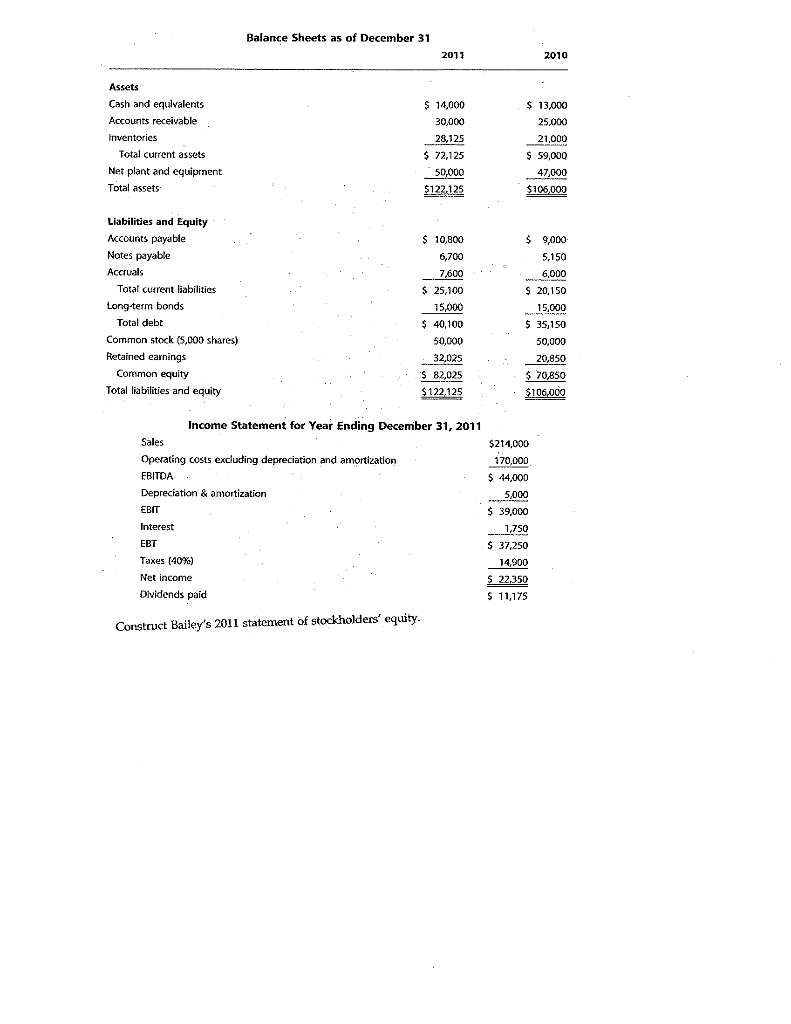

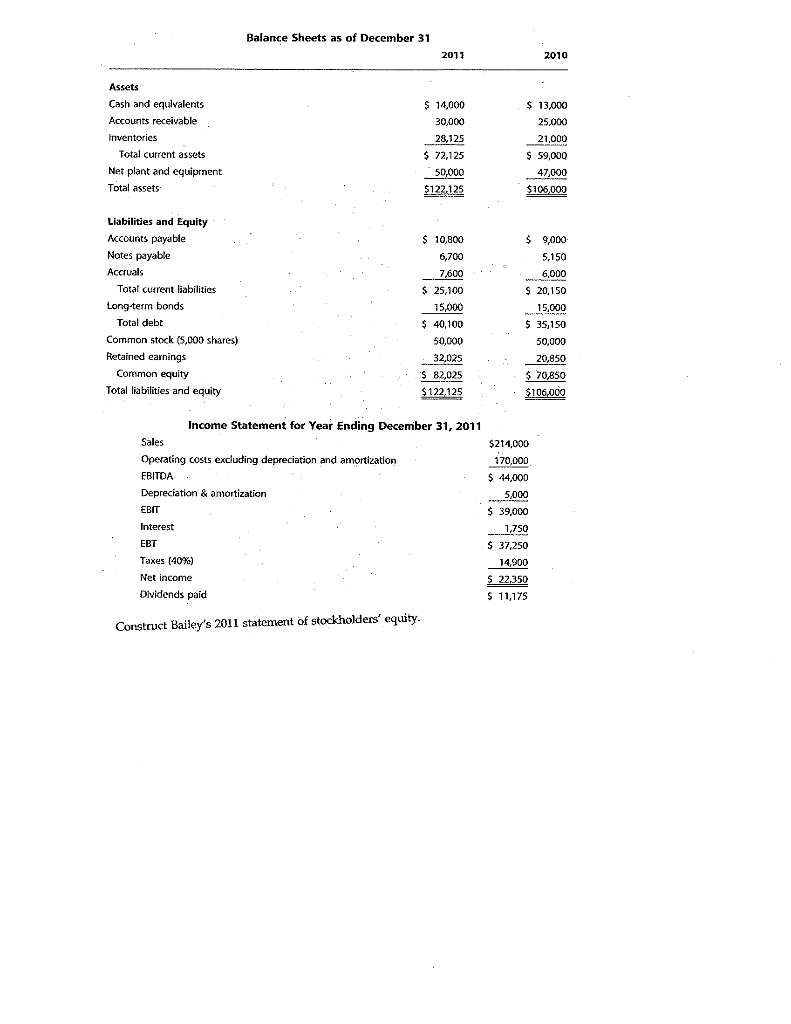

Balance Sheets as of December 31 2011 2010 Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets $ 14,000 30,000 28,125 $ 72,125 50,000 $122.125 $ 13,000 25.000 21,000 $ 59,00 47,000 $106,000 Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total debt Common stock (5,000 shares) Retained earnings Common equity Total liabilities and equity $ 10,800 6,700 7,600 $ 25,100 15,000 $ 9,000 5,150 6,000 $ 20,150 15,000 $ 35,150 50,000 20,850 $ 70,850 $106,000 $ 40,100 50,000 32,025 $ 82,025 $ 122,125 Income Statement for Year Ending December 31, 2011 Sales Operating costs excluding depreciation and amortization EBITDA Depreciation & amortization EBIT Interest $214,000 170,000 $ 44,000 5,000 $ 39,000 1,750 EBT Taxes (40%) Net income Dividends paid $ 37,250 14,900 $ 22,350 $ 11,175 Construct Bailey's 2011 statement of stockholders' equity. Notes to the Financial Statements Immediately following the four financial statements is the section entitled Notes to the Financial Statements (Exhibit 12). The notes are, in fact, an integral part of the state- ments and must be read in order to understand the presentation on the face of each financial statement. The first note to the financial statements provides a sumnary of the firm's account- ing policies. If there have been changes in any accounting policies during the reporting period, these changes will be explained and the impact quantified in a financial statement note. Other notes to the financial statements present details about particular accounts, such as Inventory Property, plant, and equipment Investments Long-term debt The equity accounts The notes also include information about Any major acquisitions or divestitures that have occurred during the accounting period Officer and employee retirement, pension, and stock option plans Leasing arrangements The term, cost, and maturity of debt Pending legal proceedings Income taxes Contingencies and commitments Quarterly results of operations Operating segments Certain supplementary information is also required by the governmental and accounting authorities-primarily the SEC and the FASB that establish accounting policies. There are, for instance, supplementary disclosure requirements relating to reserves for companies operating in the oil, gas, or other areas of the extractive indus- tries. Firms operating in foreign countries show the effect of foreign currency transla- tions. If a firm has several lines of business, the notes will contain a section showing financial information for each reporlable seginent