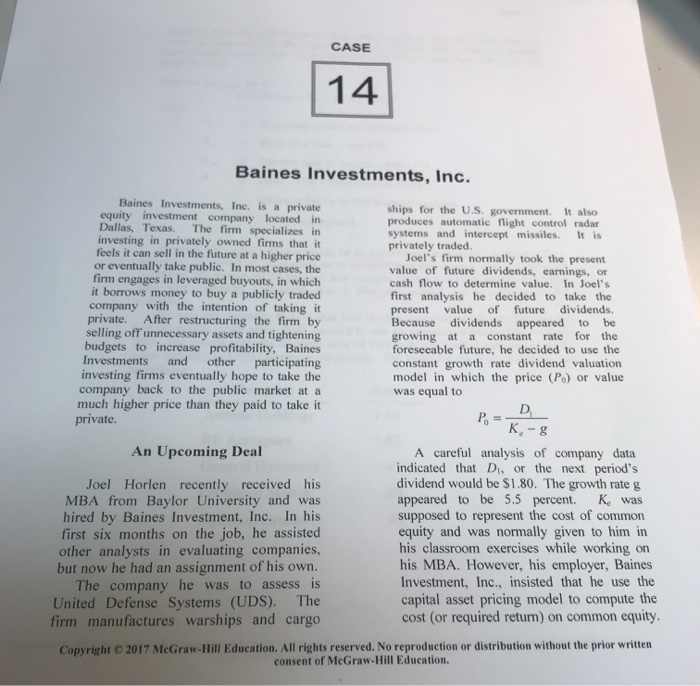

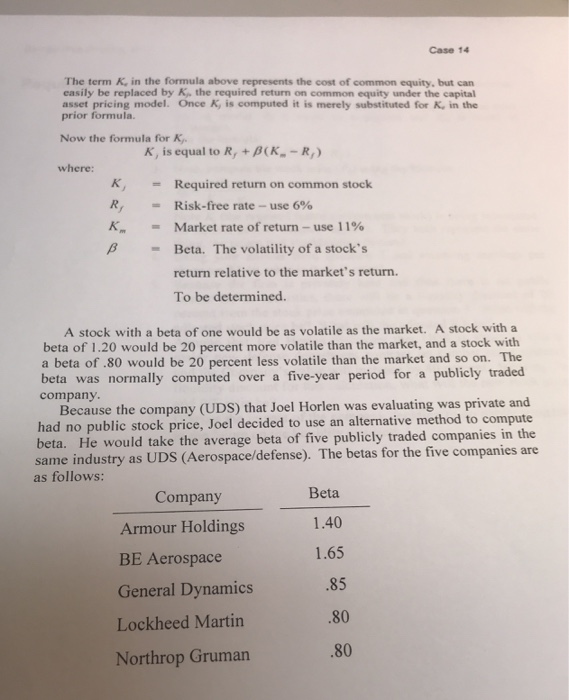

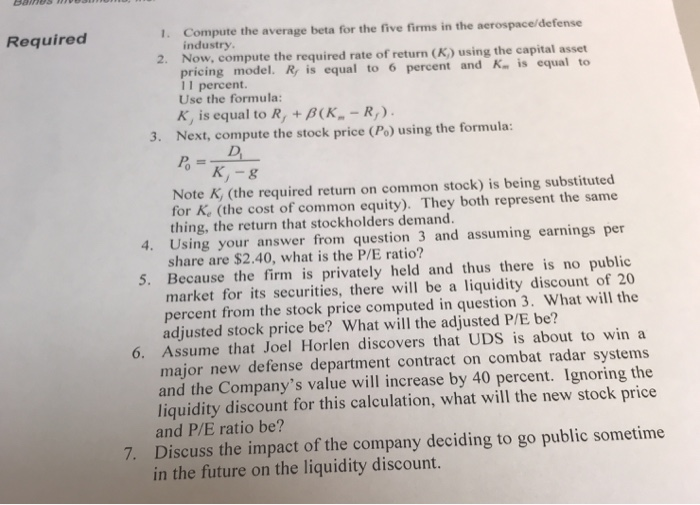

CASE 14 Baines Investments, Inc. Baines Investments, Inc. is a private equity investment company located in Dallas, Texas. The firm specializes in investing in privately owned firms that it feels it can sell in the future at a higher price or eventually take public. In most cases, the firm engages in leveraged buyouts, in which it borrows money to buy a publicly traded company with the intention of taking it private. After restructuring the firm by selling off unnecessary assets and tightening budgets to increase profitability, Baines Investments and other participating investing firms eventually hope to take the company back to the public market at a much higher price than they paid to take it private. ships for the U.S. government. It also produces automatic flight control radar systems and intercept missiles. It is privately traded. Joel's firm normally took the present value of future dividends, earnings, or cash flow to determine value. In Joel's first analysis he decided to take the present value of future dividends. Because dividends appeared to be growing at a constant rate for the foreseeable future, he decided to use the constant growth rate dividend valuation model in which the price (P.) or value was equal to D P = K -g A careful analysis of company data indicated that D, or the next period's dividend would be $1.80. The growth rate g appeared to be 5.5 percent. Ke was supposed to represent the cost of common equity and was normally given to him in his classroom exercises while working on his MBA. However, his employer, Baines Investment, Inc., insisted that he use the capital asset pricing model to compute the cost (or required return) on common equity. An Upcoming Deal Joel Horlen recently received his MBA from Baylor University and was hired by Baines Investment, Inc. In his first six months on the job, he assisted other analysts in evaluating companies, but now he had an assignment of his own. The company he was to assess is United Defense Systems (UDS). The firm manufactures warships and cargo Copyright 2017 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Case 14 The term K, in the formula above represents the cost of common equity, but can easily be replaced by K. the required return on common equity under the capital asset pricing model. Once K, is computed it is merely substituted for K, in the prior formula Now the formula for K. K, is equal to R, +B(K.-R) where: K = Required return on common stock - Risk-free rate - use 6% = Market rate of return - use 11% Beta. The volatility of a stock's return relative to the market's return. To be determined. A stock with a beta of one would be as volatile as the market. A stock with a beta of 1.20 would be 20 percent more volatile than the market, and a stock with a beta of .80 would be 20 percent less volatile than the market and so on. The beta was normally computed over a five-year period for a publicly traded company. Because the company (UDS) that Joel Horlen was evaluating was private and had no public stock price, Joel decided to use an alternative method to compute beta. He would take the average beta of five publicly traded companies in the same industry as UDS (Aerospace/defense). The betas for the five companies are as follows: Company Beta Armour Holdings 1.40 BE Aerospace 1.65 General Dynamics .85 Lockheed Martin .80 Northrop Gruman BUS WPWM Required 1. Compute the average beta for the five firms in the aerospace/defense industry. 2. Now, compute the required rate of return (K) using the capital asset pricing model. R, is equal to 6 percent and K is equal to 11 percent. Use the formula: K, is equal to R, +B(K -R). 3. Next, compute the stock price (P.) using the formula: P = -K D -8 Note K (the required return on common stock) is being substituted for K. (the cost of common equity). They both represent the same thing, the return that stockholders demand. 4. Using your answer from question 3 and assuming earnings per share are $2.40, what is the P/E ratio? 