Answered step by step

Verified Expert Solution

Question

1 Approved Answer

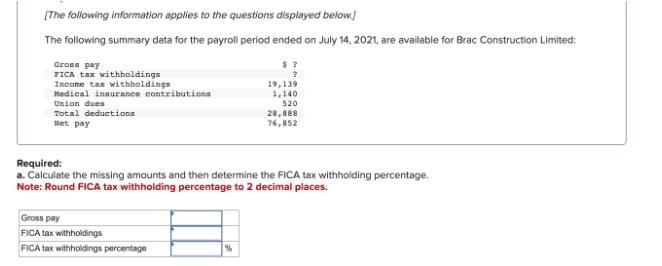

[The following information applies to the questions displayed below] The following summary data for the payroll period ended on July 14, 2021, are available

[The following information applies to the questions displayed below] The following summary data for the payroll period ended on July 14, 2021, are available for Brac Construction Limited: Gross pay FICA tax withholdings Income tax withholdings Medical insurance contributions Union dues Total deductions set pay Gross pay FICA tax withholdings FICA tax withholdings percentage $7 2 % 19,139 1,140. 520 Required: a. Calculate the missing amounts and then determine the FICA tax withholding percentage. Note: Round FICA tax withholding percentage to 2 decimal places. 28,888 76,852 The following summary data for the payroll period ended on July 14, 2021, are available for Brac Construction Limited: Gross pay FICA tax withholdings Income tax withholdings Medical insurance contributions Union dues Total deductions Net pay View transaction list b-2. Record the journal entry to show the effects of the payroll accrual. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the accrued payroll. Note: Enter debits before credits. Event 1 Record entry General Journal 19,139 1,140 520 Clear entry 28,888 76,852 Debit Credit View general Journal

Step by Step Solution

★★★★★

3.45 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started