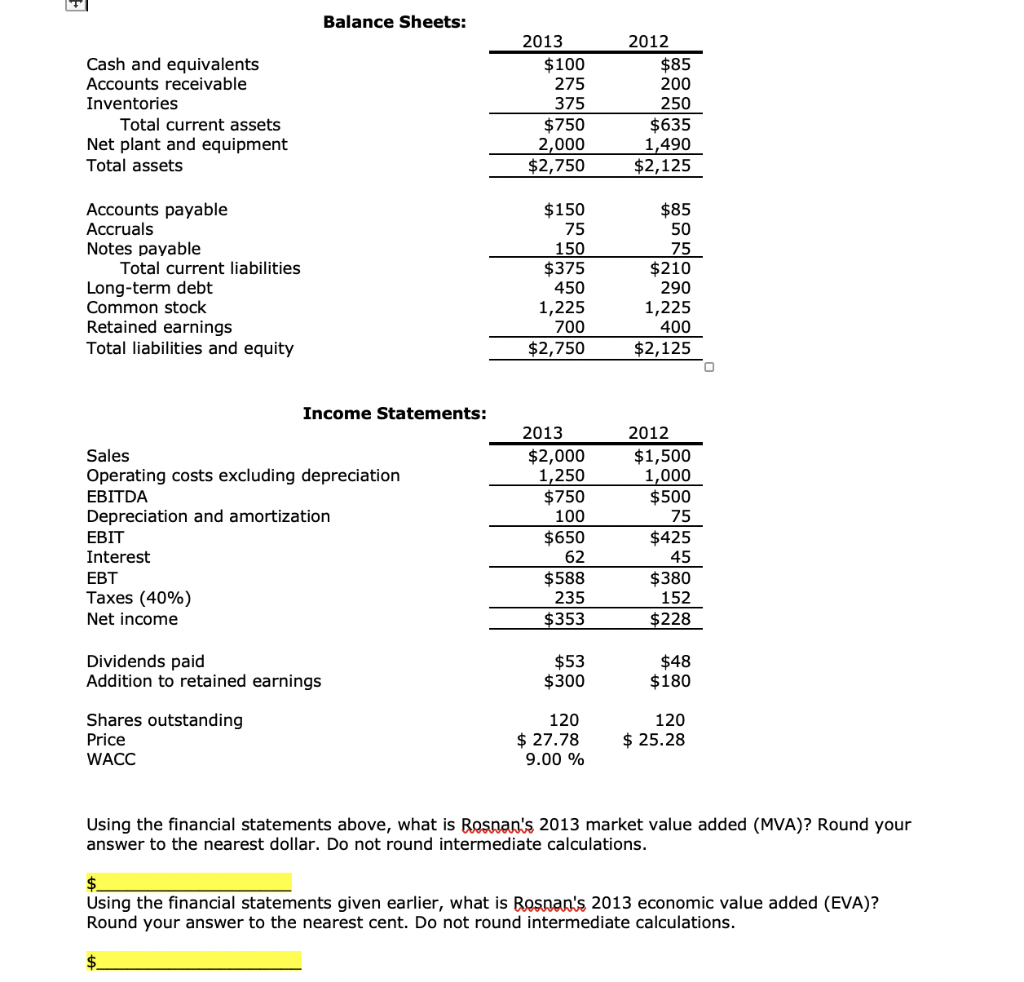

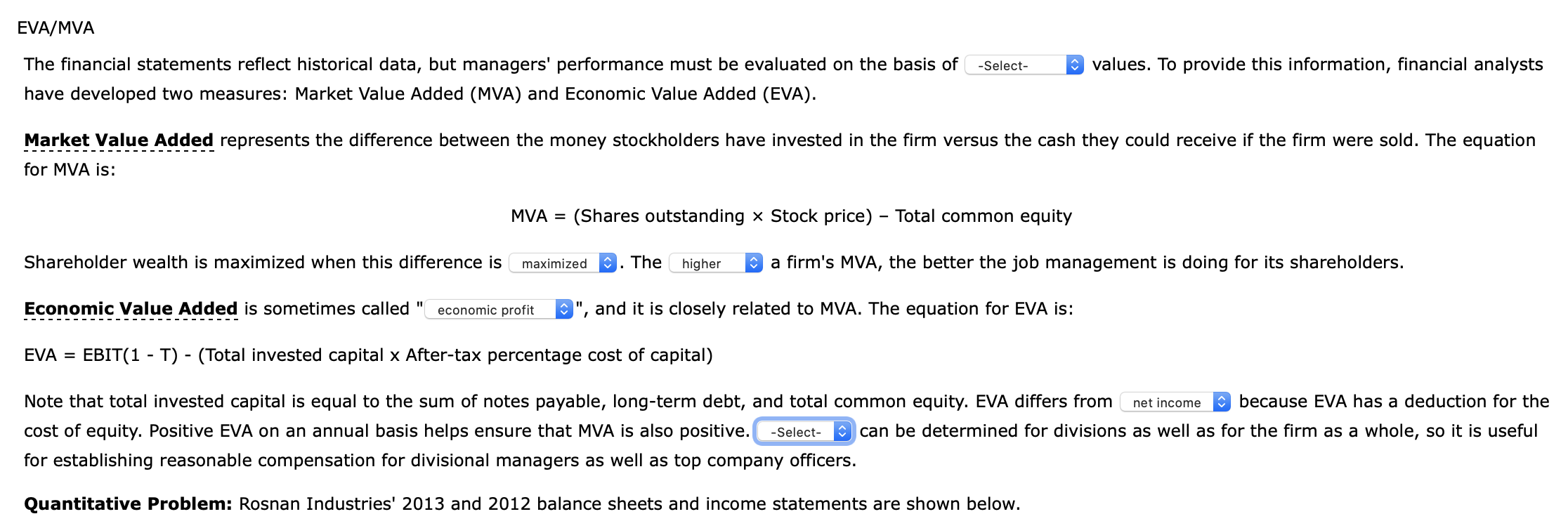

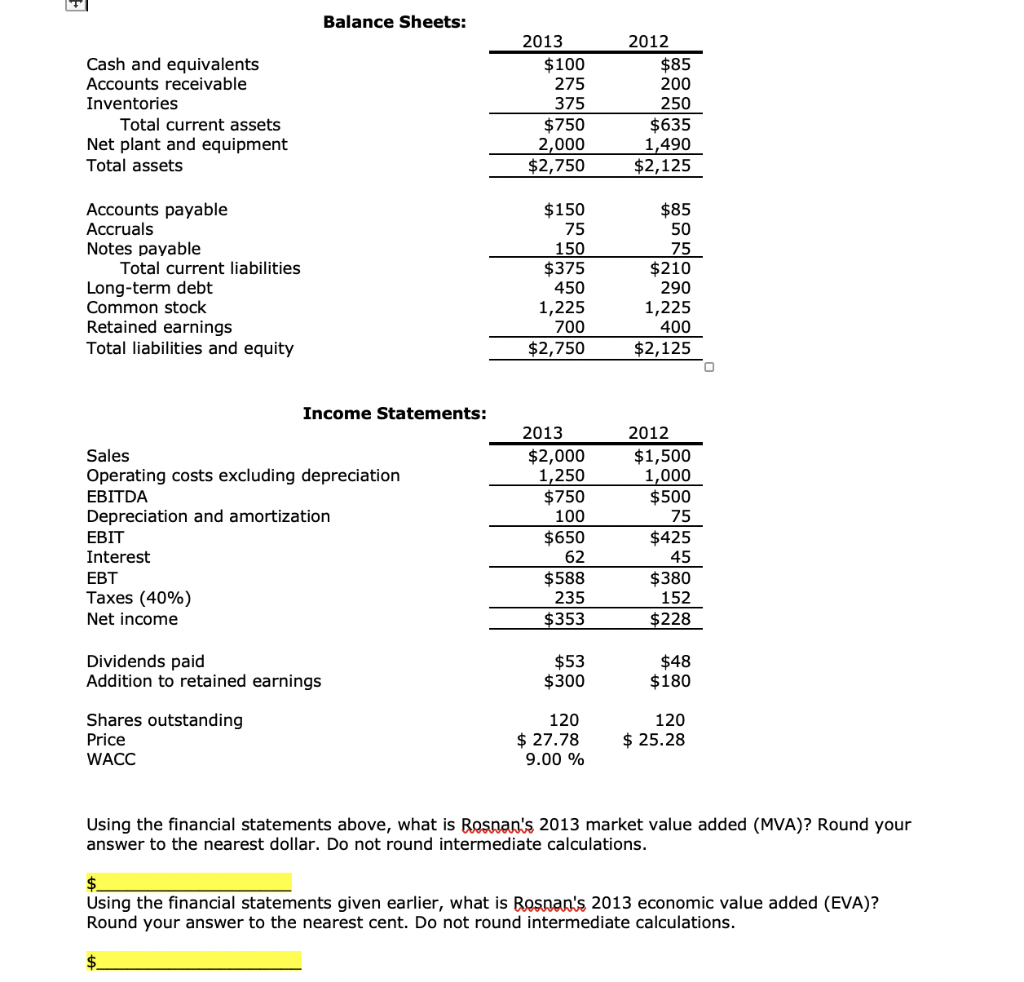

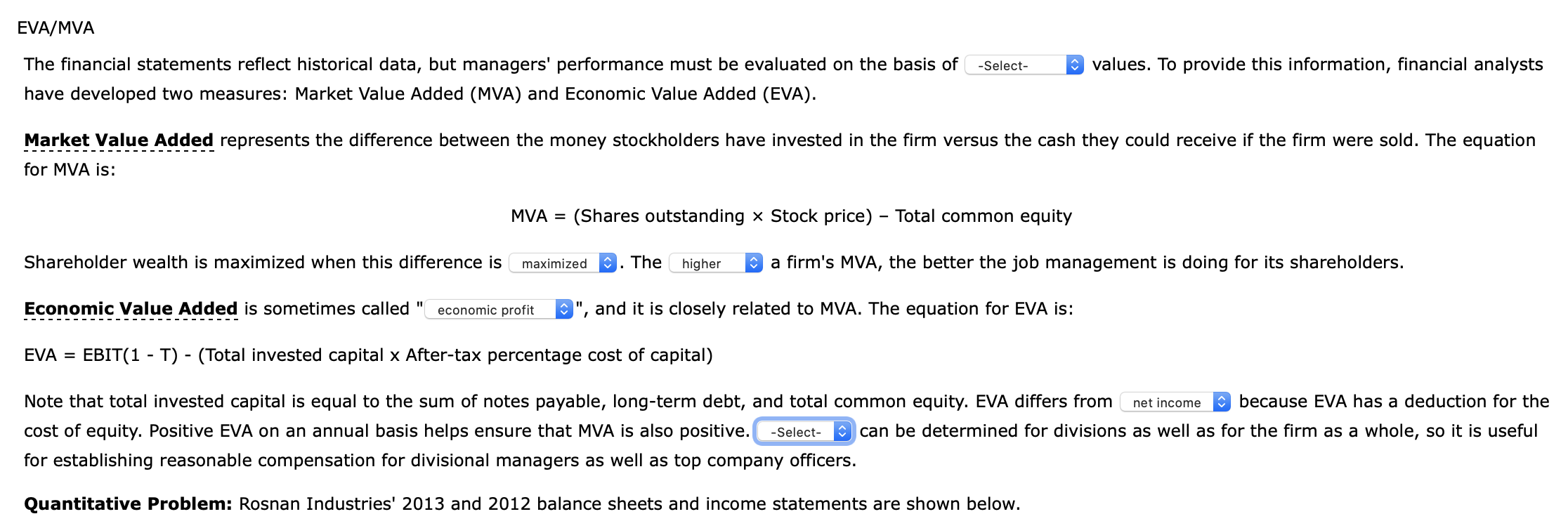

Balance Sheets: 2013 $100 275 375 Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets 2012 $85 200 250 $635 1,490 $2,125 $750 2,000 $2,750 Accounts payable Accruals Notes payable Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity $150 75 150 $375 450 1,225 700 $2,750 $85 50 75 $210 290 1,225 400 $2,125 Income Statements: 2012 $1,500 1,000 $500 75 Sales Operating costs excluding depreciation EBITDA Depreciation and amortization EBIT Interest EBT Taxes (40%) Net income 2013 $2,000 1,250 $750 100 $650 62 $588 235 $353 $425 45 $380 152 $228 Dividends paid Addition to retained earnings $53 $300 $48 $180 Shares outstanding Price WACC 120 $ 27.78 9.00 % 120 $ 25.28 Using the financial statements