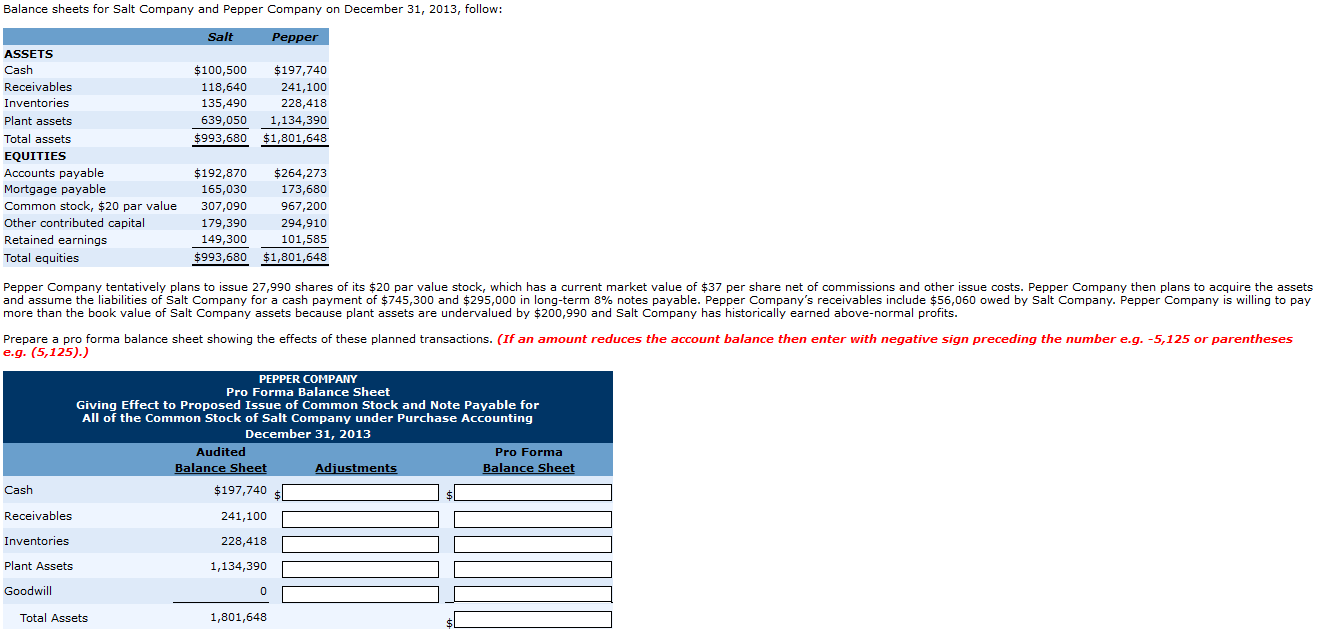

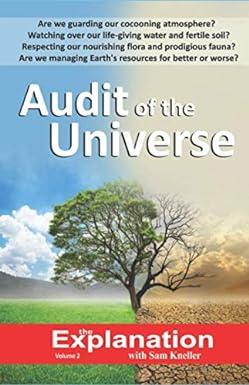

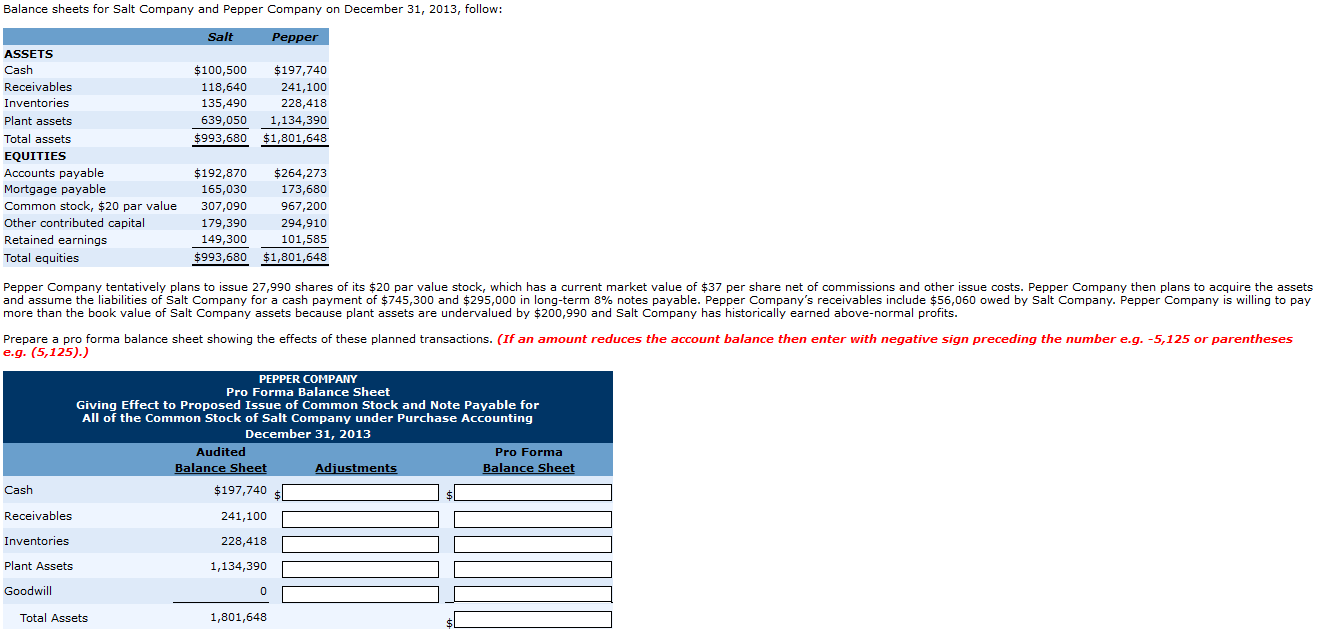

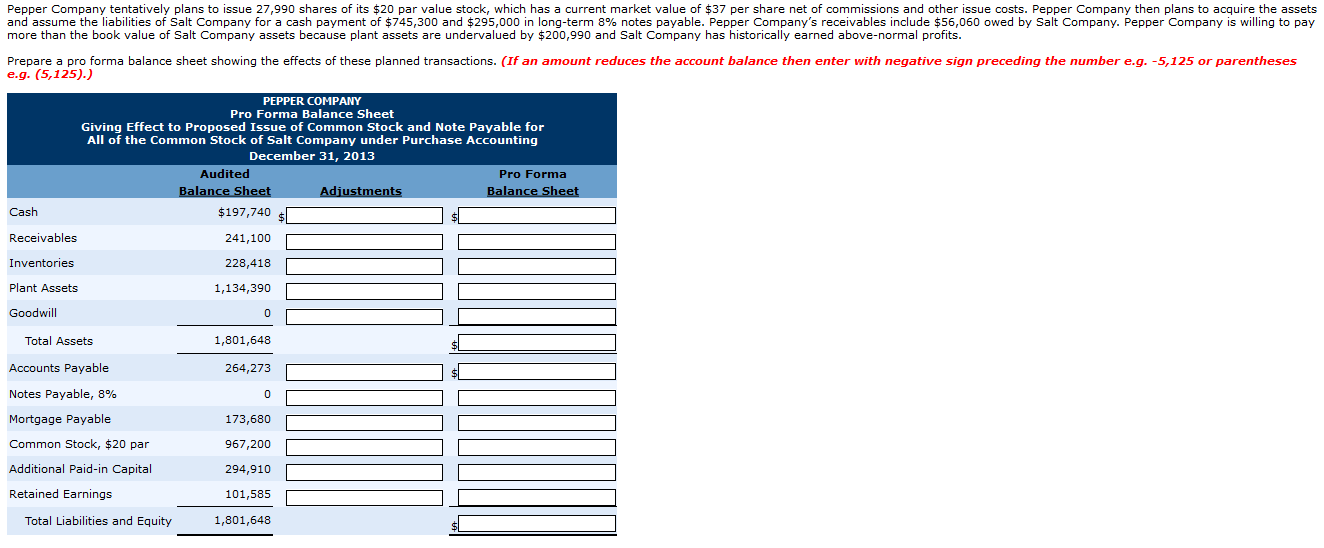

Balance sheets for Salt Company and Pepper Company on December 31, 2013, follow Salt pper ASSETS Cash $100,500 $197,740 Receivables 118,640 241,100 Inventories 228,418 135,490 Plant assets 639,050 1,134,390 $993,680 $1,801,648 Total assets EQUITIES Accounts payable Mortgage payable $192,870 165,030 $264,273 173,680 Common stock, $20 par value 967,200 307,090 Other contributed capital Retained earnings 179,390 294,910 101,585 149,300 Total equities $993,680 $1,801,648 Pepper Company tentatively plans to issue 27,990 shares of its $20 par value stock, which has a current market value of $37 per share net of commissions and other issue costs. Pepper Company then plans to acquire the assets and assume the liabilities of Salt Company for a cash payment of $745,300 and $295,000 in long-term 8% notes payable. Pepper Company's receivables include $56,060 owed by Salt Company. Pepper Company is willing to more than the book value of Salt Company assets because plant assets are undervalued by $200,990 and Salt Company has historically earned above-normal profits Prepare a pro forma balance sheet showing the effects of these planned transactions. (If an amount reduces the account balance then enter with negative sign preceding the number e.g. -5,125 or parentheses e.g. (5,125).) PPER COMPANY Pro Forma Balance Sheet Giving Effect to Proposed Issue of Common Stock and Note Payable for All of the Common Stock of Salt