Answered step by step

Verified Expert Solution

Question

1 Approved Answer

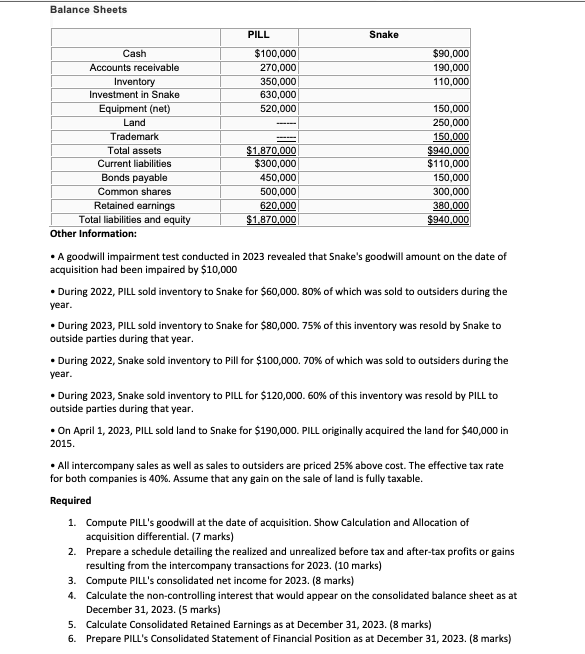

Balance Sheets - A goodwill impairment test conducted in 2023 revealed that Snake's goodwill amount on the date of acquisition had been impaired by $10,000

Balance Sheets - A goodwill impairment test conducted in 2023 revealed that Snake's goodwill amount on the date of acquisition had been impaired by $10,000 - During 2022, PILL sold inventory to Snake for $60,000. 80% of which was sold to outsiders during the year. - During 2023, PILL sold inventory to Snake for $80,000.75% of this inventory was resold by Snake to outside parties during that year. - During 2022, Snake sold inventory to Pill for $100,000. 70% of which was sold to outsiders during the year. - During 2023, Snake sold inventory to PILL for $120,000.60% of this inventory was resold by PILL to outside parties during that year. - On April 1, 2023, PILL sold land to Snake for $190,000. PILL originally acquired the land for $40,000 in 2015. - All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 40%. Assume that any gain on the sale of land is fully taxable. Required 1. Compute PILL's goodwill at the date of acquisition. Show Calculation and Allocation of acquisition differential. (7 marks) 2. Prepare a schedule detailing the realized and unrealized before tax and after-tax profits or gains resulting from the intercompany transactions for 2023. (10 marks) 3. Compute PILL's consolidated net income for 2023. (8 marks) 4. Calculate the non-controlling interest that would appear on the consolidated balance sheet as at December 31, 2023. (5 marks) 5. Calculate Consolidated Retained Earnings as at December 31, 2023. (8 marks) 6. Prepare PILL's Consolidated Statement of Financial Position as at December 31, 2023. (8 marks)

Balance Sheets - A goodwill impairment test conducted in 2023 revealed that Snake's goodwill amount on the date of acquisition had been impaired by $10,000 - During 2022, PILL sold inventory to Snake for $60,000. 80% of which was sold to outsiders during the year. - During 2023, PILL sold inventory to Snake for $80,000.75% of this inventory was resold by Snake to outside parties during that year. - During 2022, Snake sold inventory to Pill for $100,000. 70% of which was sold to outsiders during the year. - During 2023, Snake sold inventory to PILL for $120,000.60% of this inventory was resold by PILL to outside parties during that year. - On April 1, 2023, PILL sold land to Snake for $190,000. PILL originally acquired the land for $40,000 in 2015. - All intercompany sales as well as sales to outsiders are priced 25% above cost. The effective tax rate for both companies is 40%. Assume that any gain on the sale of land is fully taxable. Required 1. Compute PILL's goodwill at the date of acquisition. Show Calculation and Allocation of acquisition differential. (7 marks) 2. Prepare a schedule detailing the realized and unrealized before tax and after-tax profits or gains resulting from the intercompany transactions for 2023. (10 marks) 3. Compute PILL's consolidated net income for 2023. (8 marks) 4. Calculate the non-controlling interest that would appear on the consolidated balance sheet as at December 31, 2023. (5 marks) 5. Calculate Consolidated Retained Earnings as at December 31, 2023. (8 marks) 6. Prepare PILL's Consolidated Statement of Financial Position as at December 31, 2023. (8 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started