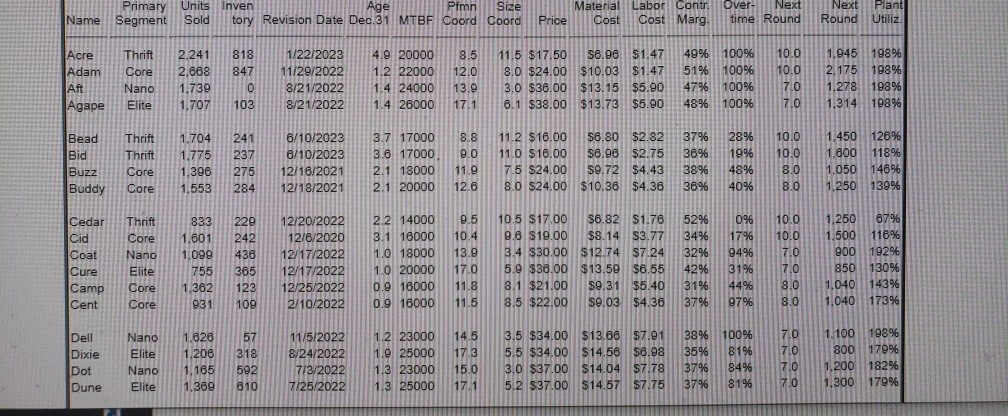

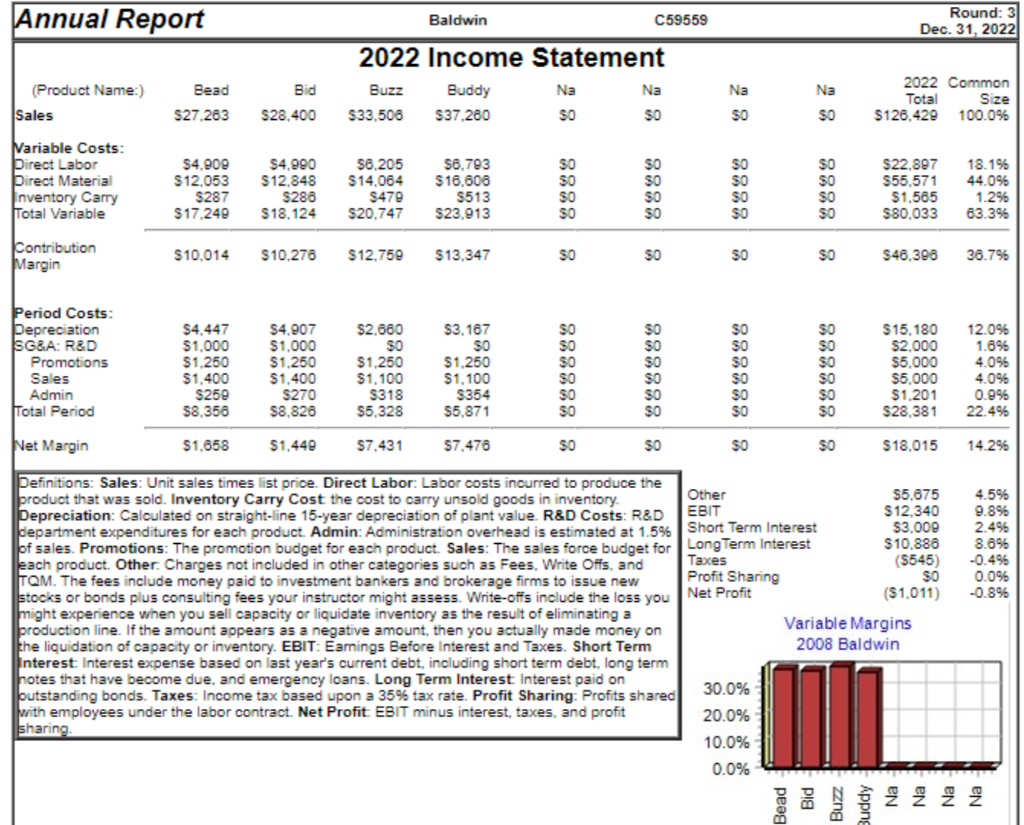

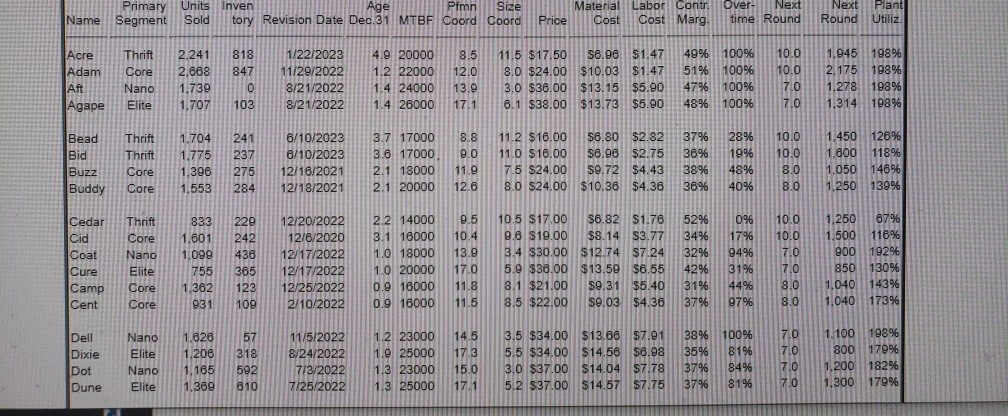

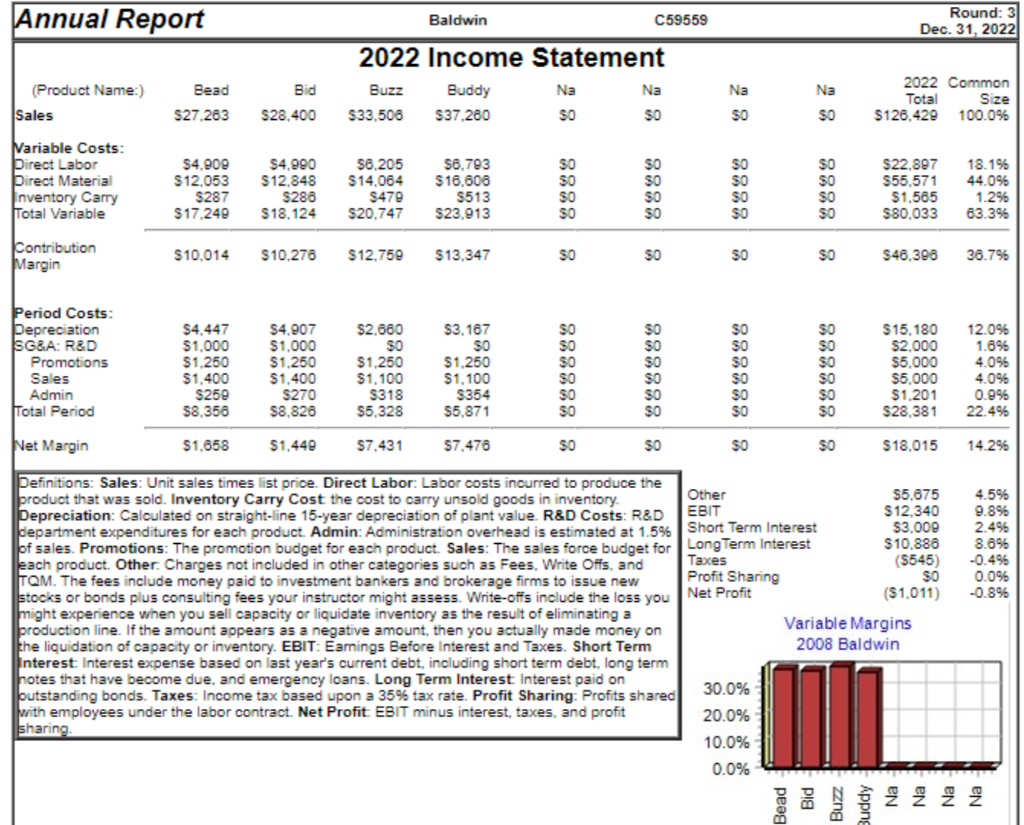

Baldwin's product Bead has material costs that are rising from $6.80 to $7.80. Assume that period costs and other labor costs remain unchanged. If Baldwin decides to absorb the cost and not pass any on to its customers in the form of raised prices how many units of product Bead would need to be sold next round to break even on the product? Select: 1 Save Answer 1,311 1,554 0 1,632 1,794 Primary Units Inven Age Pfmn Size Name Segment Sold tory Revision Date Dec.31 MTBF Coord Coord Material Labor Contr. Over Next Price Cost Cost Marg. time Round Next Plant Round Utiliz. Acre Adam Aft Agape Thrift Core Nano 2.241 2.668 1.739 1,707 818 847 0 103 1/22/2023 11/29/2022 8/21/2022 8/21/2022 4.9 20000 1.2 22000 1.4 24000 1.4 26000 8.5 12.0 13.9 17.1 11.5 $17.50 56.96 $1.47 8.0 $24.00 $10.03 $1.47 3.0 $36.00 $13.15 $5.90 6.1 $38.00 $13.73 $5.90 49% 100% 51% 100% 47% 100% 48% 100% 10.0 10.0 7.0 7.0 1.945 198% 2,175 198% 1.278 198% 1.314 198% Elite Bead Bid Buzz Buddy Thrift Thrift Core Core 1.704 1.775 1.396 1.553 241 237 275 284 6/10/2023 6/10/2023 12/16/2021 12/18/2021 3.7 17000 3.6 17000 2.1 18000 2.1 20000 8.8 9.0 11.9 12.6 11.2 $16.00 56.80 $2.82 11.0 $16.00 $6.96 $2.75 7.5 $24.00 $9.72 $4.43 8.0 $24.00 $10.36 $4.36 37% 36% 38% 36% 28% 19% 48% 40% 10.0 10.0 8.0 8.0 1.450 126% 1.800 118% 1.050 146% 1.250 139% Cedar Cid Coat Thrift Core Nano Elite Core Core 833 1.601 1.099 755 1.362 931 229 242 436 365 123 109 12/20/2022 12/6/2020 12/17/2022 12/17/2022 12/25/2022 2/10/2022 2.2 14000 3.1 16000 