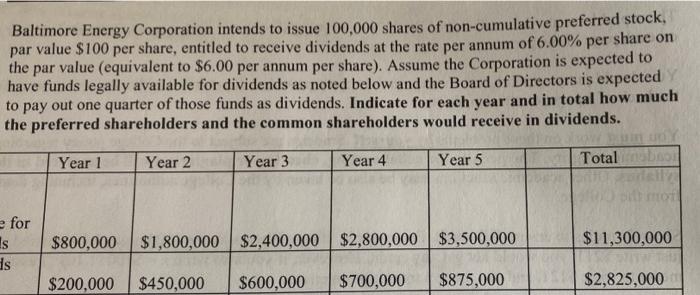

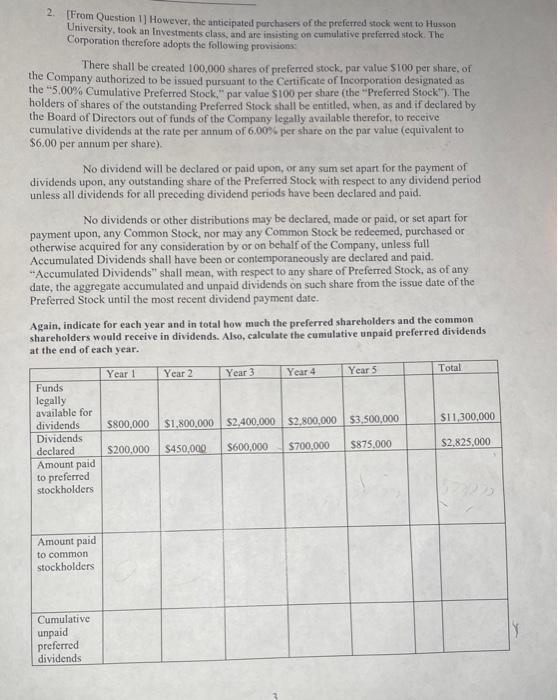

Baltimore Energy Corporation intends to issue 100,000 shares of non-cumulative preferred stock, par value $100 per share, entitled to receive dividends at the rate per annum of 6.00% per share on the par value (equivalent to $6.00 per annum per share). Assume the Corporation is expected to have funds legally available for dividends as noted below and the Board of Directors is expected to pay out one quarter of those funds as dividends. Indicate for each year and in total how much the preferred shareholders and the common shareholders would receive in dividends. Year 1 Year 2 Year 3 Year 4 Year 5 Total for Is ds $800,000 $1,800,000 $2,400,000 $2,800,000 $3,500,000 $11,300,000 $200,000 $450,000 $600,000 $700,000 $875,000 $2,825,000 2. From Question 1] However, the anticipated purchasers of the preferred stock went to Husson University, took an Investments class, and are insisting on cumulative preferred stock. The Corporation therefore adopts the following provisions There shall be created 100,000 shares of preferred stock, par value S100 per share of the Company authorized to be issued pursuant to the Certificate of Incorporation designated as the "5.00% Cumulative Preferred Stock." par value $100 per share the "Preferred Stock"). The holders of shares of the outstanding Preferred Stock shall be entitled, when, as and if declared by the Board of Directors out of funds of the Company legally available therefor, to receive cumulative dividends at the rate per annum of 6.00% per share on the par value (equivalent to $6.00 per annum per share). No dividend will be declared or paid upon, or any sum set apart for the payment of dividends upon any outstanding share of the Preferred Stock with respect to any dividend period unless all dividends for all preceding dividend periods have been declared and paid. No dividends or other distributions may be declared, made or paid, or set apart for payment upon any Common Stock, nor may any Common Stock be redeemed, purchased or otherwise acquired for any consideration by or on behalf of the Company, unless full Accumulated Dividends shall have been or contemporaneously are declared and paid. "Accumulated Dividends" shall mean, with respect to any share of Preferred Stock, as of any date, the aggregate accumulated and unpaid dividends on such share from the issue date of the Preferred Stock until the most recent dividend payment date. Again, indicate for each year and in total how much the preferred shareholders and the common shareholders would receive in dividends. Also, calculate the cumulative unpaid preferred dividends at the end of each year. Year 1 Year 2 Year 3 Year 4 Year 5 Total Funds legally available for dividends $800,000 $1,800,000 $2,400,000 $2,800,000 $3,500,000 S11,300,000 Dividends declared $200,000 $450,000 $600,000 $700,000 $875.000 $2.825,000 Amount paid to preferred stockholders Amount paid to common stockholders Cumulative unpaid preferred dividends Baltimore Energy Corporation intends to issue 100,000 shares of non-cumulative preferred stock, par value $100 per share, entitled to receive dividends at the rate per annum of 6.00% per share on the par value (equivalent to $6.00 per annum per share). Assume the Corporation is expected to have funds legally available for dividends as noted below and the Board of Directors is expected to pay out one quarter of those funds as dividends. Indicate for each year and in total how much the preferred shareholders and the common shareholders would receive in dividends. Year 1 Year 2 Year 3 Year 4 Year 5 Total for Is ds $800,000 $1,800,000 $2,400,000 $2,800,000 $3,500,000 $11,300,000 $200,000 $450,000 $600,000 $700,000 $875,000 $2,825,000 2. From Question 1] However, the anticipated purchasers of the preferred stock went to Husson University, took an Investments class, and are insisting on cumulative preferred stock. The Corporation therefore adopts the following provisions There shall be created 100,000 shares of preferred stock, par value S100 per share of the Company authorized to be issued pursuant to the Certificate of Incorporation designated as the "5.00% Cumulative Preferred Stock." par value $100 per share the "Preferred Stock"). The holders of shares of the outstanding Preferred Stock shall be entitled, when, as and if declared by the Board of Directors out of funds of the Company legally available therefor, to receive cumulative dividends at the rate per annum of 6.00% per share on the par value (equivalent to $6.00 per annum per share). No dividend will be declared or paid upon, or any sum set apart for the payment of dividends upon any outstanding share of the Preferred Stock with respect to any dividend period unless all dividends for all preceding dividend periods have been declared and paid. No dividends or other distributions may be declared, made or paid, or set apart for payment upon any Common Stock, nor may any Common Stock be redeemed, purchased or otherwise acquired for any consideration by or on behalf of the Company, unless full Accumulated Dividends shall have been or contemporaneously are declared and paid. "Accumulated Dividends" shall mean, with respect to any share of Preferred Stock, as of any date, the aggregate accumulated and unpaid dividends on such share from the issue date of the Preferred Stock until the most recent dividend payment date. Again, indicate for each year and in total how much the preferred shareholders and the common shareholders would receive in dividends. Also, calculate the cumulative unpaid preferred dividends at the end of each year. Year 1 Year 2 Year 3 Year 4 Year 5 Total Funds legally available for dividends $800,000 $1,800,000 $2,400,000 $2,800,000 $3,500,000 S11,300,000 Dividends declared $200,000 $450,000 $600,000 $700,000 $875.000 $2.825,000 Amount paid to preferred stockholders Amount paid to common stockholders Cumulative unpaid preferred dividends