above, what is Rosnan's 2013 market value added (MVA)? Round your answer to the nearest dollar. Do not round intermediate calculations. Using the financial statements given earlier, what is Rosnan's 2013 economic value added (EVA)? Round your answer to the nearest cent. Do not round intermediate calculations. EVA/MVA values. To provide this information, financial analysts The financial statements reflect historical data, but managers' performance must be evaluated on the basis of -Select- have developed two measures: Market Value Added (MVA) and Economic Value Added (EVA). Market Value Added represents the difference between the money stockholders have invested in the firm versus the cash they could receive if the firm were sold. The equation for MVA is: MVA = (Shares outstanding ~ Stock price) - Total common equity Shareholder wealth is maximized when this difference is maximized . The higher a firm's MVA, the better the job management is doing for its shareholders. Economic Value Added is sometimes called "economic profit ", and it is closely related to MVA. The equation for EVA is: EVA = EBIT(1 - T) - (Total invested capital x After-tax percentage cost of capital) Note that total invested capital is equal to the sum of notes payable, long-term debt, and total common equity. EVA differs from net income because EVA has a deduction for the cost of equity. Positive EVA on an annual basis helps ensure that MVA is also positive. -Select- can be determined for divisions as well as for the firm as a whole, so it is useful for establishing reasonable compensation for divisional managers as well as top company officers. Quantitative Problem: Rosnan Industries' 2013 and 2012 balance sheets and income statements are shown below