Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Baldwin Inc. is an athletic footware company that began operations on January 1, 2014. The following transactions relate to debt investments acquired by Baldwin Inc.,

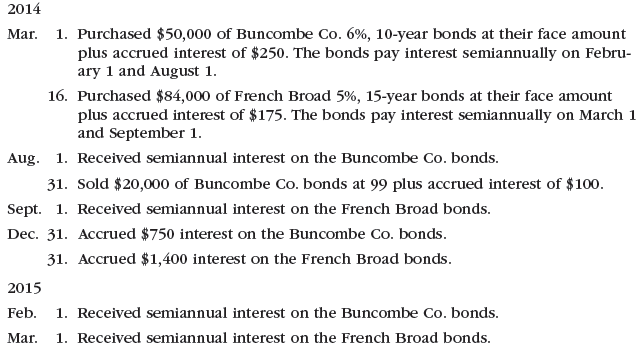

Baldwin Inc. is an athletic footware company that began operations on January 1, 2014. The following transactions relate to debt investments acquired by Baldwin Inc., which has a fiscal year ending on December 31:

Journalize the entries to record these transactions. For a compound transaction, if an amount box does not require an entry, leave it blank.

Baldwin Inc. is an athletic footware company that began operations on January 1, 2014. The following transactions relate to debt investments acquired by Baldwin Inc., which has a fiscal year ending on December 31:2014 Mar. 1. Purchased $50,000 of Buncombe Co. 6%, 10-year bonds at their face amount plus accrued interest of $250. The bonds pay interest semiannually on February 1 and August 1. 16. Purchased $84,000 of French Broad 5%, 15-year bonds at their face amount plus accrued interest of $175. The bonds pay interest semiannually on March 1 and September 1. Aug. 1. Received semiannual Interest on the Buncombe Co. bonds. 31. Sold $20,000 of Buncombe Co. bonds at 99 plus accrued Interest of $100. Sept. 1. Received semiannual Interest on the French Broad bonds. Dec. 31. Accrued $750 interest on the Buncombe Co. bonds. 31. Accrued $1,400 interest on the French Broad bonds. 2015 Feb. 1. Received semiannual Interest on the Buncombe Co. bonds. Mar. 1. Received semiannual interest on the French Broad bonds.Journalize the entries to record these transactions. For a compound transaction, if an amount box does not require an entry, leave it blank. Baldwin Inc. is an athletic footware company that began operations on January 1, 2014. The following transactions relate to debt investments acquired by Baldwin Inc., which has a fiscal year ending on December 31:2014 Mar. 1. Purchased $50,000 of Buncombe Co. 6%, 10-year bonds at their face amount plus accrued interest of $250. The bonds pay interest semiannually on February 1 and August 1. 16. Purchased $84,000 of French Broad 5%, 15-year bonds at their face amount plus accrued interest of $175. The bonds pay interest semiannually on March 1 and September 1. Aug. 1. Received semiannual Interest on the Buncombe Co. bonds. 31. Sold $20,000 of Buncombe Co. bonds at 99 plus accrued Interest of $100. Sept. 1. Received semiannual Interest on the French Broad bonds. Dec. 31. Accrued $750 interest on the Buncombe Co. bonds. 31. Accrued $1,400 interest on the French Broad bonds. 2015 Feb. 1. Received semiannual Interest on the Buncombe Co. bonds. Mar. 1. Received semiannual interest on the French Broad bonds.Journalize the entries to record these transactions. For a compound transaction, if an amount box does not require an entry, leave it blankStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started