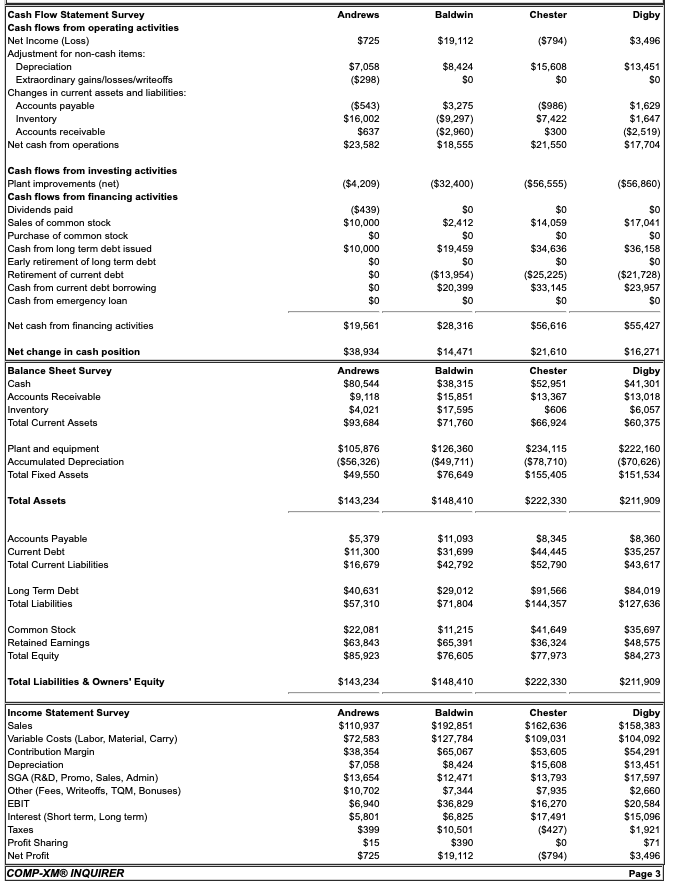

Baldwin Corp. ended the year carrying $17,595,000 worth of inventory. Had they sold their entire inventory at their current prices, how much more revenue would it have brought to Baldwin Corp?

Cash Flow Statement Survey Andrews Baldwin Chester Digby Cash flows from operating activities Net Income (Loss) $725 $19,112 ($794) $3,496 Adjustment for non-cash items: Depreciation $7,058 $8,424 $15,608 $13,451 Extraordinary gains/losses/writeoffs ($298) SO SO Changes in current assets and liabilities: Accounts payable ($543) $3,275 ($986) $1,629 Inventory $16,002 ($9,297) $7,422 $1,647 Accounts receivable $637 ($2,960) $300 ($2,519) Net cash from operations $23,582 $18,555 $21,550 $17,704 Cash flows from investing activities Plant improvements (net] ($4,209) ($32,400) ($56,555) ($56,860) Cash flows from financing activities Dividends paid ($439) SO $0 SO Sales of common stock $10,000 $2.412 $14,059 $17,041 Purchase of common stock $0 SO $0 SO Cash from long term debt issued $10,000 $19,459 $34,636 $36,158 Early retirement of long term debt $0 SO $0 SO Retirement of current debt ($13,954) ($25,225) ($21,728) Cash from current debt borrowing $0 $20,399 $33,145 $23,957 Cash from emergency loan SO $0 SO Net cash from financing activities $19,561 $28,316 $56,616 $55,427 Net change in cash position $38,934 $14,471 $21,610 $16,271 Balance Sheet Survey Andrews Baldwin Chester Digby Cash $80,544 $38,315 $52,951 $41,301 Accounts Receivable $9,118 $15,851 $13,367 $13,018 Inventory $4,021 $17,595 $606 $6,057 Total Current Assets $93,684 $71,760 $66,924 $60,375 Plant and equipment $105,876 $126,360 $234, 115 $222,160 Accumulated Depreciation ($56,326) ($49,711) ($78,710) ($70,626) Total Fixed Assets $49,550 $76.649 $ 155,405 $151,534 Total Assets $143,234 $148,410 $222,330 $211,909 Accounts Payable $5,379 $11,093 $8,345 $8,360 Current Deb $11,300 $31,699 $44,445 $35,257 Total Current Liabilities $16,679 $42,792 $52,790 $43,617 Long Term Debt $40,631 $29,012 $91,566 $84,019 Total Liabilities $57,310 $71,804 $144,357 $127,636 Common Stock $22,081 $11,215 $41,649 $35,697 Retained Eamings $63,843 $65,391 $36,324 $48,575 Total Equity $85,923 $76,605 $77,973 $84,273 Total Liabilities & Owners' Equity $143,234 $148,410 $222,330 $211,909 Income Statement Survey Andrews Baldwin Chester Digby Sales $110,937 $192,851 $162,636 $158,383 Variable Costs (Labor, Material, Carry) $72,583 $127,784 $109,031 $104,092 Contribution Margin $38,354 $65,067 $53,605 $54.291 Depreciation $7,058 $8,424 $15,608 $13,451 SGA (R&D, Promo, Sales, Admin) $13,654 $12,471 $13,793 $17,597 Other (Fees, Writeoffs, TOM, Bonuses) $10,702 $7.344 $7,935 $2,660 EBIT $6,940 $36,829 $16,270 $20,584 Interest (Short term, Long term) $5,801 $6,825 $17,491 $15,096 Taxes $399 $10,501 ($427) $1,921 Profit Sharing $15 $390 $0 $71 Net Profit $725 $19,112 ($794) $3,496 COMP-XMD INQUIRER Page 3