Answered step by step

Verified Expert Solution

Question

1 Approved Answer

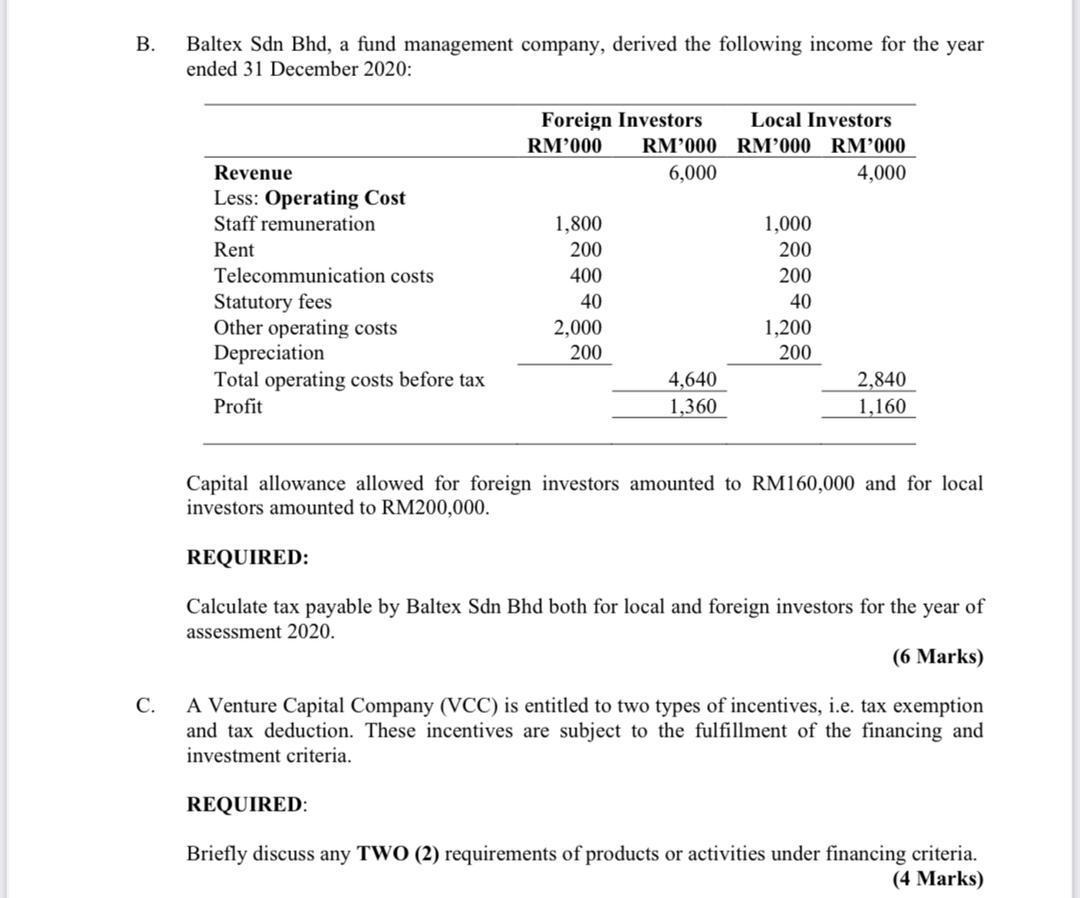

. Baltex Sdn Bhd, a fund management company, derived the following income for the year ended 31 December 2020: Foreign Investors Local Investors RM'000

. Baltex Sdn Bhd, a fund management company, derived the following income for the year ended 31 December 2020: Foreign Investors Local Investors RM'000 RM'000 RM'000 RM'000 Revenue 6,000 4,000 Less: Operating Cost Staff remuneration 1,800 1,000 Rent 200 200 Telecommunication costs 400 200 Statutory fees Other operating costs Depreciation Total operating costs before tax 40 40 2,000 1,200 200 200 4,640 2,840 1,160 Profit 1,360 Capital allowance allowed for foreign investors amounted to RM160,000 and for local investors amounted to RM200,000. REQUIRED: Calculate tax payable by Baltex Sdn Bhd both for local and foreign investors for the year of assessment 2020. (6 Marks) . A Venture Capital Company (VCC) is entitled to two types of incentives, i.e. tax exemption and tax deduction. These incentives are subject to the fulfillment of the financing and investment criteria. REQUIRED: Briefly discuss any TWO (2) requirements of products or activities under financing criteria. (4 Marks)

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Kindly see attached worksheets for your reference of sample computatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started