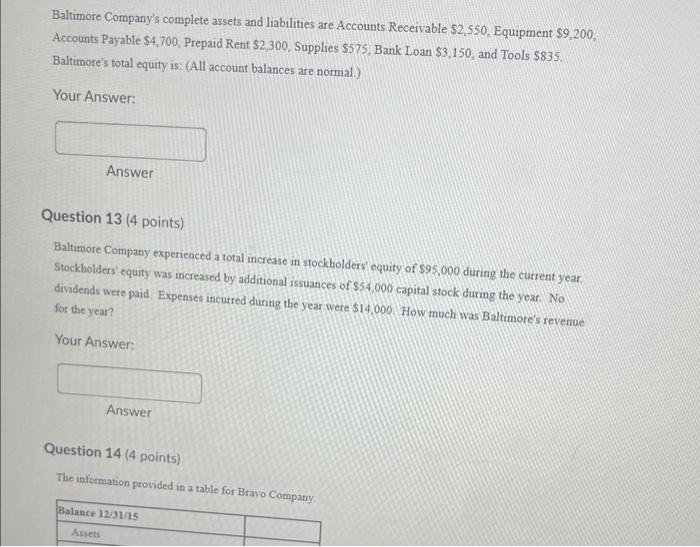

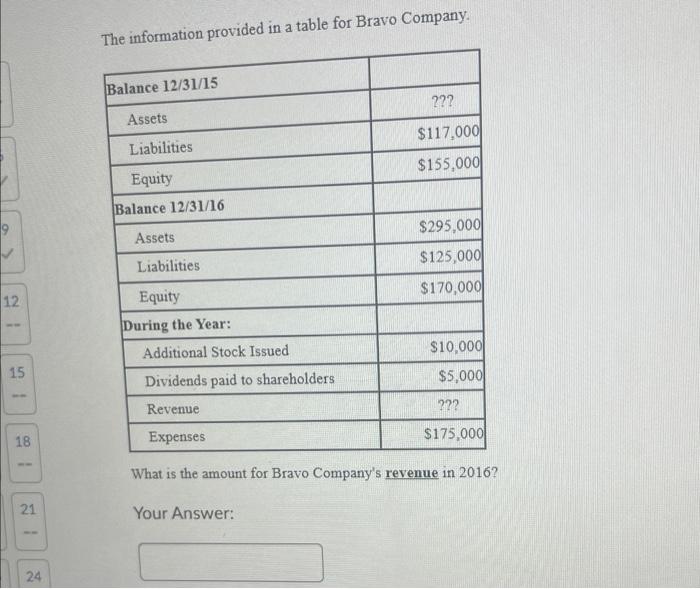

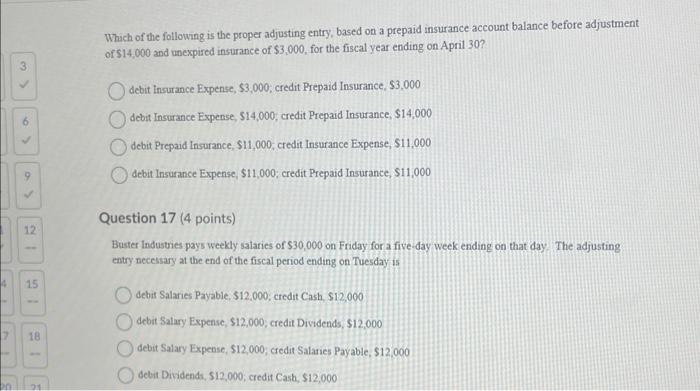

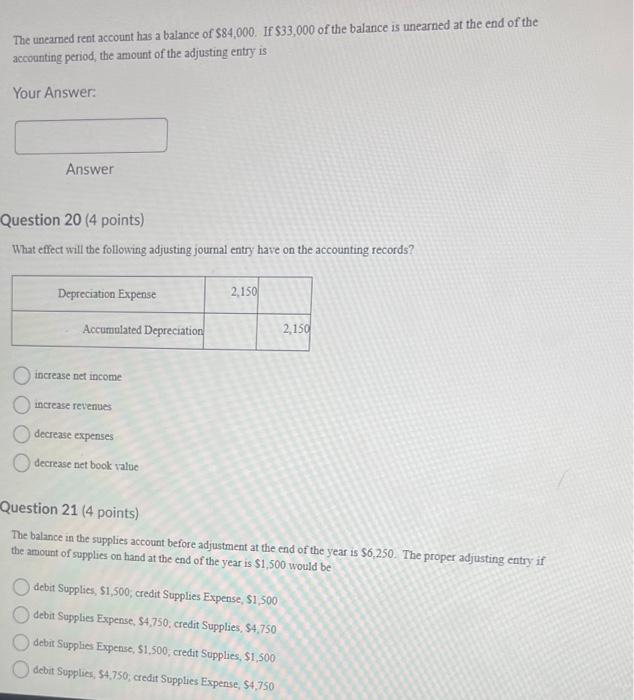

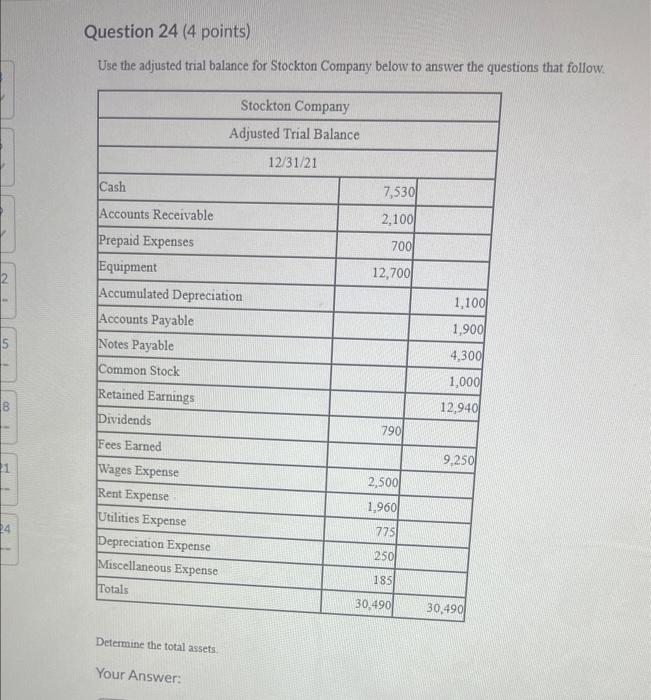

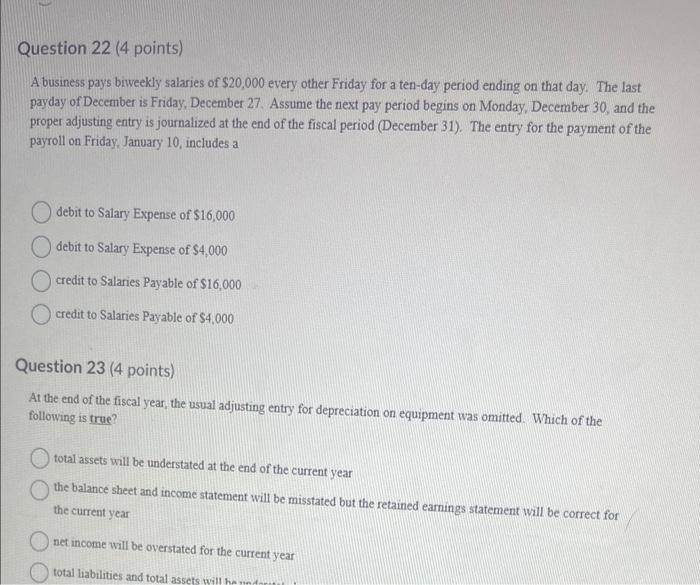

Baltimore Company's complete assets and liabilities are Accounts Recervable \$2,550, Equipment \$9,200, Accounts Payable \$4,700, Prepaid Rent \$2,300, Supplies \$575, Bank Loan \$3,150, and Tools \$835. Baltimore's total equity is. (All account balances are normal.) Your Answer: Answer Question 13 (4 points) Baltimore Company experienced a total increaso in stockholders equity of $95,000 during the current year Stockholders' equity was increased by additional issuances of $54.000 capital stock during the year No dividends were paid. Expenses incurred during the year were $14,000 How much was Baltimore's revenue for the year? Your Answer: Answer Question 14 (4 points) The information provided in a table for Bravn caman. The information provided in a table for Bravo Company. What is the amount for Bravo Company's revenue in 2016? Your Answer: Which of the following is the proper adjusting entry, based on a prepaid insurance account balance before adjustment of $14,000 and unexpired insurance of $3,000, for the fiscal year ending on April 30 ? debit insurance Expense, $3,000; credit Prepaid Insurance, $3,000 debit Insurance Expense, $14,000, credit Prepaid Insurance, $14,000 debit Prepaid Insurance, \$11,000; credit Insurance Expense, $11,000 debit Insurance Expense, $11,000; credit Prepaid Insurance, $11,000 Question 17 (4 points) Buster lndustries pays weekly salaries of $30,000 on Friday for a five-day week ending on that day. The adjusting eatry necesary at the end of the fiscal period ending on Tuesday is debit Salaries Payable, \$12,000, credit Cash, \$12,000 debit Salary Expensc, $12,000, credut Dividends, \$12,000 debit Salary Expense, \$12,000; credit Salaries