Answered step by step

Verified Expert Solution

Question

1 Approved Answer

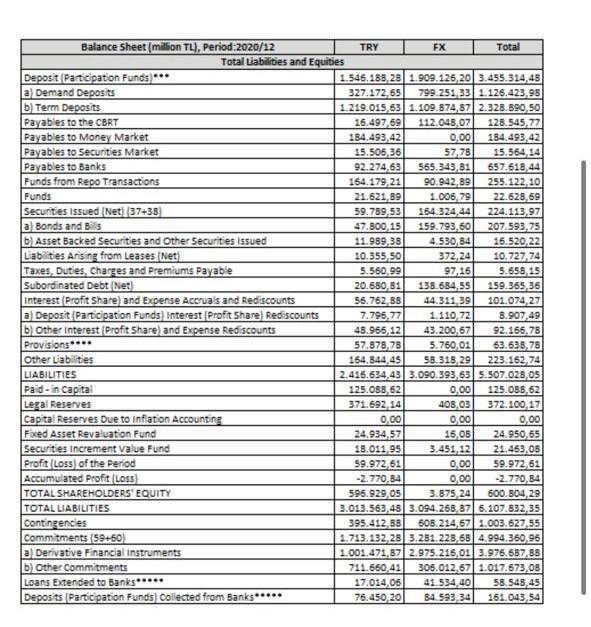

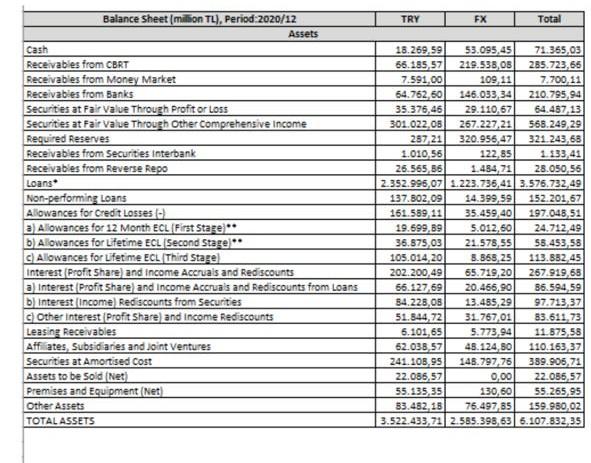

Balance Sheet (million TL), Period 2020/12 TRY FX Total Total Liabilities and Equities Deposit Participation Funds*** 1.546.188.28 1.909.125,20 3.455.314,45 a) Demand Deposits 327.172.65 799.251,33 1.126.423,98

