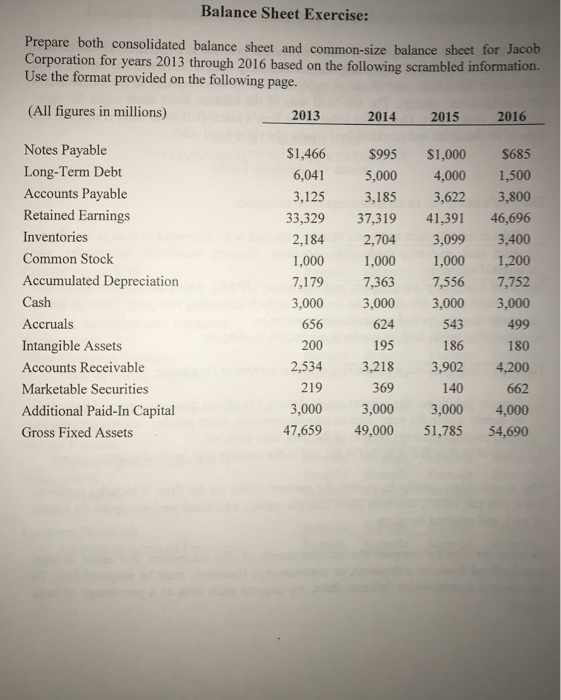

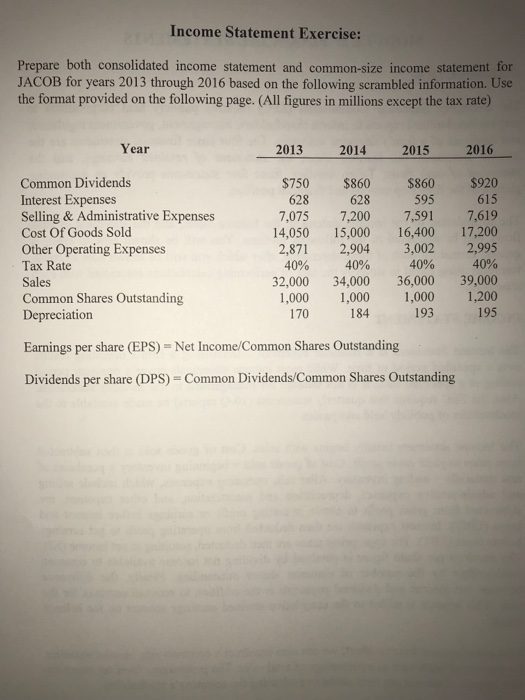

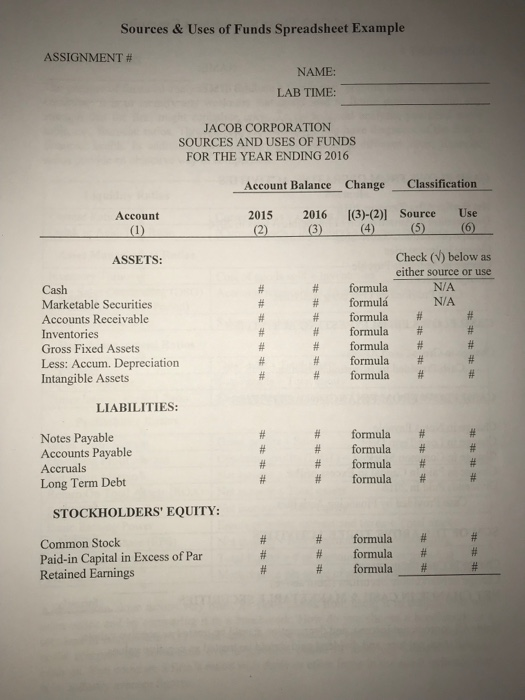

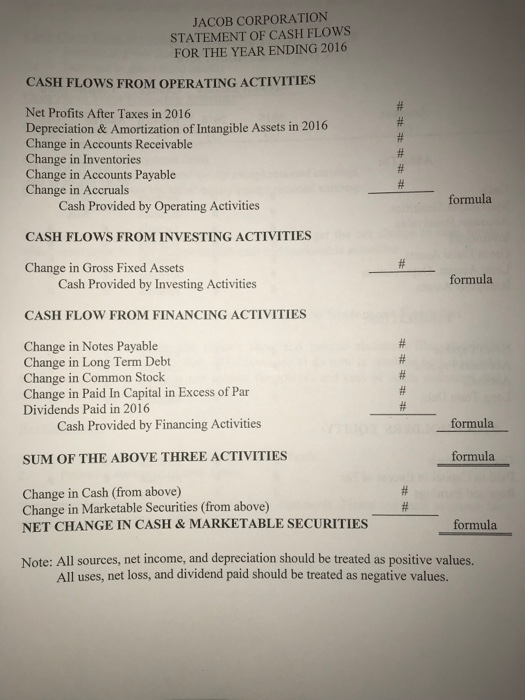

Balance Sheet Exercise: Prepare both consolidated balance sheet and common-size balance sheet Corporation for years 2013 through 2016 based on the following scrambled information. Use the format provided on the following page. for Jacob (All figures in millions) 2013 2014 2015 2016 Notes Payable Long-Term Debt Accounts Payable Retained Earnings Inventories Common Stock Accumulated Depreciation Cash Accruals Intangible Assets Accounts Receivable Marketable Securities Additional Paid-In Capital Gross Fixed Assets S1,466 $995 $1,000 S685 6,041 5,000 4,000 1,500 3,125 3,185 3,622 3,800 33,329 37,319 41,391 46,696 2,184 2,704 3,099 3,400 1,000 ,000 1,000 1,200 7,179 7,363 7,556 7,752 3,000 3,000 3,000 3,000 499 180 2,534 3,218 3,902 4.200 662 3,000 3,000 3,000 4,000 47,659 49,000 51,785 54,690 656 200 624 195 543 186 219 369 140 Income Statement Exercise: Prepare both consolidated income statement and common-size income statement for JACOB for years 2013 through 2016 based on the following scrambled information. Use the format provided on the following page. (All figures in millions except the tax rate) Year 2013 2014 2015 2016 Common Dividends Interest Expenses Selling & Administrative Expenses Cost Of Goods Sold Other Operating Expenses Tax Rate Sales Common Shares Outstanding Depreciation $750 $860 $860 $920 615 7,075 7,200 7,591 7,619 14,050 15,000 16,400 17,200 2,871 2,904 3,002 2,995 40% 40% 32,000 34,000 36,000 39,000 1,000 1,000 1,000 1,200 170 184 193 195 628 628 595 40% 40% Earnings per share (EPS)- Net Income/Common Shares Outstanding Dividends