Payable, \$12,000 Gebit Dividends, 512,000 ; credit Cash, $12,000 The uneamed rent account has a balance of $84,000. If $33,000 of the balance is unearned at the end of the accounting period, the amount of the adjusting entry is Your Answer: Answer Question 20 (4 points) What effect will the following adjusting journal entry have on the accounting records? increase net income increase revenues decrease expenses decrease net book value Question 21 (4 points) The balance in the supplies account before adjustment at the end of the year is $6,250. The proper adjusting entry if the amount of supplies on hand at the end of the year is $1,500 would be debit Supplies, 51,500, credit Supplies Expense, $1,500 debit Supplies Expense, $4,750, credit Supplies, \$4,750 debit Supplies Expense, $1,500, credit Supplies, $1,500 debit Supplies, \$4,750; credit Supplies Expense, \$4,750 Use the adjusted trial balance for Stockton Company below to answer the questions that follow. Determine the total assets Your Answer: A business pays biweekly salaries of $20,000 every other Friday for a ten-day period ending on that day. The last payday of December is Friday, December 27. Assume the next pay period begins on Monday, December 30 , and the proper adjusting entry is journalized at the end of the fiscal period (December 31 ). The entry for the payment of the payroll on Friday, January 10 , includes a debit to Salary Expense of $16,000 debit to Salary Expense of $4,000 credit to Salaries Payable of $16,000 credit to Salaries Payable of $4,000 Question 23 (4 points) At the end of the fiscal year, the usual adjusting entry for depreciation on equipment was omitted. Which of the following is true? total assets will be understated at the end of the current year the balance sheet and income statement will be misstated but the retained earnings statement will be correct for the current year net income will be overstated for the current year