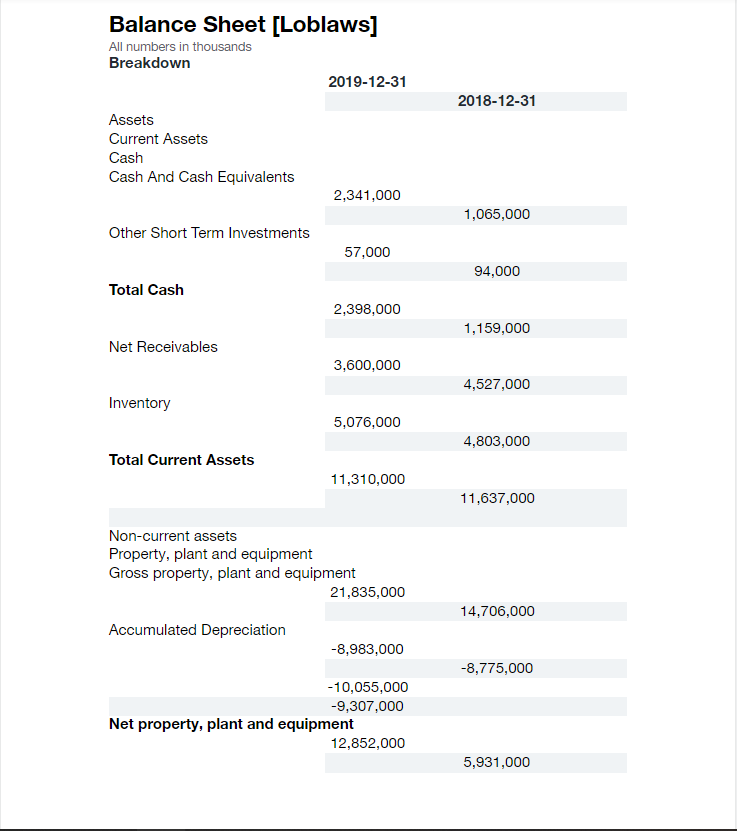

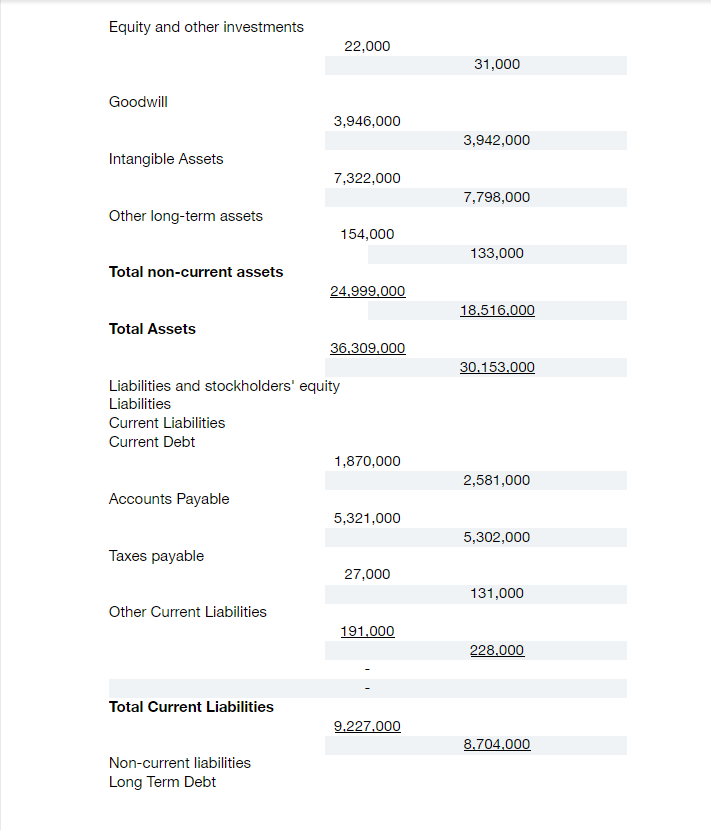

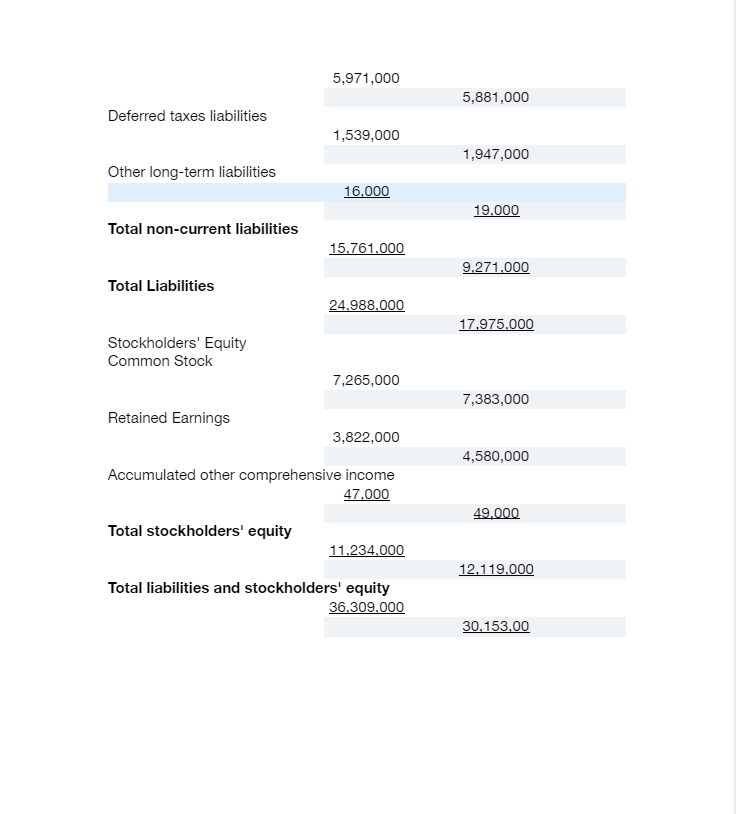

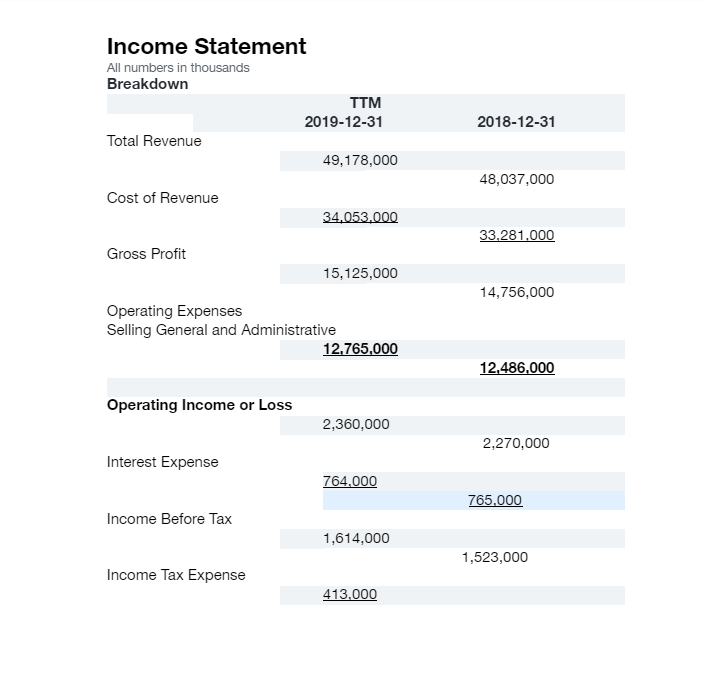

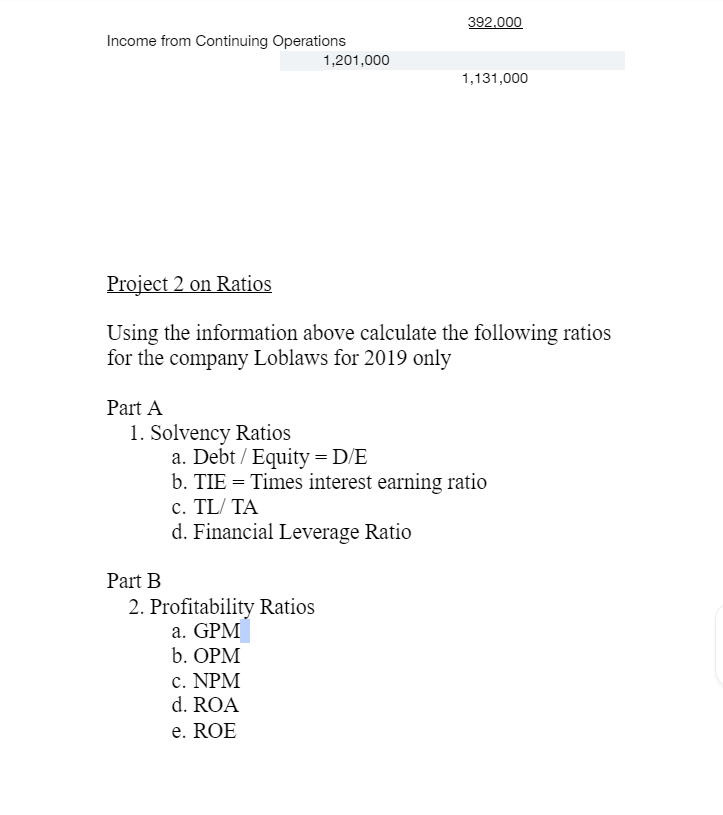

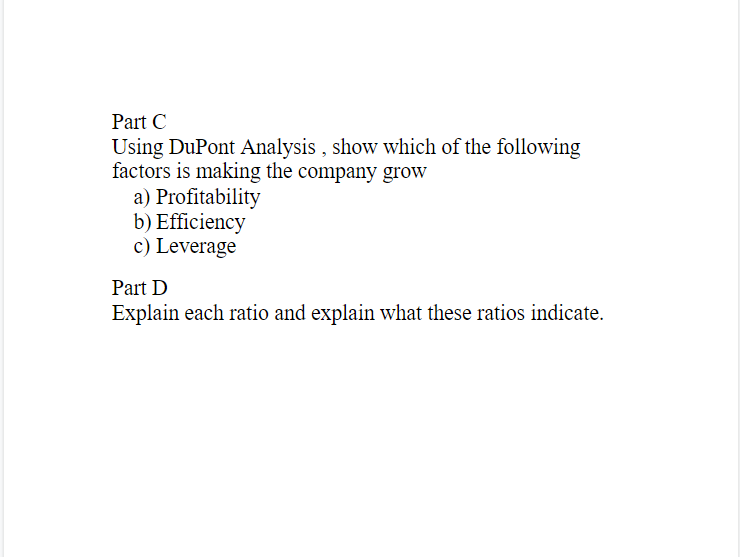

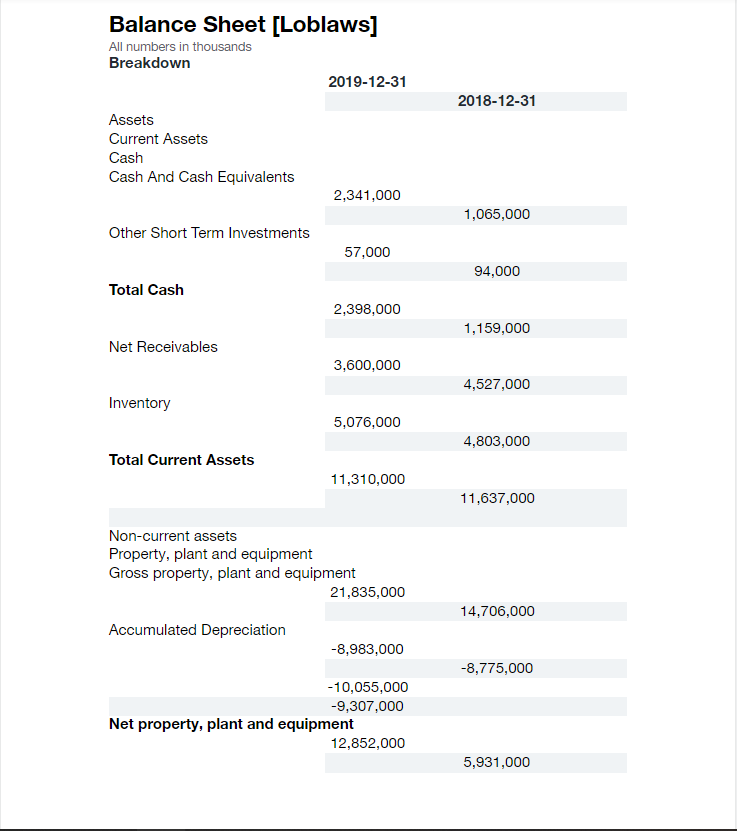

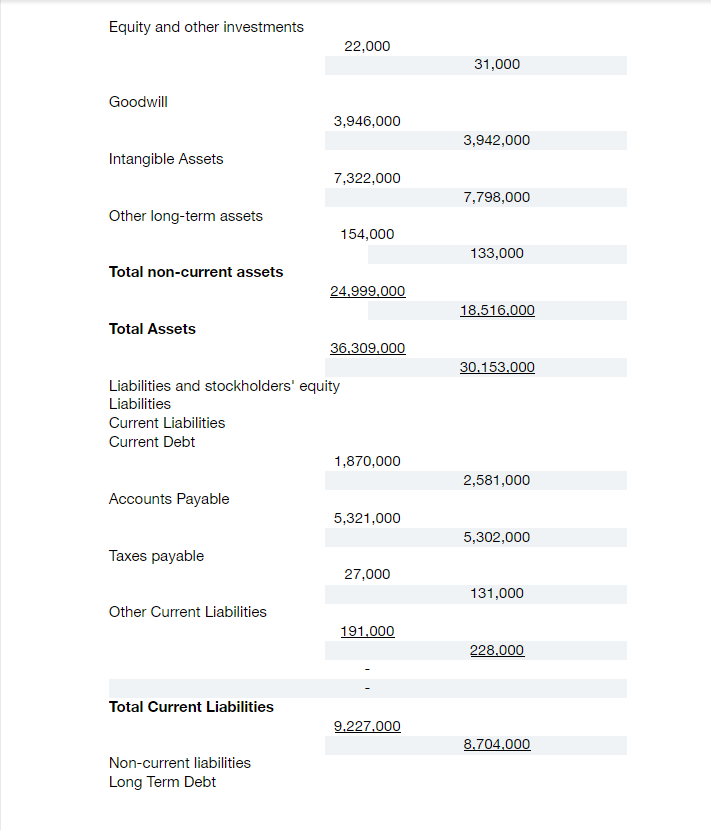

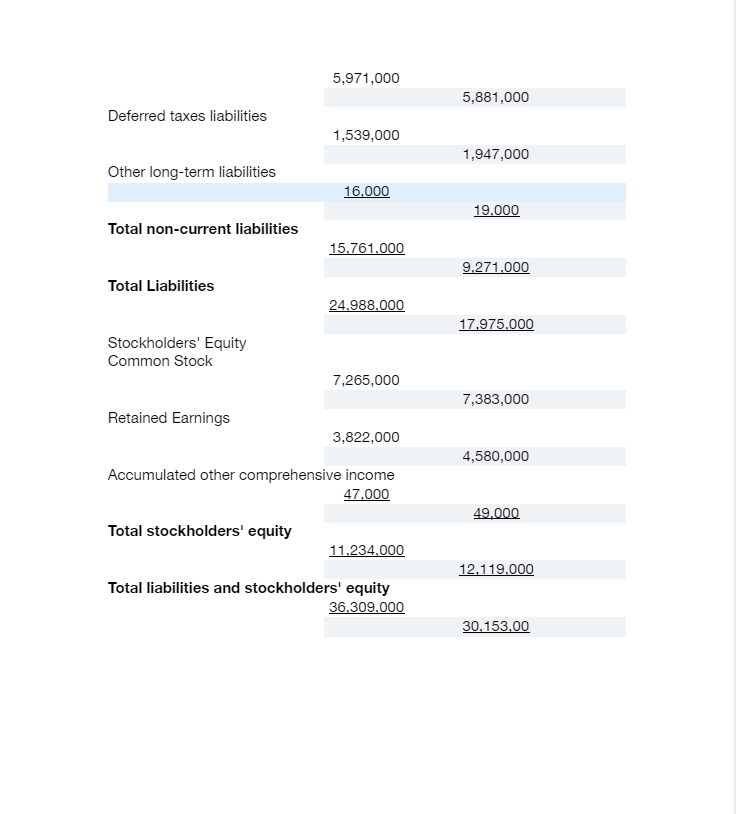

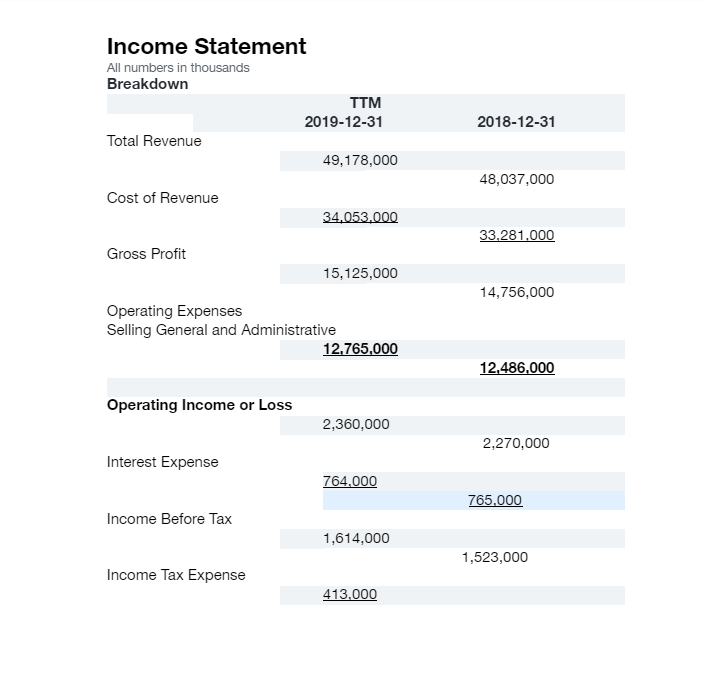

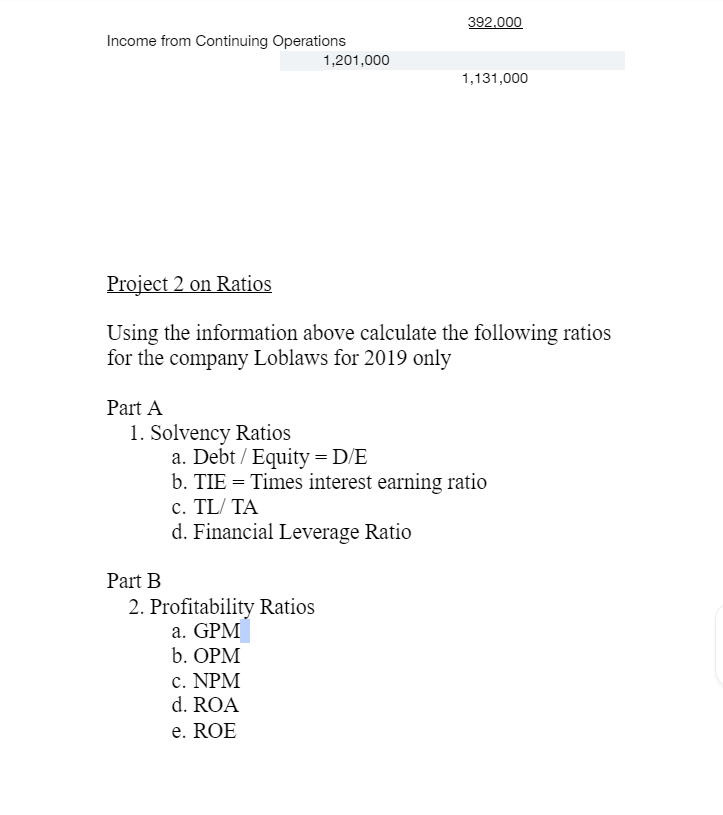

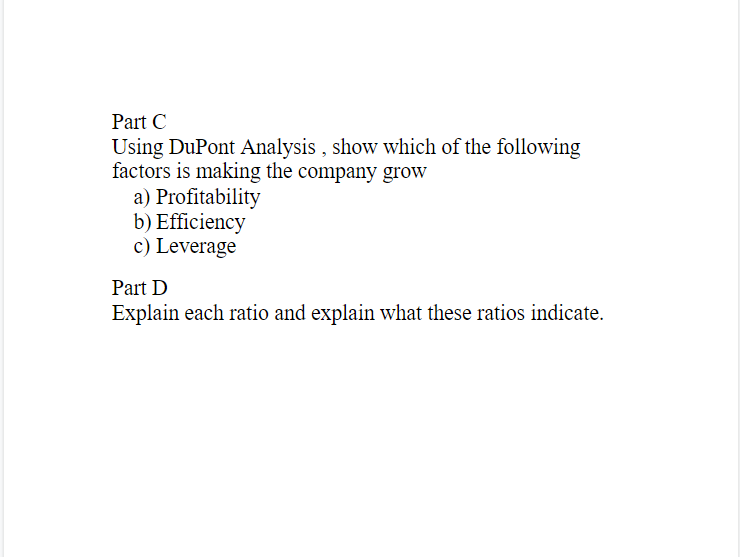