per share (DPS) Common Dividends/Common Shares Outstanding Sources & Uses of Funds Spreadsheet Example ASSIGNMENT # NAME: LAB TIME: JACOB CORPORATION SOURCES AND USES OF FUNDS FOR THE YEAR ENDING 2016 Account Balance Change Classification Account 2015 2016 [(3)-(2)] Source Use Check (v) below as either source or use N/A N/A ASSETS: H formula # formula Cash Marketable Securities Accounts Receivable Inventories Gross Fixed Assets Less: Accum. Depreciation Intangible Assets formula Hformula# H formula # formula H formula LIABILITIES: Notes Payable Accounts Payable Accruals Long Term Debt # formula #formula # formula # formula STOCKHOLDERS' EQUITY: Common Stock Paid-in Capital in Excess of Par Retained Earnings # formula# # formula # formula # JACOB CORPORATION STATEMENT OF CASH FLOWS FOR THE YEAR ENDING 2016 CASH FLOWS FROM OPERATING ACTIVITIES Net Profits After Taxes in 2016 Depreciation & Amortization of Intangible Assets in 2016 Change in Accounts Receivable Change in Inventories Change in Accounts Payable Change in Accruals formula Cash Provided by Operating Activities CASH FLOWS FROM INVESTING ACTIVITIES Change in Gross Fixed Assets Cash Provided by Investing Activities formula CASH FLOW FROM FINANCING ACTIVITIES Change in Notes Payable Change in Long Term Debt Change in Common Stock Change in Paid In Capital in Excess of Par Dividends Paid in 2016 Cash Provided by Financing Activities formula SUM OF THE ABOVE THREE ACTIVITIES formula Change in Cash (from above) Change in Marketable Securities (from above) NET CHANGE IN CASH & MARKETABLE SECURITIES formula Note: All sources, net income, and depreciation should be treated as positive values. All uses, net loss, and dividend paid should be treated as negative values