5. Because the firm is privately held and thus there is no public market for its securities, there will be a liquidity discount of 20 percent from the stock price computed in question 3. What will the adjusted stock price be? What will the adjusted P/E be? 6. Assume that Joel Horlen discovers that UDS is about to win a major new defense department contract on combat radar systems and the Company's value will increase by 40 percent. Ignoring the liquidity discount for this calculation, what will the new stock price and P/E ratio be? 7. Discuss the impact of the company deciding to go public sometime in the future on the liquidity discount. CASE 14 Baines Investments, Inc. Baines Investments, Inc. is a private equity investment company located in Dallas, Texas. The firm specializes in investing in privately owned firms that it feels it can sell in the future at a higher price or eventually take public. In most cases, the firm engages in leveraged buyouts, in which it borrows money to buy a publicly traded company with the intention of taking it private. After restructuring the firm by selling off unnecessary assets and tightening budgets to increase profitability, Baines Investments and other participating investing firms eventually hope to take the company back to the public market at a much higher price than they paid to take it private. ships for the U.S. government. It also produces automatic flight control radar systems and intercept missiles. It is privately traded. Joel's firm normally took the present value of future dividends, earnings, or cash flow to determine value. In Joel's first analysis he decided to take the present value of future dividends. Because dividends appeared to be growing at a constant rate for the foreseeable future, he decided to use the constant growth rate dividend valuation model in which the price (P.) or value was equal to D P = K -g A careful analysis of company data indicated that D, or the next period's dividend would be $1.80. The growth rate g appeared to be 5.5 percent. Ke was supposed to represent the cost of common equity and was normally given to him in his classroom exercises while working on his MBA. However, his employer, Baines Investment, Inc., insisted that he use the capital asset pricing model to compute the cost (or required return) on common equity. An Upcoming Deal Joel Horlen recently received his MBA from Baylor University and was hired by Baines Investment, Inc. In his first six months on the job, he assisted other analysts in evaluating companies, but now he had an assignment of his own. The company he was to assess is United Defense Systems (UDS). The firm manufactures warships and cargo Copyright 2017 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education. Case 14 The term K, in the formula above represents the cost of common equity, but can easily be replaced by K. the required return on common equity under the capital asset pricing model. Once K, is computed it is merely substituted for K, in the prior formula Now the formula for K. K, is equal to R, +B(K.-R) where: K = Required return on common stock - Risk-free rate - use 6% = Market rate of return - use 11% Beta. The volatility of a stock's return relative to the market's return. To be determined. A stock with a beta of one would be as volatile as the market. A stock with a beta of 1.20 would be 20 percent more volatile than the market, and a stock with a beta of .80 would be 20 percent less volatile than the market and so on. The beta was normally computed over a five-year period for a publicly traded company. Because the company (UDS) that Joel Horlen was evaluating was private and had no public stock price, Joel decided to use an alternative method to compute beta. He would take the average beta of five publicly traded companies in the same industry as UDS (Aerospace/defense). The betas for the five companies are as follows: Company Beta Armour Holdings 1.40 BE Aerospace 1.65 General Dynamics .85 Lockheed Martin .80 Northrop Gruman BUS WPWM Required 1. Compute the average beta for the five firms in the aerospace/defense industry. 2. Now, compute the required rate of return (K) using the capital asset pricing model. R, is equal to 6 percent and K is equal to 11 percent. Use the formula: K, is equal to R, +B(K -R). 3. Next, compute the stock price (P.) using the formula: P = -K D -8 Note K (the required return on common stock) is being substituted for K. (the cost of common equity). They both represent the same thing, the return that stockholders demand. 4. Using your answer from question 3 and assuming earnings per share are $2.40, what is the P/E ratio? 5. Because the firm is privately held and thus there is no public market for its securities, there will be a liquidity discount of 20 percent from the stock price computed in question 3. What will the adjusted stock price be? What will the adjusted P/E be? 6. Assume that Joel Horlen discovers that UDS is about to win a major new defense department contract on combat radar systems and the Company's value will increase by 40 percent. Ignoring the liquidity discount for this calculation, what will the new stock price and P/E ratio be? 7. Discuss the impact of the company deciding to go public sometime in the future on the liquidity discount