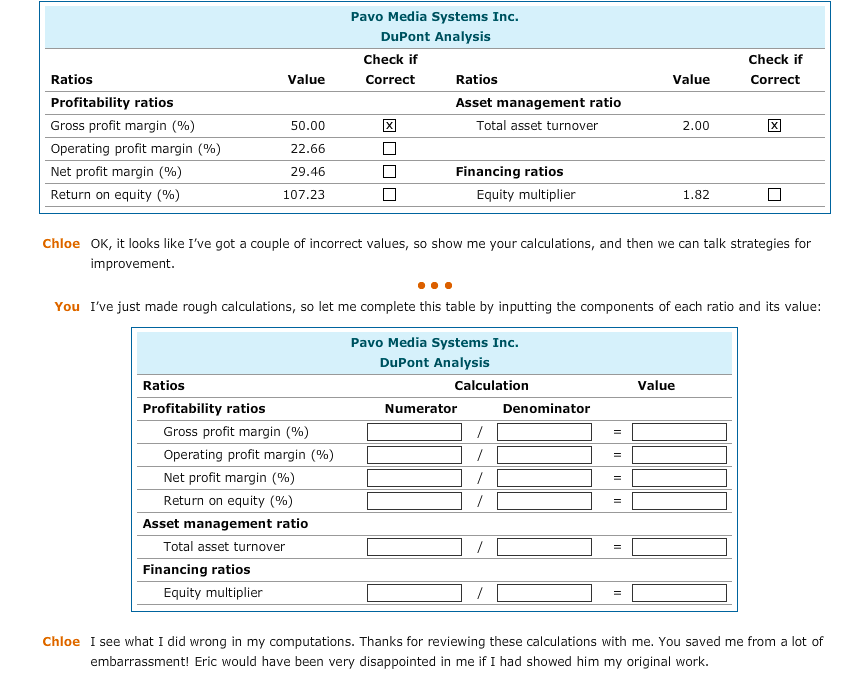

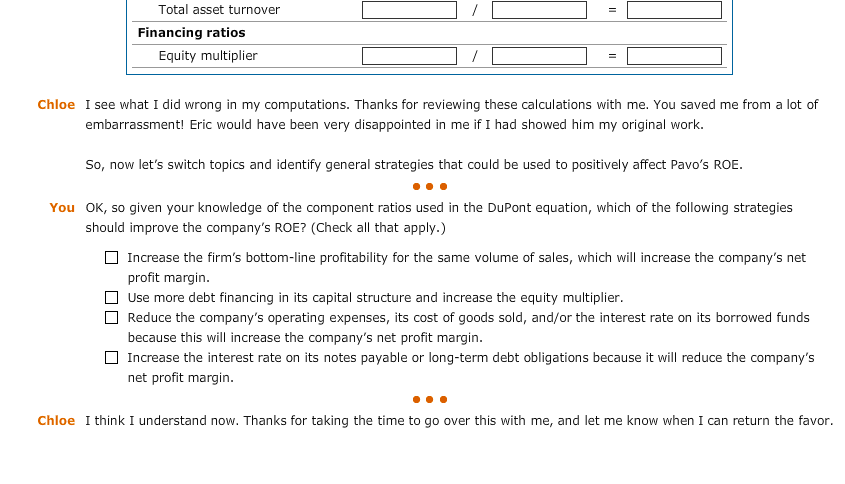

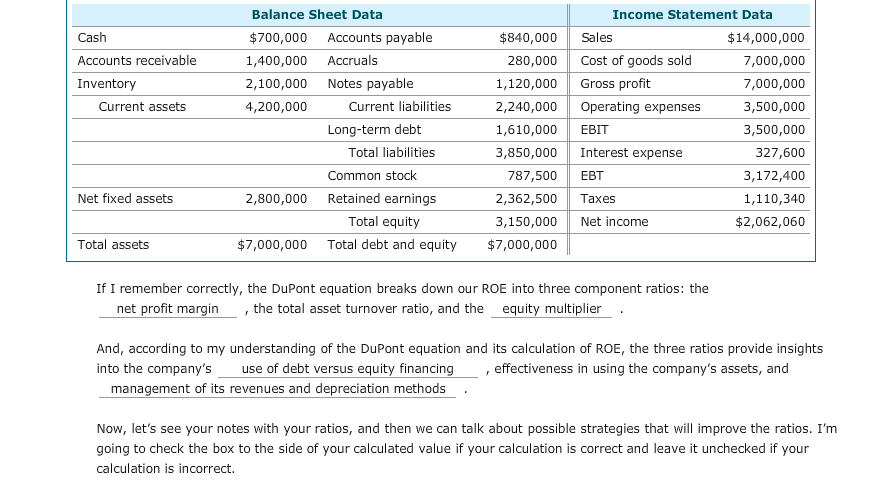

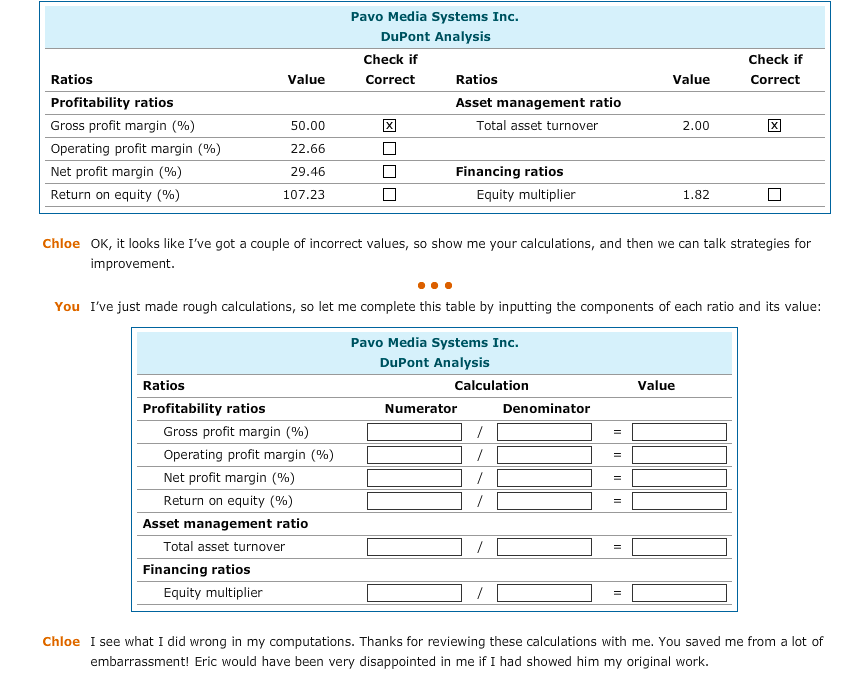

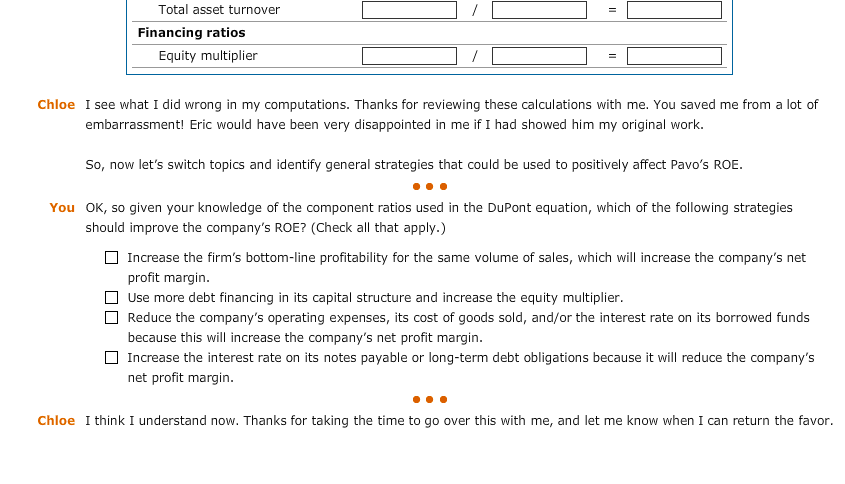

Balance Sheet Data $700,000 Accounts payable 1,400,000 Accruals 2,100,000 Notes payable 4,200,000 Income Statement Data Cash Accounts receivable Inventory $840,000 Sales 280,000Cost of goods sold 1,120,000 Gross profit 2,240,000 Operating expenses 1,610,000 EBIT 3,850,000 Interest expense $14,000,000 7,000,000 7,000,000 3,500,000 3,500,000 327,600 3,172,400 1,110,3410 $2,062,060 Current assets Current liabilities Long-term debt Total liabilities Common stock 787,500EBT 2,362,500 Taxes 3,150,000 Net income Net fixed assets 2,800,000 Retained earnings Total equity Total assets $7,000,000 Total debt and equity $7,000,000 If I remember correctly, the DuPont equation breaks down our ROE into three component ratios: the net profit marginthe total asset turnover ratio, and the _equity multiplier And, according to my understanding of the DuPont equation and its calculation of ROE, the three ratios provide insights into the company's use of debt versus equity financing , effectiveness in using the company's assets, and management of its revenues and depreciation methods . Now, let's see your notes with your ratios, and then we can talk about possible strategies that will improve the ratios. I'm going to check the box to the side of your calculated value if your calculation is correct and leave it unchecked if your calculation is incorrect. Pavo Media Systems Inc. DuPont Analysis Check if Correct Check if Ratios Profitability ratios Gross profit margin (%) Operating profit margin (%) Net profit margin(%) Return on equity (%) Value Ratios Value Correct Asset management ratio 50.00 22.66 29.46 107.23 Total asset turnover 2.00 Financing ratios Equity multiplier 1.82 Chloe OK, it looks like I've got a couple of