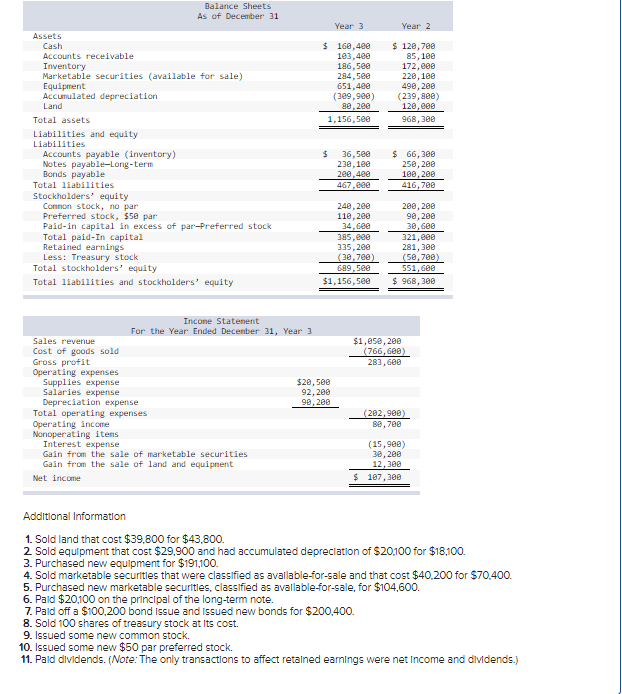

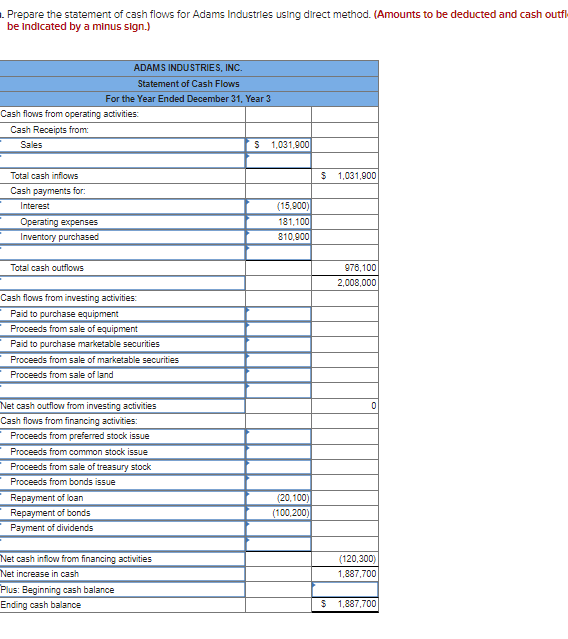

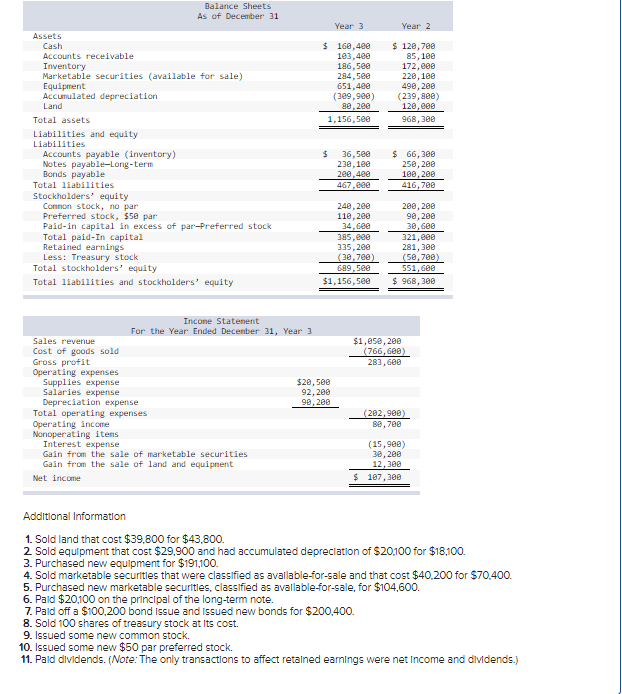

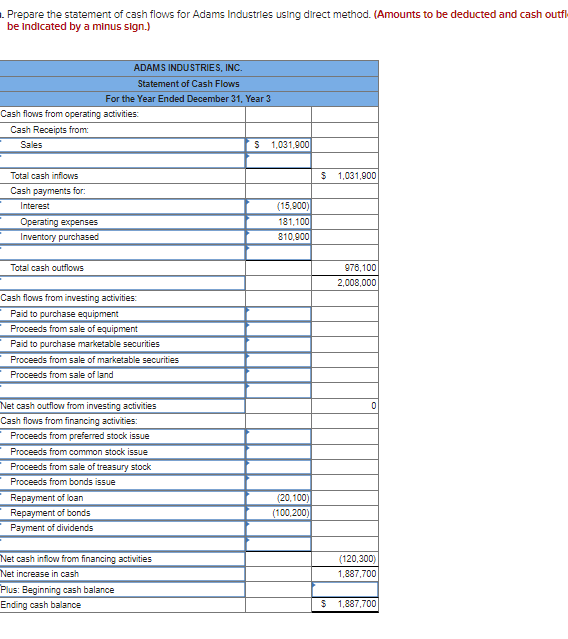

Balance Sheets As of December 31 Year 3 Year 2 $ 160,400 103, 4ee 186, see 284,5ee 651,400 (309,9ee) 80,2ee 1,156,5ee $ 120,700 85,188 172,000 220, 100 490,200 (239,880) 120.000 968, 380 $ Assets Cash Accounts receivable Inventory Marketable securities (available for sale) Equipment Accumulated depreciation Land Total assets Liabilities and equity Liabilities Accounts payable inventory) Notes payable-Long-term Bonds payable Total liabilities Stockholders' equity Connon stock, no par Preferred stock, $50 par Paid-in capital in excess of par-Preferred stock Total paid-In capital Retained earnings Less: Treasury stock Total stockholders' equity Total liabilities and stockholders' equity 36,5ee 238,182 200,400 467,800 $ 66,300 258, 280 188,280 416,700 240, 2ee 118, 2ee 34,600 385.00 335,20 (30,700 689,5ee $1,156,500 288, 200 98,280 38,680 321, eee 281,300 (50,700) 551,688 $ 968,300 $1,650,200 (766,600) 283,688 Income Statement For the Year Ended December 31, Year 3 Sales revenue Cost of goods sold Gross profit Operating expenses Supplies expense $20,58 Salaries expense 92,200 Depreciation expense 90,280 Total operating expenses Operating income Nonoperating itens Interest expense Gain from the sale of marketable securities Gain from the sale of land and equipent Net income (202,980) 89,700 (15,980) 30,200 12,300 $ 107,300 Additional Information 1. Sold land that cost $39.800 for $43.800. 2 Sold equipment that cost $29,900 and had accumulated depreciation of $20.100 for $18,100. 3. Purchased new equipment for $191,100. 