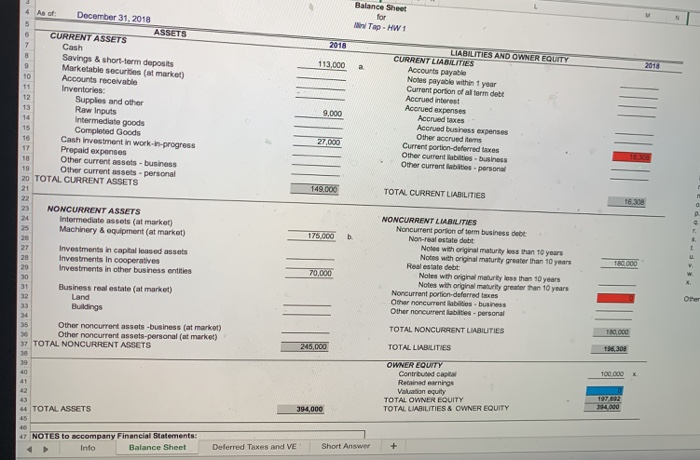

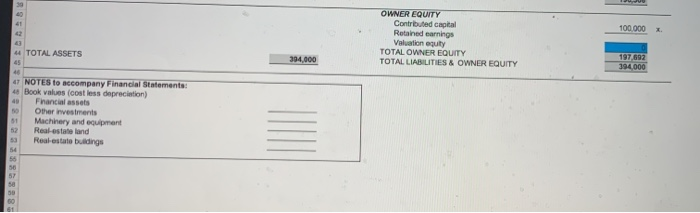

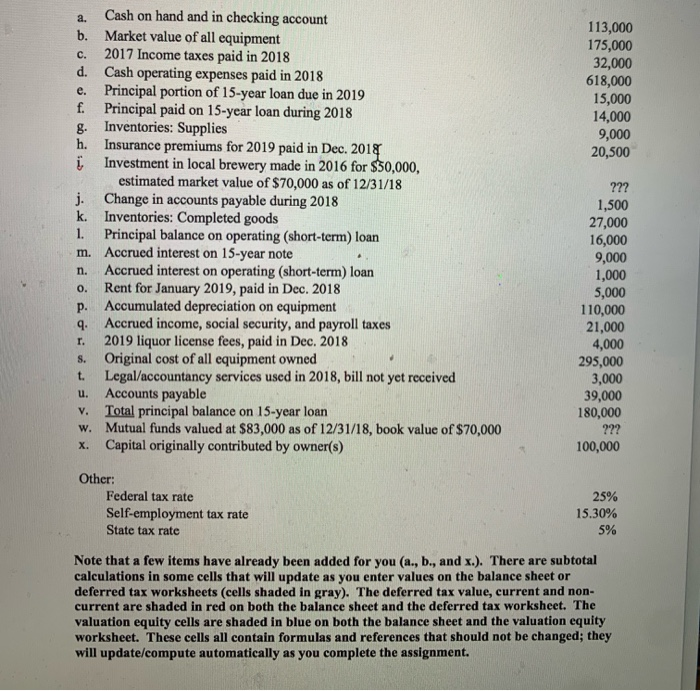

Balance Sheet for Tap - HW 1 2018 113,000 a 2018 12 13 4 As of December 31, 2018 5 ASSETS CURRENT ASSETS 7 Cash B Savings & short-term deposits 9 Marketable securities at market) 10 Accounts receivable Inventories: Supplies and other Raw Inputs Intermediate goods 15 Completed Goods 18 Cash Investment in work-in-progress 17 Prepaid expenses Other current assets-business Other current assets - personal 20 TOTAL CURRENT ASSETS 9,000 LIABILITIES AND OWNER EQUITY CURRENT LIABILITIES Accounts payable Notes payable within 1 year Current portion of all term debt Accrued interest Accrued expenses Accruedas Accrued business expenses Other accrued tems Current portion deferred faces Other current abilities - business Other current les persona 27.000 18 10 149,000 TOTAL CURRENT LIABILITIES 22 16.308 175.000 t 28 29 NONCURRENT ASSETS Intermediate assets (at market) Machinery & equipment (at market) Investments in capital leased assets Investments in cooperatives Investments in other business entities Business real estate (at market) Land Buildings 180.000 70,000 NONCURRENT LIABILITIES Noncurrent portion of term business debt Non-real estate dobit Notes with original maturity less than 10 years Notes with original maturity greater than 10 years Real estate debt: Notes with original maturity less than 10 years Notes with original maturity greater than 10 years Noncurrent portion-deferred taxes Other noncurrentes business Other noncurrent abilities - personal TOTAL NONCURRENT LIABILITIES Other Other noncurrent assets - business (at market) Other noncurrent assets-personal at market) TOTAL NONCURRENT ASSETS 180.000 245,000 TOTAL LIABILITIES 138,300 100.000 40 41 42 63 4 TOTAL ASSETS OWNER EQUITY Contributed capital Retained earnings Valuation equity TOTAL OWNER EQUITY TOTAL LIABILITIES & OWNER EQUITY 394,000 9000 47 NOTES to accompany Financial Statements: Info Balance Sheet Deferred Taxes and VE Short Answer + 41 100.000 OWNER EQUITY Contributed capital Retained earnings Valuation equity TOTAL OWNER EQUITY TOTAL LIABILITIES & OWNER EQUITY 4 TOTAL ASSETS 45 394,000 197,692 394,000 47 NOTES to accompany Financial Statements: 40 Book values (cost less depreciation) 40 Financial assets Other investments 51 Machinery and equipment Real estate and 50 Real estate buildings 54 56 50 57 30 61 a. C. 113,000 175,000 32,000 618,000 15,000 14,000 9,000 20,500 Cash on hand and in checking account b. Market value of all equipment 2017 Income taxes paid in 2018 d. Cash operating expenses paid in 2018 e. Principal portion of 15-year loan due in 2019 f. Principal paid on 15-year loan during 2018 g. Inventories: Supplies h. Insurance premiums for 2019 paid in Dec. 2018 i Investment in local brewery made in 2016 for $50,000, estimated market value of $70,000 as of 12/31/18 j. Change in accounts payable during 2018 k. Inventories: Completed goods 1. Principal balance on operating (short-term) loan m. Accrued interest on 15-year note Accrued interest on operating (short-term) loan Rent for January 2019, paid in Dec. 2018 p. Accumulated depreciation on equipment 9. Accrued income, social security, and payroll taxes 2019 liquor license fees, paid in Dec. 2018 Original cost of all equipment owned Legal/accountancy services used in 2018, bill not yet received Accounts payable Total principal balance on 15-year loan w. Mutual funds valued at $83,000 as of 12/31/18, book value of $70,000 X Capital originally contributed by owner(s) . n. 0. ??? 1,500 27,000 16,000 9,000 1,000 5,000 110,000 21,000 4,000 295,000 3,000 39,000 180,000 ??? 