Question

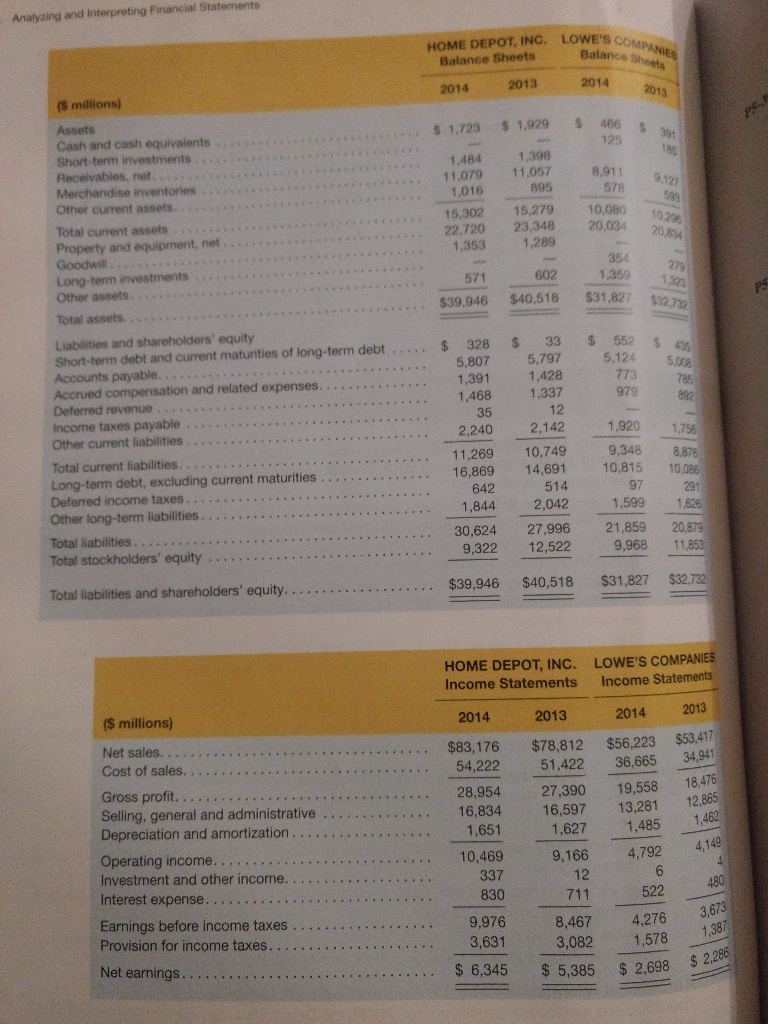

Balance sheets and income statements for the home depot inc. and lowe's companies inc . 1.Compute return on equity, return on assets, and return on

Balance sheets and income statements for the home depot inc. and lowe's companies inc .

1.Compute return on equity, return on assets, and return on financial leverage for each company in 2014

2. Disaggregate the ROA's computed into profit margin (PM) and asset turnover (AT) components. Which of these factors drives ROA for each company?

3. Compute the gross profit margin (GPM) and operating expense-to-sales ratios for each company. How do these companies' profitability measures compare?

4. Compute the accounts receivable turnover (ART), inventory turnover (INVT), and property, plant, and equipment turnover (PPET) for each company. How do these companies, turnover measures compare?

5. Compare and evaluate these competitors' performance in 2014.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started