Balance Sheet (million TL), Period 2020/12 TRY FX Total Total Liabilities and Equities Deposit Participation Funds*** 1.546.188.28 1.909.125,20 3.455.314,45 a) Demand Deposits 327.172.65 799.251,33 1.126.423,98 b) Term Deposits 1.219.015,53 1.109.874,57 2.328.890,50 Payables to the CBRT 16.497,69 112.048,07 128.545,77 Payables to Money Market 184.493,42 0,00 184.493,42 Payables to Securities Market 15.505, 36 57,78 15.564,14 Payables to Banks 92.274,63 565.343,81 657.618,44 Funds from Repo Transactions 164.179,21 90.942,89 255.122,10 Funds 21.621,69 1.00679 22.628,69 Securities issued (Net) (37+38) 59.789, 53 164.324,44 224.113,97 a Bonds and is 47.800,15 159.793,50 207.593,75 b) Asset Backed Securities and Other Securities issued 11.989,35 4.530,84 16.520,22 Labilities Arising from Leases (Net 10.355,50 372,24 10.727,74 Taxes, Duties, Charges and Premiums Payable 5.560.99 97,16 5.658,15 Subordinated Debt Net 20.650,81 138.684,55 159.365,36 Interest (Profit Share and Expense Accruals and Rediscounts 56.762.BS 44.311 39 101.074,27 a) Deposit Participation Funds) Interest Profit Share) Rediscounts 7.795.77 1.110,72 8.907,49 b) Other interest (Profit Share and Expense Rediscounts 48.966,12 43.200,67 92.166,78 Provisions.... 57.878,78 5.760,01 63.635,78 Other Liabilities 164.844,45 53.318,29 223.162.74 LIABILITIES 2.455.634,43 3.090.393,63 5.507.028,05 Paid - in Capital 125.055,62 0.00 125.085.62 Leral Reserves 371.692 14 408.03 372.100,17 Capital Reserves Due to Inflation Accounting 0,00 0,00 0,00 Fixed Asset Revaluation Fund 24.934,57 16,08 24.950,65 Securities increment Value Fund 13.011.95 3.451, 12 21.453,05 Proft Loss of the Period 59.972,61 0.00 59.972.61 Accumulated Profit (Loss -2.770.84 0,00 -2.770,84 TOTAL SHAREHOLDERS' EQUITY 595.929,05 3.875, 24 600.804,29 TOTAL LIABILITIES 3.013.563,48 3.094.268,57 6.107.532,35 contingencies 395.412,85 505.214,67 1.003.627,55 Commitments (59-50 1.713.132.28 3.281.228,68 4.994.360,96 a) Derivative Financial instruments 1.001.471,37 2.975.216,01 3.976.687,88 b) Other Commitments 711.660,41 306.012,67 1.017.673,05 Loans Extended to Banks..... 17.014,06 41.534,40 58.548,45 Deposits Participation Funds) Collected from Banks***** 76.450 201 34.593 341 161.043,54 TRY FX Total Balance sheet million TL), Period:2020/12 Assets Cash Receivables from CBRT Receivables from Money Market Receivables from Banks Securities at Fair Value Through Profit or loss Securities at Fair Value Through Other Comprehensive Income Required Reserves Receivables from Securities Interbank Receivables from Reverse Repo Loans Non-performing Loans Allowances for Credit Losses) 3) Allowances for 12 Month ECL (First Stage)" b Allowances for Lifetime ECL Second Stagel** c) Allowances for Lifetime ECL Third Stage) Interest (Profit Share) and income Accruals and Rediscounts a) Interest Profit Share and income Accruals and Rediscounts from Loans b) Interest Income Rediscounts from Securities s Other interest Profit Share and income Rediscounts Leasint Receivables Aff ates Subsidiaries and Joint Ventures Securities at Amortised Cost Assets to be sold (Net Premises and Equipment Net) Other Assets TOTAL ASSETS 15.269,59 53.095,45 71.365,03 66.185,57 219.533,05 285.723,66 7.591,00 109,11 7.700 11 54.762.60 146.033 34 210.795,94 35.376,46 29.110.67 64.487, 13 301.022.08 267.227.21 568.249,29 257,21 320.956,47 321.243,68 1.010 56 122,85 1.133,41 26.565 36 1.45471 28.050,56 2.352.995,07 1.223.735,41 3.575.732,49 137.802,09 14.399,59 152. 201,67 161.589 11 35.459,40 197.048,51 19.599.89 5.012.50 24.712,49 36.375,03 21.578,55 55.453,58 105.014,20 3.863,25 113.852,45 202.200,49 65.719,20 267.919,65 66.127,69 20.466,90 86.594,59 34.228,03 13.485,29 97.713 37 51.844.72 31.767,01 83.611.73 6.101,65 5.773,94 11.575 55 62.038,57 43.124,80 110.163,37 241.103,95 145.797,76 389.905,78 22.085,57 0,00 22.056,57 55.135,35 130, 60 55.265,95 33.482.18 76.497,85 159.980.02 3.522.433,73 2.585.398,63 6.107.832.35 2) Calculate the Loan dollarization and deposit dollarization ratio for Turkish Banking Sector according to table above. And, What if loan dollarization is high than deposit dollarization? Balance Sheet (million TL), Period 