incorrect values, so show me your calculations, and then we can talk strategies for improvement You I've just made rough calculations, so let me complete this table by inputting the components of each ratio and its value: Pavo Media Systems Inc. DuPont Analysis Ratios Calculation Value Profitability ratios Numerator Denominator Gross profit margin (%) Operating profit margin (%) Net profit margin (%) Return on equity (%) Asset management ratio Total asset turnover Financing ratios Equity multiplier Chloe I see what I did wrong in my computations. Thanks for reviewing these calculations with me. You saved me from a lot of embarrassment! Eric would have been very disappointed in me if I had showed him my original work. Total asset turnover Financing ratios Equity multiplier Chloe I see what I did wrong in my computations. Thanks for reviewing these calculations with me. You saved me from a lot of embarrassment! Eric would have been very disappointed in me if I had showed him my original work. So, now let's switch topics and identify general strategies that could be used to positively affect Pavo's ROE You OK, so given your knowledge of the component ratios used in the DuPont equation, which of the following strategies should improve the company's ROE? (Check all that apply.) Increase the firm's bottom-line profitability for the same volume of sales, which will increase the company's net profit margin. Use more debt financing in its capital structure and increase the equity multiplier. Reduce the company's operating expenses, its cost of goods sold, and/or the interest rate on its borrowed funds because this will increase the company's net profit margin. Increase the interest rate on its notes payable or long-term debt obligations because it will reduce the company's net profit margin. Chloe I think I understand now. Thanks for taking the time to go over this with me, and let me know when I can return the favor