100,000 T. S. t. u. V. Other: Federal tax rate Self-employment tax rate State tax rate 25% 15.30% 5% Note that a few items have already been added for you (a., b., and x.). There are subtotal calculations in some cells that will update as you enter values on the balance sheet or deferred tax worksheets (cells shaded in gray). The deferred tax value, current and non- current are shaded in red on both the balance sheet and the deferred tax worksheet. The valuation equity cells are shaded in blue on both the balance sheet and the valuation equity worksheet. These cells all contain formulas and references that should not be changed; they will update/compute automatically as you complete the assignment. Market Value Tax Basis Difference 0 36,000 0 0 36,000 0 0 0 0 36,000 0 0 0 O 1 Calculation of Deferred Taxes 2. for 3 Mini Tap - HW 1 4 As of: 5 December 31, 2018 6 7 Current Portion 8 9 Valuation of Specific Current Asset Items 10 Marketable securities 11 Inventories 12 Accounts receivable 13 Cash investment in work in progress 14 Prepaid expenses 15 16 1. Excess of Market Value over Tax Basis of Current Assets (Sum) 17 18 Deductions 19 Accounts payable 20 Accrued interest 21 Accrued taxes 22 Other accrued expenses 23 2. Total deductions 24 25 3. Current portion of deferred taxable income 11 -2, zero if negative] 26 27 4. Estimated federal and state income tax rate 28 5. Deferred federal and state tax expense [3x4) 29 6. Estimated self-employment tax rato 30 7. Social Security Tax Income Limit 31 8. Deferred self-employment tax [the minimum of 3x6 or 71 32 9. Total current portion of deferred Income taxes [58] 33 34 35 Noncurrent Portion 36 37 Deferred taxable income from noncurrent assets 38 Real Estate - Land 39 Machinery and equipment 40 Real Estate - Buildings 41 Other Noncurrent Assets 42 43 10. Noncurrent portion of deferred taxable income (sum, zero i negative) 44 11. Estimated federal and state income tax rate 45 12. Total noncurrent portion of deferred taxes (10x11] 46 47 36,000 30% 10,800 15.3% 132,900 5,508 16 308 Market Value Tax Basis Gain/Loss O 0 0 0 0 30% Balance Sheet for Tap - HW 1 2018 113,000 a 2018 12 13 4 As of December 31, 2018 5 ASSETS CURRENT ASSETS 7 Cash B Savings & short-term deposits 9 Marketable securities at market) 10 Accounts receivable Inventories: Supplies and other Raw Inputs Intermediate goods 15 Completed Goods 18 Cash Investment in work-in-progress 17 Prepaid expenses Other current assets-business Other current assets - personal 20 TOTAL CURRENT ASSETS 9,000 LIABILITIES AND OWNER EQUITY CURRENT LIABILITIES Accounts payable Notes payable within 1 year Current portion of all term debt Accrued interest Accrued expenses Accruedas Accrued business expenses Other accrued tems Current portion deferred faces Other current abilities - business Other current les persona 27.000 18 10 149,000 TOTAL CURRENT LIABILITIES 22 16.308 175.000 t 28 29 NONCURRENT ASSETS Intermediate assets (at market) Machinery & equipment (at market) Investments in capital leased assets Investments in cooperatives Investments in other business entities Business real estate (at market) Land Buildings 180.000 70,000 NONCURRENT LIABILITIES Noncurrent portion of term business debt Non-real estate dobit Notes with original maturity less than 10 years Notes with original maturity greater than 10 years Real estate debt: Notes with original maturity less than 10 years Notes with original maturity greater than 10 years Noncurrent portion-deferred taxes Other noncurrentes business Other noncurrent abilities - personal TOTAL NONCURRENT LIABILITIES Other Other noncurrent assets - business (at market) Other noncurrent assets-personal at market) TOTAL NONCURRENT ASSETS 180.000 245,000 TOTAL LIABILITIES 138,300 100.000 40 41 42 63 4 TOTAL ASSETS OWNER EQUITY Contributed capital Retained earnings Valuation equity TOTAL OWNER EQUITY TOTAL LIABILITIES & OWNER EQUITY 394,000 9000 47 NOTES to