2020/12 TRY FX Total Total Liabilities and Equities Deposit Participation Funds*** 1.546.188.28 1.909.125,20 3.455.314,45 a) Demand Deposits 327.172.65 799.251,33 1.126.423,98 b) Term Deposits 1.219.015,53 1.109.874,57 2.328.890,50 Payables to the CBRT 16.497,69 112.048,07 128.545,77 Payables to Money Market 184.493,42 0,00 184.493,42 Payables to Securities Market 15.505, 36 57,78 15.564,14 Payables to Banks 92.274,63 565.343,81 657.618,44 Funds from Repo Transactions 164.179,21 90.942,89 255.122,10 Funds 21.621,69 1.00679 22.628,69 Securities issued (Net) (37+38) 59.789, 53 164.324,44 224.113,97 a Bonds and is 47.800,15 159.793,50 207.593,75 b) Asset Backed Securities and Other Securities issued 11.989,35 4.530,84 16.520,22 Labilities Arising from Leases (Net 10.355,50 372,24 10.727,74 Taxes, Duties, Charges and Premiums Payable 5.560.99 97,16 5.658,15 Subordinated Debt Net 20.650,81 138.684,55 159.365,36 Interest (Profit Share and Expense Accruals and Rediscounts 56.762.BS 44.311 39 101.074,27 a) Deposit Participation Funds) Interest Profit Share) Rediscounts 7.795.77 1.110,72 8.907,49 b) Other interest (Profit Share and Expense Rediscounts 48.966,12 43.200,67 92.166,78 Provisions.... 57.878,78 5.760,01 63.635,78 Other Liabilities 164.844,45 53.318,29 223.162.74 LIABILITIES 2.455.634,43 3.090.393,63 5.507.028,05 Paid - in Capital 125.055,62 0.00 125.085.62 Leral Reserves 371.692 14 408.03 372.100,17 Capital Reserves Due to Inflation Accounting 0,00 0,00 0,00 Fixed Asset Revaluation Fund 24.934,57 16,08 24.950,65 Securities increment Value Fund 13.011.95 3.451, 12 21.453,05 Proft Loss of the Period 59.972,61 0.00 59.972.61 Accumulated Profit (Loss -2.770.84 0,00 -2.770,84 TOTAL SHAREHOLDERS' EQUITY 595.929,05 3.875, 24 600.804,29 TOTAL LIABILITIES 3.013.563,48 3.094.268,57 6.107.532,35 contingencies 395.412,85 505.214,67 1.003.627,55 Commitments (59-50 1.713.132.28 3.281.228,68 4.994.360,96 a) Derivative Financial instruments 1.001.471,37 2.975.216,01 3.976.687,88 b) Other Commitments 711.660,41 306.012,67 1.017.673,05 Loans Extended to Banks..... 17.014,06 41.534,40 58.548,45 Deposits Participation Funds) Collected from Banks***** 76.450 201 34.593 341 161.043,54 TRY FX Total Balance sheet million TL), Period:2020/12 Assets Cash Receivables from CBRT Receivables from Money Market Receivables from Banks Securities at Fair Value Through Profit or loss Securities at Fair Value Through Other Comprehensive Income Required Reserves Receivables from Securities Interbank Receivables from Reverse Repo Loans Non-performing Loans Allowances for Credit Losses) 3) Allowances for 12 Month ECL (First Stage)" b Allowances for Lifetime ECL Second Stagel** c) Allowances for Lifetime ECL Third Stage) Interest (Profit Share) and income Accruals and Rediscounts a) Interest Profit Share and income Accruals and Rediscounts from Loans b) Interest Income Rediscounts from Securities s Other interest Profit Share and income Rediscounts Leasint Receivables Aff ates Subsidiaries and Joint Ventures Securities at Amortised Cost Assets to be sold (Net Premises and Equipment Net) Other Assets TOTAL ASSETS 15.269,59 53.095,45 71.365,03 66.185,57 219.533,05 285.723,66 7.591,00 109,11 7.700 11 54.762.60 146.033 34 210.795,94 35.376,46 29.110.67 64.487, 13 301.022.08 267.227.21 568.249,29 257,21 320.956,47 321.243,68 1.010 56 122,85 1.133,41 26.565 36 1.45471 28.050,56 2.352.995,07 1.223.735,41 3.575.732,49 137.802,09 14.399,59 152. 201,67 161.589 11 35.459,40 197.048,51 19.599.89 5.012.50 24.712,49 36.375,03 21.578,55 55.453,58 105.014,20 3.863,25 113.852,45 202.200,49 65.719,20 267.919,65 66.127,69 20.466,90 86.594,59 34.228,03 13.485,29 97.713 37 51.844.72 31.767,01 83.611.73 6.101,65 5.773,94 11.575 55 62.038,57 43.124,80 110.163,37 241.103,95 145.797,76 389.905,78 22.085,57 0,00 22.056,57 55.135,35 130, 60 55.265,95 33.482.18 76.497,85 159.980.02 3.522.433,73 2.585.398,63 6.107.832.35 2) Calculate the Loan dollarization and deposit dollarization ratio for Turkish Banking Sector according to table above. And, What if loan dollarization is high than deposit dollarization

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started