Answered step by step

Verified Expert Solution

Question

1 Approved Answer

balance sheet is for the month, the cash budget needs to be prepared for December 2019 from the November balance sheet below, sales value is

balance sheet is for the month, the cash budget needs to be prepared for December 2019 from the November balance sheet below, sales value is the accounts receivable, everything from the dot points is in the balance sheet, use the dot points and the balance sheet to solve for the cash budget, that is all, use math for the solving components

please answer in excel

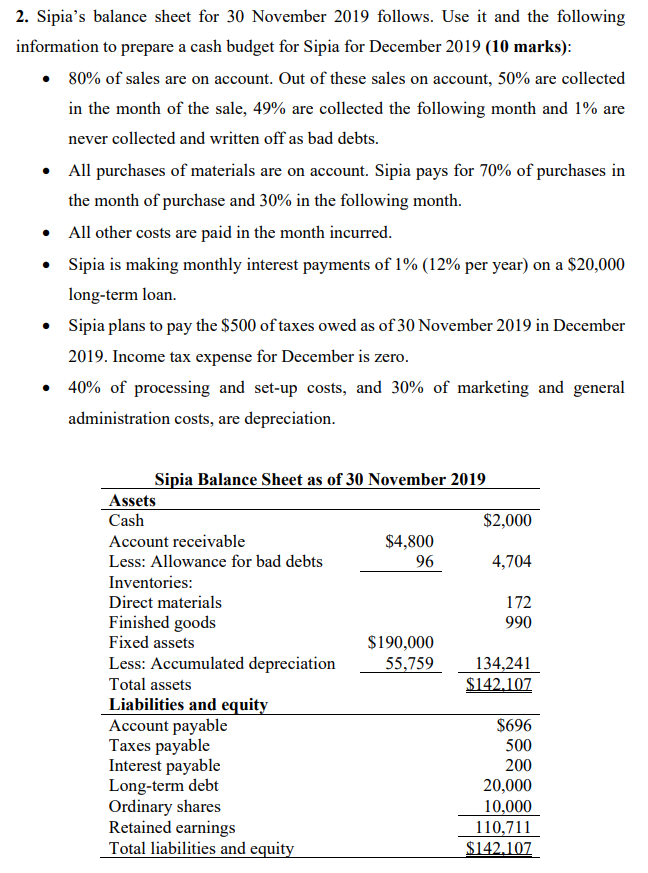

2. Sipia's balance sheet for 30 November 2019 follows. Use it and the following information to prepare a cash budget for Sipia for December 2019 (10 marks): 80% of sales are on account. Out of these sales on account, 50% are collected in the month of the sale, 49% are collected the following month and 1% are never collected and written off as bad debts. All purchases of materials are on account. Sipia pays for 70% of purchases in the month of purchase and 30% in the following month. All other costs are paid in the month incurred. Sipia is making monthly interest payments of 1% (12% per year) on a $20,000 long-term loan. Sipia plans to pay the $500 of taxes owed as of 30 November 2019 in December 2019. Income tax expense for December is zero. 40% of processing and set-up costs, and 30% of marketing and general administration costs, are depreciation. 172 Sipia Balance Sheet as of 30 November 2019 Assets Cash $2,000 Account receivable $4,800 Less: Allowance for bad debts 96 4,704 Inventories: Direct materials Finished goods 990 Fixed assets $190,000 Less: Accumulated depreciation 55,759 134,241 Total assets $142.107 Liabilities and equity Account payable $696 Taxes payable 500 Interest payable 200 Long-term debt 20,000 Ordinary shares 10,000 Retained earnings 110,711 Total liabilities and equity $142.107 2. Sipia's balance sheet for 30 November 2019 follows. Use it and the following information to prepare a cash budget for Sipia for December 2019 (10 marks): 80% of sales are on account. Out of these sales on account, 50% are collected in the month of the sale, 49% are collected the following month and 1% are never collected and written off as bad debts. All purchases of materials are on account. Sipia pays for 70% of purchases in the month of purchase and 30% in the following month. All other costs are paid in the month incurred. Sipia is making monthly interest payments of 1% (12% per year) on a $20,000 long-term loan. Sipia plans to pay the $500 of taxes owed as of 30 November 2019 in December 2019. Income tax expense for December is zero. 40% of processing and set-up costs, and 30% of marketing and general administration costs, are depreciation. 172 Sipia Balance Sheet as of 30 November 2019 Assets Cash $2,000 Account receivable $4,800 Less: Allowance for bad debts 96 4,704 Inventories: Direct materials Finished goods 990 Fixed assets $190,000 Less: Accumulated depreciation 55,759 134,241 Total assets $142.107 Liabilities and equity Account payable $696 Taxes payable 500 Interest payable 200 Long-term debt 20,000 Ordinary shares 10,000 Retained earnings 110,711 Total liabilities and equity $142.107Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started