accompany Financial Statements: Info Balance Sheet Deferred Taxes and VE Short Answer + 41 100.000 OWNER EQUITY Contributed capital Retained earnings Valuation equity TOTAL OWNER EQUITY TOTAL LIABILITIES & OWNER EQUITY 4 TOTAL ASSETS 45 394,000 197,692 394,000 47 NOTES to accompany Financial Statements: 40 Book values (cost less depreciation) 40 Financial assets Other investments 51 Machinery and equipment Real estate and 50 Real estate buildings 54 56 50 57 30 61 a. C. 113,000 175,000 32,000 618,000 15,000 14,000 9,000 20,500 Cash on hand and in checking account b. Market value of all equipment 2017 Income taxes paid in 2018 d. Cash operating expenses paid in 2018 e. Principal portion of 15-year loan due in 2019 f. Principal paid on 15-year loan during 2018 g. Inventories: Supplies h. Insurance premiums for 2019 paid in Dec. 2018 i Investment in local brewery made in 2016 for $50,000, estimated market value of $70,000 as of 12/31/18 j. Change in accounts payable during 2018 k. Inventories: Completed goods 1. Principal balance on operating (short-term) loan m. Accrued interest on 15-year note Accrued interest on operating (short-term) loan Rent for January 2019, paid in Dec. 2018 p. Accumulated depreciation on equipment 9. Accrued income, social security, and payroll taxes 2019 liquor license fees, paid in Dec. 2018 Original cost of all equipment owned Legal/accountancy services used in 2018, bill not yet received Accounts payable Total principal balance on 15-year loan w. Mutual funds valued at $83,000 as of 12/31/18, book value of $70,000 X Capital originally contributed by owner(s) . n. 0. ??? 1,500 27,000 16,000 9,000 1,000 5,000 110,000 21,000 4,000 295,000 3,000 39,000 180,000 ??? 100,000 T. S. t. u. V. Other: Federal tax rate Self-employment tax rate State tax rate 25% 15.30% 5% Note that a few items have already been added for you (a., b., and x.). There are subtotal calculations in some cells that will update as you enter values on the balance sheet or deferred tax worksheets (cells shaded in gray). The deferred tax value, current and non- current are shaded in red on both the balance sheet and the deferred tax worksheet. The valuation equity cells are shaded in blue on both the balance sheet and the valuation equity worksheet. These cells all contain formulas and references that should not be changed; they will update/compute automatically as you complete the assignment. Market Value Tax Basis Difference 0 36,000 0 0 36,000 0 0 0 0 36,000 0 0 0 O 1 Calculation of Deferred Taxes 2. for 3 Mini Tap - HW 1 4 As of: 5 December 31, 2018 6 7 Current Portion 8 9 Valuation of Specific Current Asset Items 10 Marketable securities 11 Inventories 12 Accounts receivable 13 Cash investment in work in progress 14 Prepaid expenses 15 16 1. Excess of Market Value over Tax Basis of Current Assets (Sum) 17 18 Deductions 19 Accounts payable 20 Accrued interest 21 Accrued taxes 22 Other accrued expenses 23 2. Total deductions 24 25 3. Current portion of deferred taxable income 11 -2, zero if negative] 26 27 4. Estimated federal and state income tax rate 28 5. Deferred federal and state tax expense [3x4) 29 6. Estimated self-employment tax rato 30 7. Social Security Tax Income Limit 31 8. Deferred self-employment tax [the minimum of 3x6 or 71 32 9. Total current portion of deferred Income taxes [58] 33 34 35 Noncurrent Portion 36 37 Deferred taxable income from noncurrent assets 38 Real Estate - Land 39 Machinery and equipment 40 Real Estate - Buildings 41 Other Noncurrent Assets 42 43 10. Noncurrent portion of deferred taxable income (sum, zero i negative) 44 11. Estimated federal and state income tax rate 45 12. Total noncurrent portion of deferred taxes (10x11] 46 47 36,000 30% 10,800 15.3% 132,900 5,508 16 308 Market Value Tax Basis Gain/Loss O 0 0 0 0 30%