Answered step by step

Verified Expert Solution

Question

1 Approved Answer

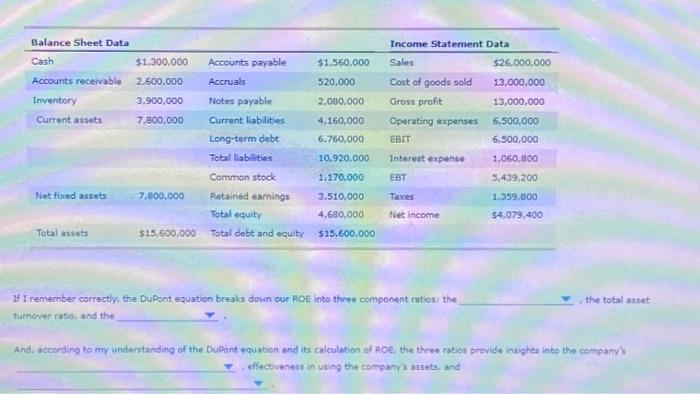

Balance Sheet Data Cash Accounts receivable Inventory Current assets Net fixed assets Total assets $1,300,000 2,600,000 3,900,000 7,800,000 7,800,000 $15,600,000 Accounts payable Accruals Notes payable

Balance Sheet Data Cash Accounts receivable Inventory Current assets Net fixed assets Total assets $1,300,000 2,600,000 3,900,000 7,800,000 7,800,000 $15,600,000 Accounts payable Accruals Notes payable Current liabilities Long-term debt Total liabilities Common stock Retained earnings Total equity Total debt and equity $1,560,000 520,000 2,080,000 4,160,000 6,760,000 10,920,000 1,170,000 3,510,000 4,680,000 $15,600,000 Income Statement Data Sales Cost of goods sold Gross profit Operating expenses EBIT Interest expense EBT Taxes Net income If I remember correctly, the DuPont equation breaks down our ROE into three component ratios: the turnover ratio, and the $26,000,000 13,000,000 13,000,000 6,500,000 6,500,000 1,060,800 5,439,200 1,359,800 $4,079,400 the total asset And, according to my understanding of the DuPont equation and its calculation of ROE, the three ratios provide insights into the company's , effectiveness in using the company's assets, and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started