Balance Sheet [Loblaws] All numbers in thousands Breakdown 2019-12-31 2018-12-31 Assets Current Assets Cash Cash And Cash Equivalents 2,341,000 1,065,000 Other Short Term Investments 57,000 94,000 Total Cash 2,398,000 1,159,000 Net Receivables 3,600,000 4,527,000 Inventory 5,076,000 4,803,000 Total Current Assets 11,310,000 11,637,000 Non-current assets Property, plant and equipment Gross property, plant and equipment 21,835,000 14,706,000 Accumulated Depreciation -8,983,000 -8,775,000 - 10,055,000 -9,307,000 Net property, plant and equipment 12,852,000 5,931,000 Equity and other investments 22,000 31,000 Goodwill 3,946,000 3,942,000 Intangible Assets 7,322,000 7,798,000 Other long-term assets 154,000 133,000 Total non-current assets 24.999,000 18.516,000 Total Assets 36,309,000 30.153,000 Liabilities and stockholders' equity Liabilities Current Liabilities Current Debt 1,870,000 2,581,000 Accounts Payable 5,321,000 5,302,000 Taxes payable 27,000 131,000 Other Current Liabilities 191,000 228,000 Total Current Liabilities 9.227.000 8.704,000 Non-current liabilities Long Term Debt 5,971,000 5,881,000 Deferred taxes liabilities 1,539,000 1,947,000 Other long-term liabilities 16.000 19,000 Total non-current liabilities 15,761,000 9.271,000 Total Liabilities 24,988,000 17.975,000 Stockholders' Equity Common Stock 7,265,000 7,383,000 Retained Earnings 3,822,000 4,580,000 Accumulated other comprehensive income 47.000 49.000 Total stockholders' equity 11.234,000 12,119.000 Total liabilities and stockholders' equity 36,309,000 30,153,00 Income Statement All numbers in thousands Breakdown TTM 2019-12-31 Total Revenue 49,178,000 2018-12-31 48,037,000 Cost of Revenue 34.053.000 33.281.000 Gross Profit 15,125,000 14,756,000 Operating Expenses Selling General and Administrative 12,765,000 12,486,000 Operating Income or Loss 2,360,000 2,270,000 Interest Expense 764.000 765,000 Income Before Tax 1,614,000 1,523,000 Income Tax Expense 413.000 392.000 Income from Continuing Operations 1,201,000 1,131,000 Project 2 on Ratios Using the information above calculate the following ratios for the company Loblaws for 2019 only Part A 1. Solvency Ratios a. Debt / Equity = D/E b. TIE = Times interest earning ratio c. TL/TA d. Financial Leverage Ratio Part B 2. Profitability Ratios a. GPM b. OPM c. NPM d. ROA e. ROE Part C Using DuPont Analysis , show which of the following factors is making the company grow a) Profitability b) Efficiency c) Leverage Part D Explain each ratio and explain what these ratios indicate