Company under Purchase Accounting December 31, 2013 Audited Pro Forma Balance Sheet Balance Sheet Adjustments Cash $197,740 Receivables 241,100 Inventories 228,418 Plant Assets 1,134,390 Goodwill 0 Total Assets 1,801,648 Pepper Company tentatively plans to issue 27,990 shares of its $20 par value stock, which has a current market value of $37 per share net of commissions and other issue costs. Pepper Company then plans to acquire the and assume the liabilities of Salt Company for a cash payment of $745,300 and $295,000 in long-term 8% notes payable. Pepper Company's receivables include $56,060 owed by Salt Company. Pepper Company is willing to more than the book value of Salt Company assets because plant assets are undervalued by $200,990 and Salt Company has historically earned above-normal profits. Prepare a pro forma balance sheet showing the effects of these planned transactions. (If an amount reduces the account balance then enter with negative sign preceding the number e.g. -5,125 or parentheses e.g. (5,125).) PEPPER COMPANY Pro Forma Balance Sheet Giving Effect to Proposed Issue of Common Stock and Note Payable for All of the Common Stock of Salt Company under Purchase Accounting December 31, 2013 Audited Pro Forma Balance Sheet Balance Sheet Adjustments $197,740 Cash Receivables 241,100 Inventories 228,418 Plant Assets 1,134,390 Goodwill 0 Total Assets 1,801,648 Accounts Payable 264,273 Notes Payable, 8% 0 Mortgage Payable 173,680 Common Stock, $20 par 967,200 Additional Paid-in Capital 294,910 Retained Earnings 101,585 1,801,648 Total Liabilities and Equity