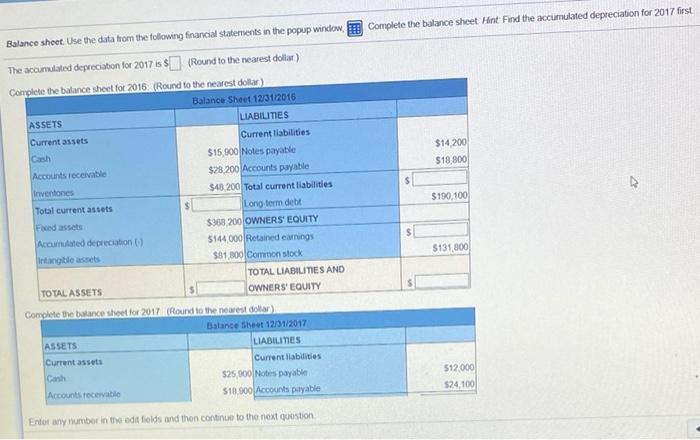

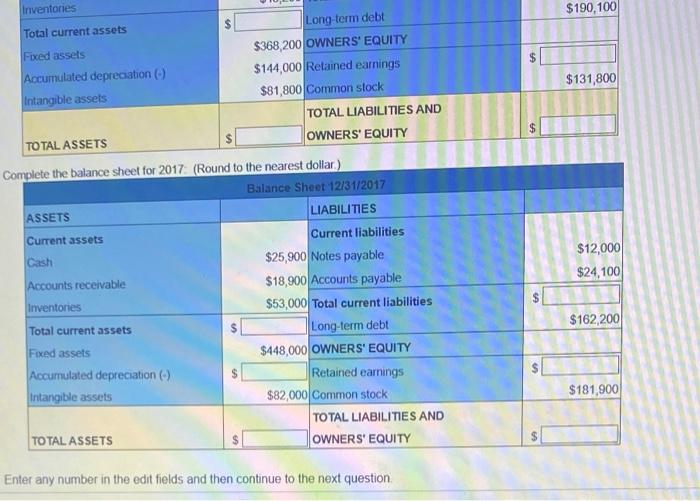

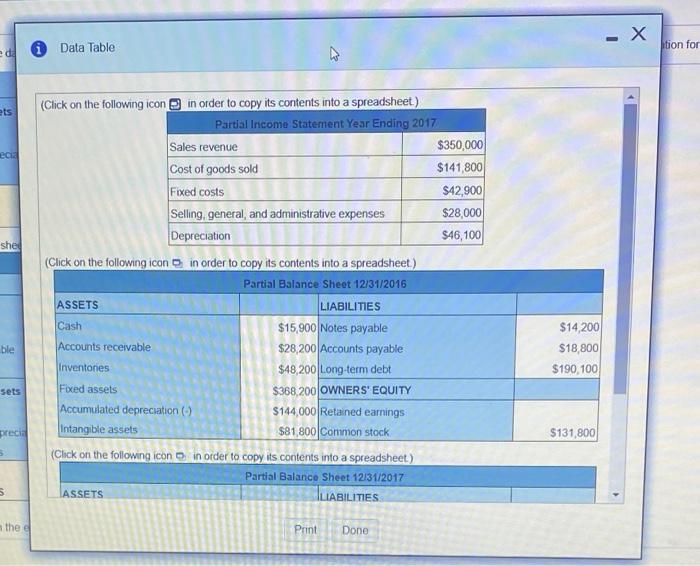

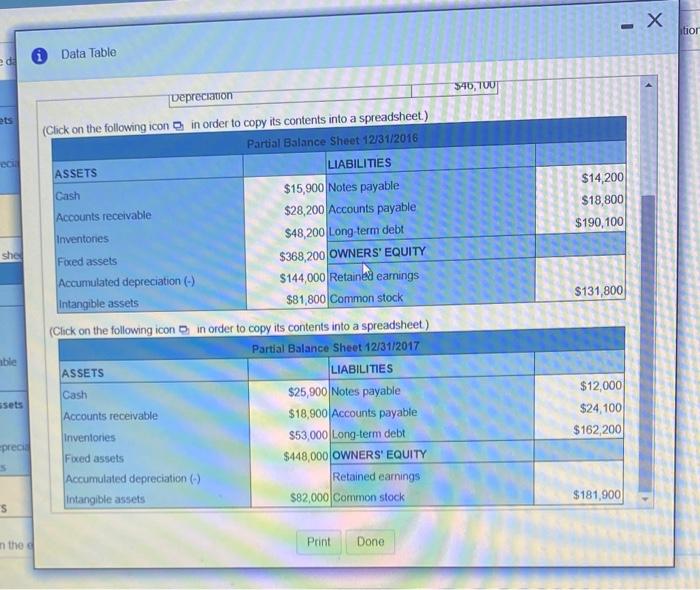

Balance sheet Use the data from the following financial statements in the popup window, TE Complete the balance sheet Hint Find the accumulated depreciation for 2017 first The accumulated depreciation for 2017 is $ (Round to the nearest dollar) Complete the balance sheet for 2016. (Round to the nearest dollar Balance Sheet 12/31/2016 LIABILITIES ASSETS Current liabilities Current assets $14200 $18,800 Accounts receivable Inventones $190,100 Total current assets Faced assets Accurated depreciation Intangible assets $15.900 Notes payable $28.200 Accounts payable 548 200 Total current liabilities Long term debt $368 200 OWNERS' EQUITY 5144 000 Retained earnings $81300 Common stock TOTAL LIABILITIES AND OWNERS' EQUITY $131 300 TOTAL ASSETS Complete the balance sheet for 2017 (Round to the nearest dollar Balance sheet 12/31/2017 ASSETS Current assets LIABILITIES Current liabilities $25,000 Notes payable $18.900 Accounts payable $12.000 $24.100 Accounts receivable Enter any number in the edit fields and then continue to the next question Inventories $190, 100 Total current assets Fixed assets Long-term debe $368,200 OWNERS' EQUITY $144,000 Retained earnings $81,800 Common stock $131,800 Accumulated depreciation (-) Intangible assets TOTAL LIABILITIES AND GA TOTAL ASSETS OWNERS' EQUITY Complete the balance sheet for 2017 (Round to the nearest dollar.) Balance Sheet 12/31/2017 ASSETS LIABILITIES Current liabilitie Current assets Cash $12,000 $24,100 Accounts receivable Inventories Total current assets $25,900 Notes payable $18,900 Accounts payable $53,000 Total current liabilities Long-term debt $448,000 OWNERS' EQUITY Retained earnings $82,000 Common stock $162,200 Fixed assets Accumulated depreciation (-) Intangible assets $181,900 TOTAL LIABILITIES AND TOTAL ASSETS OWNERS' EQUITY CA Enter any number in the edit fields and then continue to the next question 0 Data Table tion for ets eca (Click on the following icon in order to copy its contents into a spreadsheet) Partial Income Statement Year Ending 2017 Sales revenue $350,000 Cost of goods sold $141,800 Fixed costs $42,900 Selling, general, and administrative expenses $28,000 Depreciation $46,100 (Click on the following icon in order to copy its contents into a spreadsheet) she Partial Balance Sheet 12/31/2016 ble $14,200 $18,800 $190, 100 sets ASSETS LIABILITIES Cash $15,900 Notes payable Accounts receivable $28,200 Accounts payable Inventones $48,200 Long-term debt Fixed assets $368,200 OWNERS' EQUITY Accumulated depreciation $144,000 Retained earnings Intangible assets $81 800 Common stock (Click on the following icon in order to copy its contents into a spreadsheet) Partial Balance Sheet 12/31/2017 LIABILITIES precia $131,800 5 5 ASSETS the e Print Done - X tior Data Table $16, TUUT Depreciation (Click on the following icon in order to copy its contents into a spreadsheet.) Partial Balance Sheet 12/31/2016 ASSETS $14,200 $18,800 $190,100 she $131,800 LIABILITIES Cash $15,900 Notes payable Accounts receivable $28,200 Accounts payable Inventones $48,200 Long term debt Fixed assets $368,200 OWNERS' EQUITY Accumulated depreciation (-) $144,000 Retained earnings Intangible assets $81,800 Common stock (Click on the following icon in order to copy its contents into a spreadsheet) Partial Balance Sheet 12/31/2017 LIABILITIES Cash $25,900 Notes payable Accounts receivable $18,900 Accounts payable Inventories $53,000 Long-term debt Foxed assets $448,000 OWNERS' EQUITY Accumulated depreciation (-) Retained earnings Intangible assets $82,000 Common stock able ASSETS ssets $12,000 $24,100 $162,200 prec $181,900 s n the Print Done