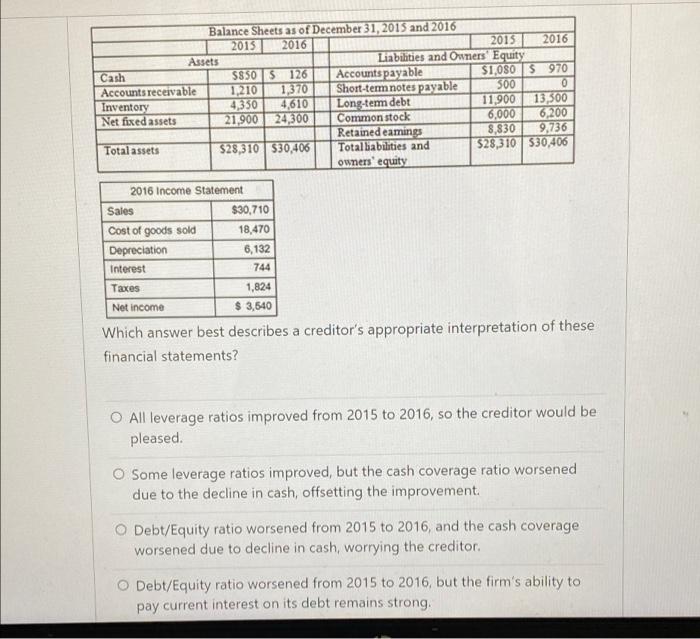

Balance Sheets as of December 31, 2015 and 2016 2013 2016 2015 2016 Assets Liabilities and Owners' Equity Cash S8SOS 126 Accounts payable $1,0803970 Accounts receivable 1.210 1,370 Short-term notes payable 500 0 Inventory 4,350 4,610 Long-term debt 11,900 13,500 Net fixed assets 21,900 24,300 Common stock 6,000 6,200 Retained eamings 8,830 9,736 Total assets $28,310 530,406 Totalbabilities and $28,310 530,406 owners equity 2016 Income Statement Sales $30,710 Cost of goods sold 18,470 Depreciation 6,132 Interest 744 Taxes 1,824 Net Income $ 3,540 Which answer best describes a creditor's appropriate interpretation of these financial statements? O All leverage ratios improved from 2015 to 2016, so the creditor would be pleased. O Some leverage ratios improved, but the cash coverage ratio worsened due to the decline in cash, offsetting the improvement O Debt/Equity ratio worsened from 2015 to 2016, and the cash coverage worsened due to decline in cash, worrying the creditor. O Debt/Equity ratio worsened from 2015 to 2016, but the firm's ability to pay current interest on its debt remains strong. Balance Sheets as of December 31, 2015 and 2016 2013 2016 2015 2016 Assets Liabilities and Owners' Equity Cash S8SOS 126 Accounts payable $1,0803970 Accounts receivable 1.210 1,370 Short-term notes payable 500 0 Inventory 4,350 4,610 Long-term debt 11,900 13,500 Net fixed assets 21,900 24,300 Common stock 6,000 6,200 Retained eamings 8,830 9,736 Total assets $28,310 530,406 Totalbabilities and $28,310 530,406 owners equity 2016 Income Statement Sales $30,710 Cost of goods sold 18,470 Depreciation 6,132 Interest 744 Taxes 1,824 Net Income $ 3,540 Which answer best describes a creditor's appropriate interpretation of these financial statements? O All leverage ratios improved from 2015 to 2016, so the creditor would be pleased. O Some leverage ratios improved, but the cash coverage ratio worsened due to the decline in cash, offsetting the improvement O Debt/Equity ratio worsened from 2015 to 2016, and the cash coverage worsened due to decline in cash, worrying the creditor. O Debt/Equity ratio worsened from 2015 to 2016, but the firm's ability to pay current interest on its debt remains strong