Answered step by step

Verified Expert Solution

Question

1 Approved Answer

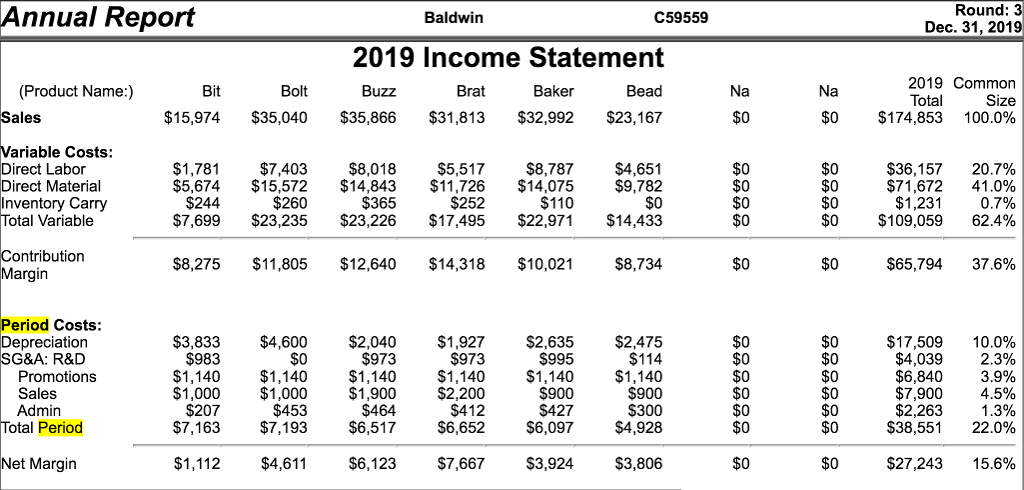

Baldwins product Bit has material costs that are rising from $6.82 to $7.82. Assume that period costs and other labor costs remain unchanged. If Baldwin

Baldwins product Bit has material costs that are rising from $6.82 to $7.82. Assume that period costs and other labor costs remain unchanged. If Baldwin decides to absorb the cost and not pass any on to its customers in the form of raised prices how many units of product Bit would need to be sold next round to break even on the product?

| Select: 1 | ||||||||

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started