Answered step by step

Verified Expert Solution

Question

1 Approved Answer

balanced Scorecard (1069) controllable expenses (1060) cost center (1058) cost price approach (1074) decentralization (1056) division (1056) DuPont formula (1065) income from operations (1063) investment

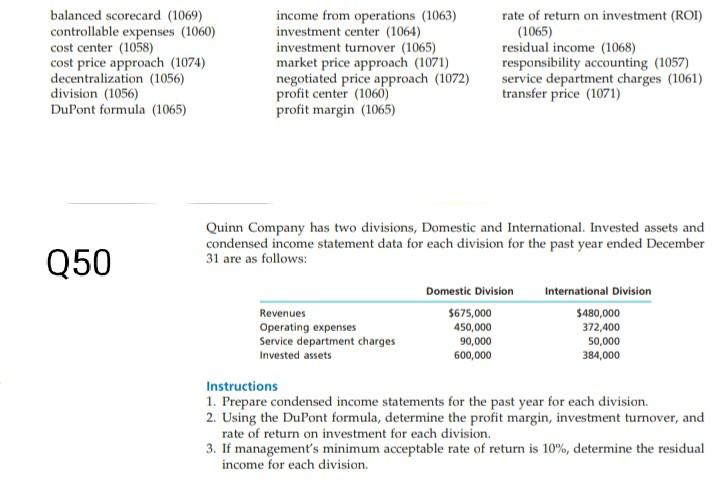

balanced Scorecard (1069) controllable expenses (1060) cost center (1058) cost price approach (1074) decentralization (1056) division (1056) DuPont formula (1065) income from operations (1063) investment center (1064) investment turnover (1065) market price approach (1071) negotiated price approach (1072) profit center (1060) profit margin (1065) rate of return on investment (ROI) (1065) residual income (1068) responsibility accounting (1057) service department charges (1061) transfer price (1071) Q50 Quinn Company has two divisions, Domestic and International. Invested assets and condensed income statement data for each division for the past year ended December 31 are as follows: Domestic Division International Division Revenues $675,000 $480,000 Operating expenses 450,000 372,400 Service department charges 90,000 50,000 Invested assets 600,000 384,000 Instructions 1. Prepare condensed income statements for the past year for each division. 2. Using the DuPont formula, determine the profit margin, investment turnover, and rate of return on investment for each division. 3. If management's minimum acceptable rate of return is 10%, determine the residual income for each division

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started