Answered step by step

Verified Expert Solution

Question

1 Approved Answer

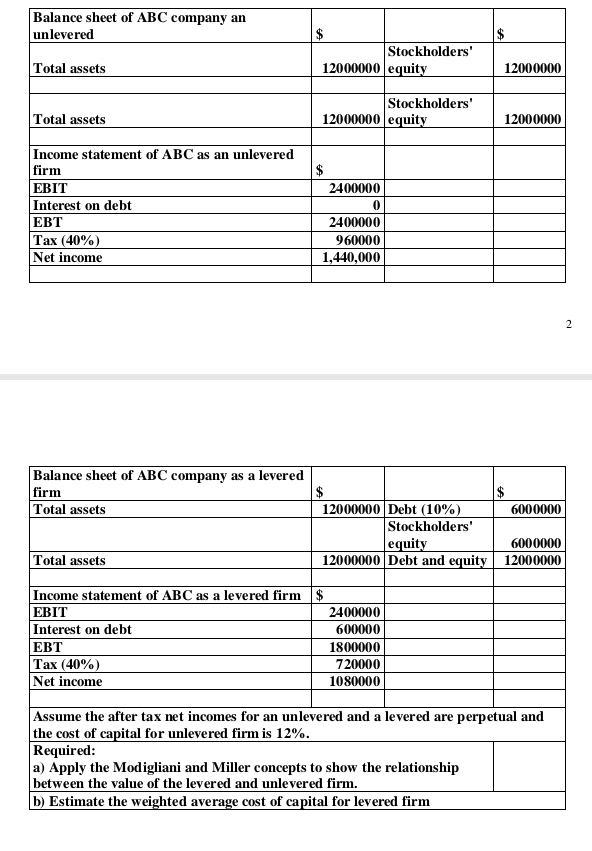

Balance sheet of ABC company anunleveredTotal assetsTotal assetsIncome statement of ABC as an unleveredfirmEBITLnterest on debtEBTTax ( 4 0 % ) Balance sheet of ABC

Balance sheet of ABC company anunleveredTotal assetsTotal assetsIncome statement of ABC as an unleveredfirmEBITLnterest on debtEBTTax Balance sheet of ABC company as a leveredfirmTotal assetsTotal assetsomeIncome statement of ABC as a levered firmEBITInterest on debtEBTTax Net incomethe cost of capital for unlevered firm is Required:OetbequityequityDebt StockholdersStockholders'Debt and equityStockholders'equitya Apply the Modigliani and Miller concepts to show the relationshipn the value of the levered and unlevered firm.Assume the after tax net incomes for an unlevered and a levered are perpetual and$ate the weighted average cost of capital levered firm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started