1.0 18000 1.0 20000 0.9 16000 0.9 16000 9.5 10.4 13.9 17.0 11.8 11.5 10.5 $17.00 $6.82 $1.76 52% 0% 9.6 $19.00 $8.14 $3.77 34% 17% 3.4 $30.00 $12.74 $7.24 32% 94% 5.9 $36.00 $13.59 $6.55 42% 31% 8.1 $21.00 59.31 $5.40 31% 44% 8.5 $22.00 $9.03 $4.36 37% 97% 10.0 10.0 7.0 7.0 8.0 8.0 1.250 67% 1.500 116% 900 192% 850 1309 1,040 143% 1.040 173% Cure Camp Cent 1.626 1,206 Dell Dixie Dot Dune Nano Elite Nano Elite 57 318 592 810 11/5/2022 8/24/2022 7/3/2022 7/25/2022 1.2 23000 1.9 25000 1.3 23000 1.3 25000 14.5 17.3 15.0 17.1 3.5 $34.00 $13.66 $7.91 38% 100% 5.5 $34.00 $14.56 $8.98 35% 81% 3.0 $37.00 $14.04 $7.78 37% 84% 5.2 $37.00 $14.57 $7.75 37% 81% 7.0 17.0 7.0 7.0 1.100 198% 800 179% 1.200 182% 1.300 179% 1.165 1.369 Annual Report Baldwin C59559 Round: 3 Dec. 31, 2022 Bid (Product Name:) Sales Na Bead $27.263 2022 Income Statement Buzz Buddy Na Na $33,506 S37.260 SO SO Na SO 2022 Common Total Size $126,429 100.0% S28.400 SO Variable Costs: Direct Labor Direct Material Lnventory Carry Total Variable $4.900 S12.053 $287 $17.249 $4.990 $12.848 $286 S18,124 $6,205 $14,064 $479 $20.747 56.793 $16.606 S513 $23.913 SO SO SO SO SO SO SO SO SO SO SO SO $22.897 $55,571 $1,565 380,033 18.1% 44.0% 1.2% 63.3% SO Contribution Margin $10.014 $10.276 $12.750 $13,347 50 50 SO SO $46,398 36.796 SO Period Costs: epreciation SG&A: R&D Promotions Sales Admin Total Period $4,447 $1,000 $1.250 $1,400 S250 $8,356 $4.907 $1,000 $1.250 $1,400 S270 58.826 $2,660 SO $1.250 $1,100 5318 $5,328 $3.167 SO $1.250 $1,100 S354 $5,871 SO SO $0 SO SO SO SO SO $0 SO SO SO $0 SO SO SO $15.180 $2.000 $5,000 $5,000 $1.201 $28,381 12.0% 1.896 4.0% 4.09 0.9% 22.4% Net Margin $1,658 $1,449 $7.431 57.470 SO SO SO SO $18,015 14.2% 4.596 9.89 2.4% 8.6% -0.4% 0.096 -0.896 new Definitions: Sales: Unit sales times list price. Direct Labor: Labor costs incurred to produce the product that was sold. Inventory Carry Cost the cost to carry unsold goods in inventory Other 55.675 Depreciation: Calculated on straight-line 15-year depreciation of plant value. R&D Costs: R&D EBIT $12.340 department expenditures for each product. Admin: Administration overhead is estimated at 1.5% Short Term Interest $3,000 of sales. Promotions: The promotion budget for each product. Sales: The sales force budget for Long Term Interest $10,886 each product. Other Charges not included in other categories such as Fees, Write Offs, and Taxes (3545) TOM. The fees include money paid to investment bankers and brokerage firms to issue Profit Sharing $0 stocks or bonds plus consulting fees your instructor might assess. Write-offs include the loss you Net Profit (51,011) might experience when you sell capacity or liquidate inventory as the result of eliminating a production line. If the amount appears as a negative amount, then you actually made money on Variable Margins the liquidation of capacity or inventory. EBIT: Earnings Before Interest and Taxes. Short Term 2008 Baldwin Interest: Interest expense based on last year's current debt, including short term debt, long term notes that have become due, and emergency loans. Long Term Interest Interest paid on outstanding bonds. Taxes: Income tax based upon a 35% tax rate. Profit Sharing: Profits shared 30.0% with employees under the labor contract. Net Profit: EBIT minus interest, taxes, and profit 20.0% sharing 10.0% 0.0% Na Na