Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Balance Sheet, Net Income, and Cash Flows Financial information related to Abby's Interiors for October and November of 20Y6 is as follows October 31, 20Y6

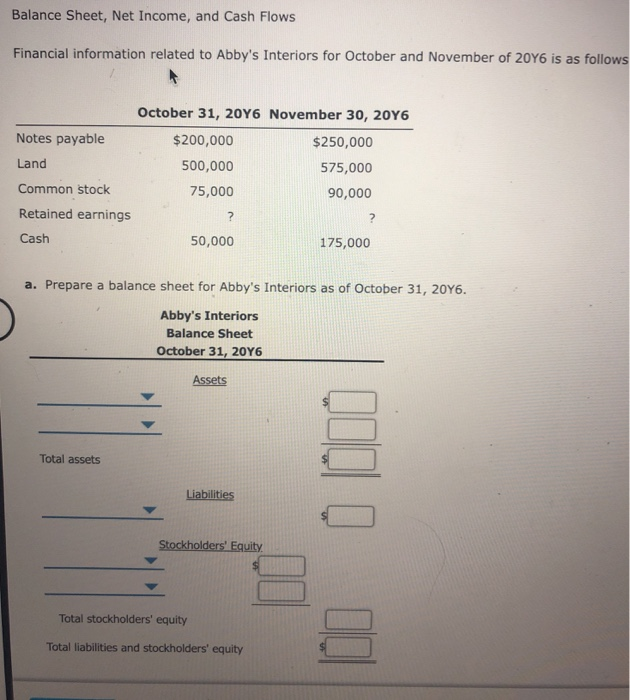

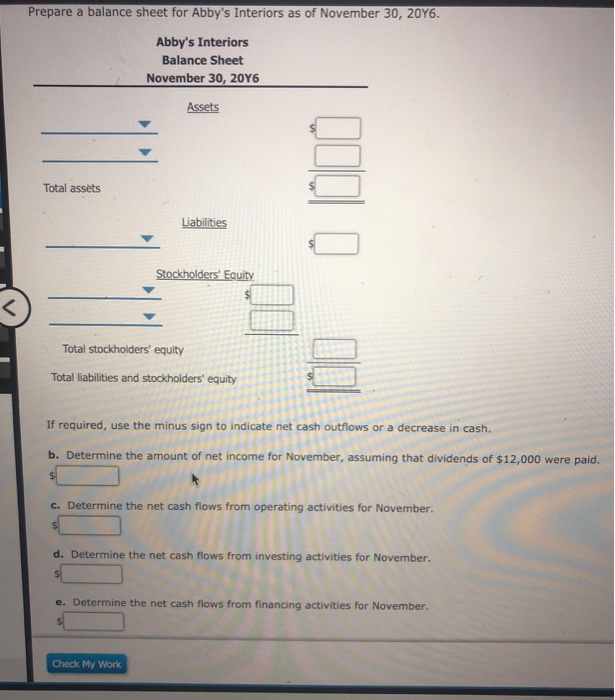

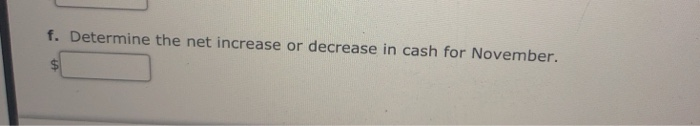

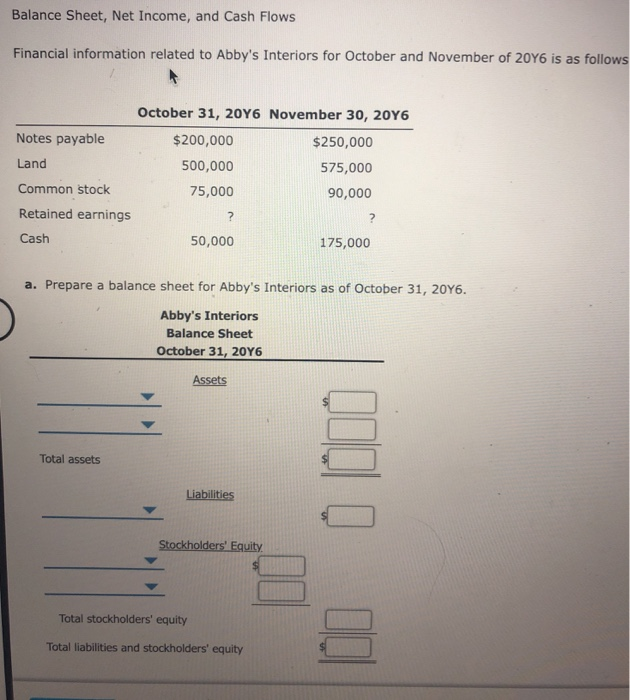

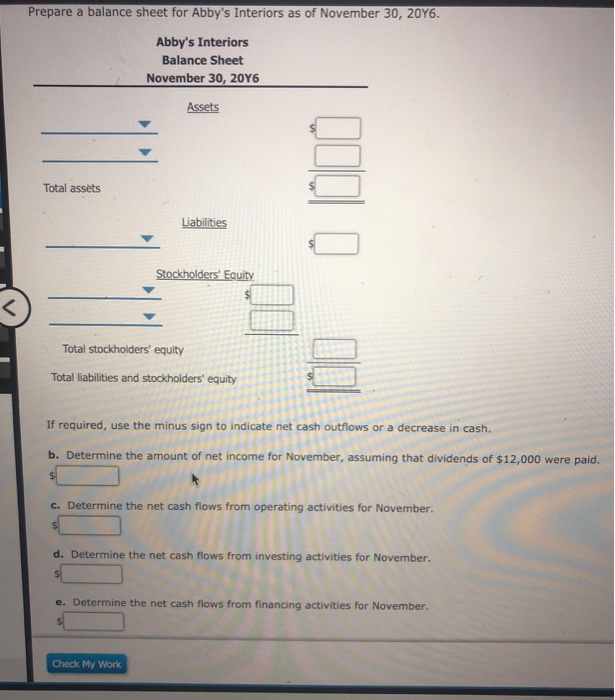

Balance Sheet, Net Income, and Cash Flows Financial information related to Abby's Interiors for October and November of 20Y6 is as follows October 31, 20Y6 November 30, 20Y6 Notes payable Land Common stock Retained earnings Cash $200,000 500,000 75,000 $250,000 575,000 90,000 50,000 175,000 a. Prepare a balance sheet for Abby's Interiors as of october 31, 20Y6. Abby's Interiors Balance Sheet October 31, 20Y6 Assets Total assets Liabilities Stockholders' Equity Total stockholders' equity Total liabilities and stockholders' equity Prepare a balance sheet for Abby's Interiors as of November 30, 20Y6 Abby's Interiors Balance Sheet November 30, 20Y6 Assets Total assets Liabilities Total stockholders' equity Total liabilities and stockholders' equity If required, use the minus sign to indicate net cash outflows or a decrease in cash. b. Determine the amount of net income for November, assuming that dividends of $12,000 were paid. c. Determine the net cash flows from operating activities for November. d. Determine the net cash flows from investing activities for November. e. Determine the net cash flows from financing activities for November. Check My Work f. Determine the net increase or decrease in cash for November

Balance Sheet, Net Income, and Cash Flows Financial information related to Abby's Interiors for October and November of 20Y6 is as follows October 31, 20Y6 November 30, 20Y6 Notes payable Land Common stock Retained earnings Cash $200,000 500,000 75,000 $250,000 575,000 90,000 50,000 175,000 a. Prepare a balance sheet for Abby's Interiors as of october 31, 20Y6. Abby's Interiors Balance Sheet October 31, 20Y6 Assets Total assets Liabilities Stockholders' Equity Total stockholders' equity Total liabilities and stockholders' equity Prepare a balance sheet for Abby's Interiors as of November 30, 20Y6 Abby's Interiors Balance Sheet November 30, 20Y6 Assets Total assets Liabilities Total stockholders' equity Total liabilities and stockholders' equity If required, use the minus sign to indicate net cash outflows or a decrease in cash. b. Determine the amount of net income for November, assuming that dividends of $12,000 were paid. c. Determine the net cash flows from operating activities for November. d. Determine the net cash flows from investing activities for November. e. Determine the net cash flows from financing activities for November. Check My Work f. Determine the net increase or decrease in cash for November

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started