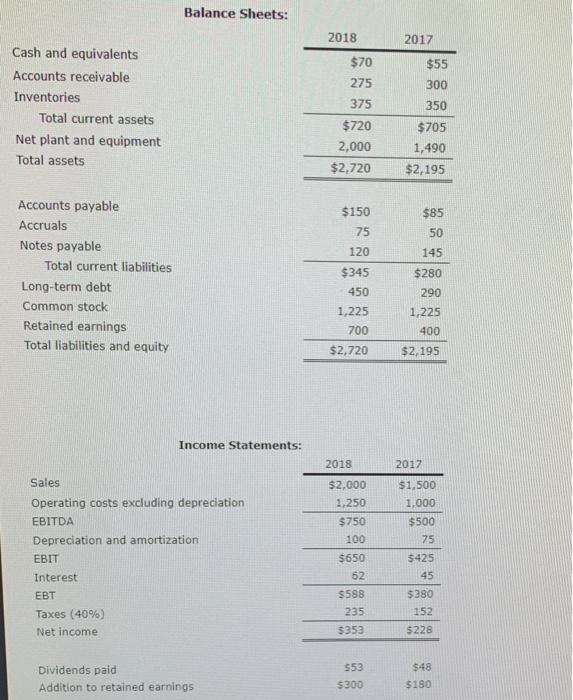

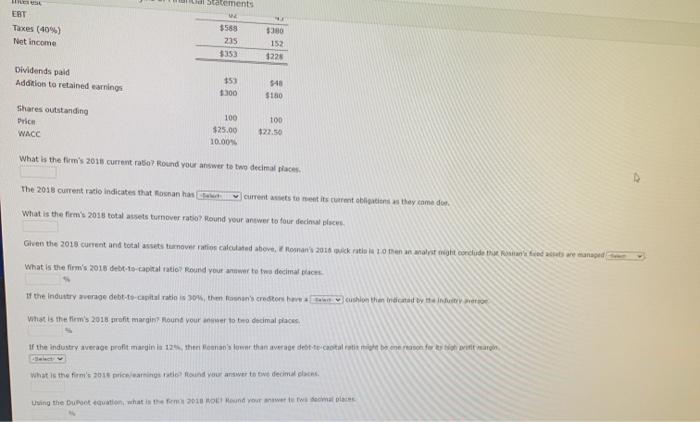

Balance Sheets: 2018 2017 $70 $55 275 300 Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets 375 350 $720 2,000 $2.720 $705 1,490 $2,195 $150 75 $85 50 120 145 Accounts payable Accruals Notes payable Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity $280 290 $345 450 1,225 700 1,225 400 $2,720 $2,195 Income Statements: 2017 Sales 2018 $2,000 1.250 $750 100 $1,500 1.000 Operating costs excluding depreciation EBITDA Depreciation and amortization EBIT $500 75 $650 62 $425 45 Interest EBT Taxes (40%) Net income $588 235 $380 152 $353 5228 $48 Dividends paid Addition to retained earnings 553 $300 $180 di statements EBT Taxes (40%) Net income $588 215 $353 $380 152 1228 Dividends paid Addition to retained earnings 15) 1300 $40 $180 Shares outstanding ri 100 WACC 100 $25.00 10.00 $22.50 What is the firm's 2018 current rabo Round your answer to two decimal places The 2018 current ratio indicates that Rosan has current is to its current obligations as they comedor What is the firm's 2018 total sets turnover ratio? Round your answer to four decina looms. Given the 2018 current and total sets turnover rates Calculated above, Woman's 2016 gick rutin la Loten an alth condude the road we managed What is the flim's 2018 debt-to-capital ratio Round your answer to twa decima i If the industry eage debt-to-capital ratlos 90%, then's creditors Cushion than indicated by the intuitive What is the firm's 2018 profit margin Hount voor de toro decimal places If the industry average profit margin in the son than were dette castrati berson for stari what is the firm's 2018 pristofound your answer to two decimal Using the Dutcquation what is the 2018 Ond your awesome Balance Sheets: 2018 2017 $70 $55 275 300 Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets 375 350 $720 2,000 $2.720 $705 1,490 $2,195 $150 75 $85 50 120 145 Accounts payable Accruals Notes payable Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity $280 290 $345 450 1,225 700 1,225 400 $2,720 $2,195 Income Statements: 2017 Sales 2018 $2,000 1.250 $750 100 $1,500 1.000 Operating costs excluding depreciation EBITDA Depreciation and amortization EBIT $500 75 $650 62 $425 45 Interest EBT Taxes (40%) Net income $588 235 $380 152 $353 5228 $48 Dividends paid Addition to retained earnings 553 $300 $180 di statements EBT Taxes (40%) Net income $588 215 $353 $380 152 1228 Dividends paid Addition to retained earnings 15) 1300 $40 $180 Shares outstanding ri 100 WACC 100 $25.00 10.00 $22.50 What is the firm's 2018 current rabo Round your answer to two decimal places The 2018 current ratio indicates that Rosan has current is to its current obligations as they comedor What is the firm's 2018 total sets turnover ratio? Round your answer to four decina looms. Given the 2018 current and total sets turnover rates Calculated above, Woman's 2016 gick rutin la Loten an alth condude the road we managed What is the flim's 2018 debt-to-capital ratio Round your answer to twa decima i If the industry eage debt-to-capital ratlos 90%, then's creditors Cushion than indicated by the intuitive What is the firm's 2018 profit margin Hount voor de toro decimal places If the industry average profit margin in the son than were dette castrati berson for stari what is the firm's 2018 pristofound your answer to two decimal Using the Dutcquation what is the 2018 Ond your awesome