4. Sold marketable securities that were classified as available-for-sale and that cost $40.200 for $70.400. 5. Purchased new marketable securitles classified as available-for-sale, for $104,600. 6. Paid $20,100 on the principal of the long-term note. 7. Paid off a $100,200 bond issue and issued new bonds for $200,400. 8. Sold 100 shares of treasury stock at its cost. 9. Issued some new common stock. 10. Issued some new $50 par preferred stock. 11. Pald dividends. (Note: The only transactions to affect retained eamings were net Income and dividends.) Prepare the statement of cash flows for Adams Industries using direct method. (Amounts to be deducted and cash outfi be indicated by a minus sign.) ADAMS INDUSTRIES, INC. Statement of Cash Flows For the Year Ended December 31, Year 3 Cash flows from operating activities: Cash Receipts from Sales $ 1,031,900 $ 1,031,900 Total cash inflows Cash payments for: Interes: Operating expenses Inventory purchased (15.900) 181,100 810,900 Total cash outflows 976,100 2,008,000 Cash flows from investing activities: Paid to purchase equipment Proceeds from sale of equipment Paid to purchase marketable securities Proceeds from sale of marketable securities Proceeds from sale of land 0 Net cash outflow from investing activities Cash flows from financing activities: Proceeds from preferred stock issue Proceeds from common stock issue Proceeds from sale of treasury stock Proceeds from bonds issue Repayment of loan Repayment of bonds Payment of dividends (20.100) (100,200) (120,300) 1,887,700 Net cash inflow from financing activities Net increase in cash Plus: Beginning cash balance Ending cash balance S 1,887,700