Answered step by step

Verified Expert Solution

Question

1 Approved Answer

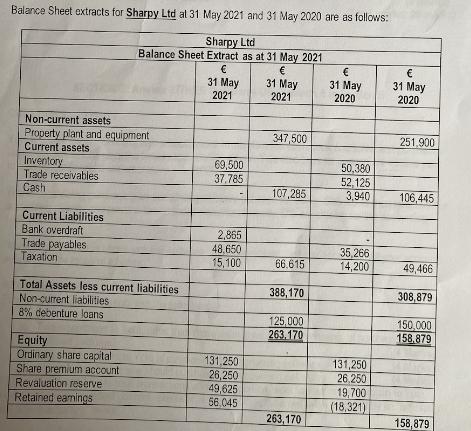

Balance Sheet extracts for Sharpy Ltd at 31 May 2021 and 31 May 2020 are as follows: Sharpy Ltd Balance Sheet Extract as at

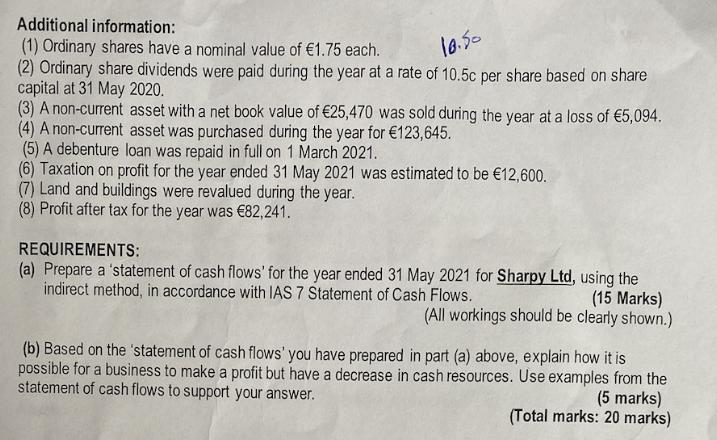

Balance Sheet extracts for Sharpy Ltd at 31 May 2021 and 31 May 2020 are as follows: Sharpy Ltd Balance Sheet Extract as at 31 May 2021 31 May 2021 Non-current assets Property plant and equipment Current assets Inventory Trade receivables. Cash Current Liabilities Bank overdraft Trade payables Taxation Total Assets less current liabilities Non-current liabilities 8% debenture loans Equity Ordinary share capital Share premium account Revaluation reserve Retained eamings 31 May 2021 69,500 37,785 2,865 48,650 15,100 131,250 26,250 49,625 56,045 347,500 107,285 66.615 388,170 125,000 263,170 263,170 31 May 2020 50,380 52,125 3,940 35,266 14,200 131,250 26,250 19,700 (18,321) 31 May 2020 251,900 106,445 49,466 308,879 150,000 158.879 158,879 Additional information: (1) Ordinary shares have a nominal value of 1.75 each. 10.50 (2) Ordinary share dividends were paid during the year at a rate of 10.5c per share based on share capital at 31 May 2020. (3) A non-current asset with a net book value of 25,470 was sold during the year at a loss of 5,094. (4) A non-current asset was purchased during the year for 123,645. (5) A debenture loan was repaid in full on 1 March 2021. (6) Taxation on profit for the year ended 31 May 2021 was estimated to be 12,600. (7) Land and buildings were revalued during the year. (8) Profit after tax for the year was 82,241. REQUIREMENTS: (a) Prepare a 'statement of cash flows' for the year ended 31 May 2021 for Sharpy Ltd, using the indirect method, in accordance with IAS 7 Statement of Cash Flows. (15 Marks) (All workings should be clearly shown.) (b) Based on the statement of cash flows' you have prepared in part (a) above, explain how it is possible for a business to make a profit but have a decrease in cash resources. Use examples from the statement of cash flows to support your answer. (5 marks) (Total marks: 20 marks)

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A Part Refer to image B Part Cash flows and profit are two distinct ideas Because the cash flow is not an expense there may be cash outflows that are ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started