Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Banana Berhad is the parent of a listed group of companies which have a year end of 30 June 2021. Banana has made a number

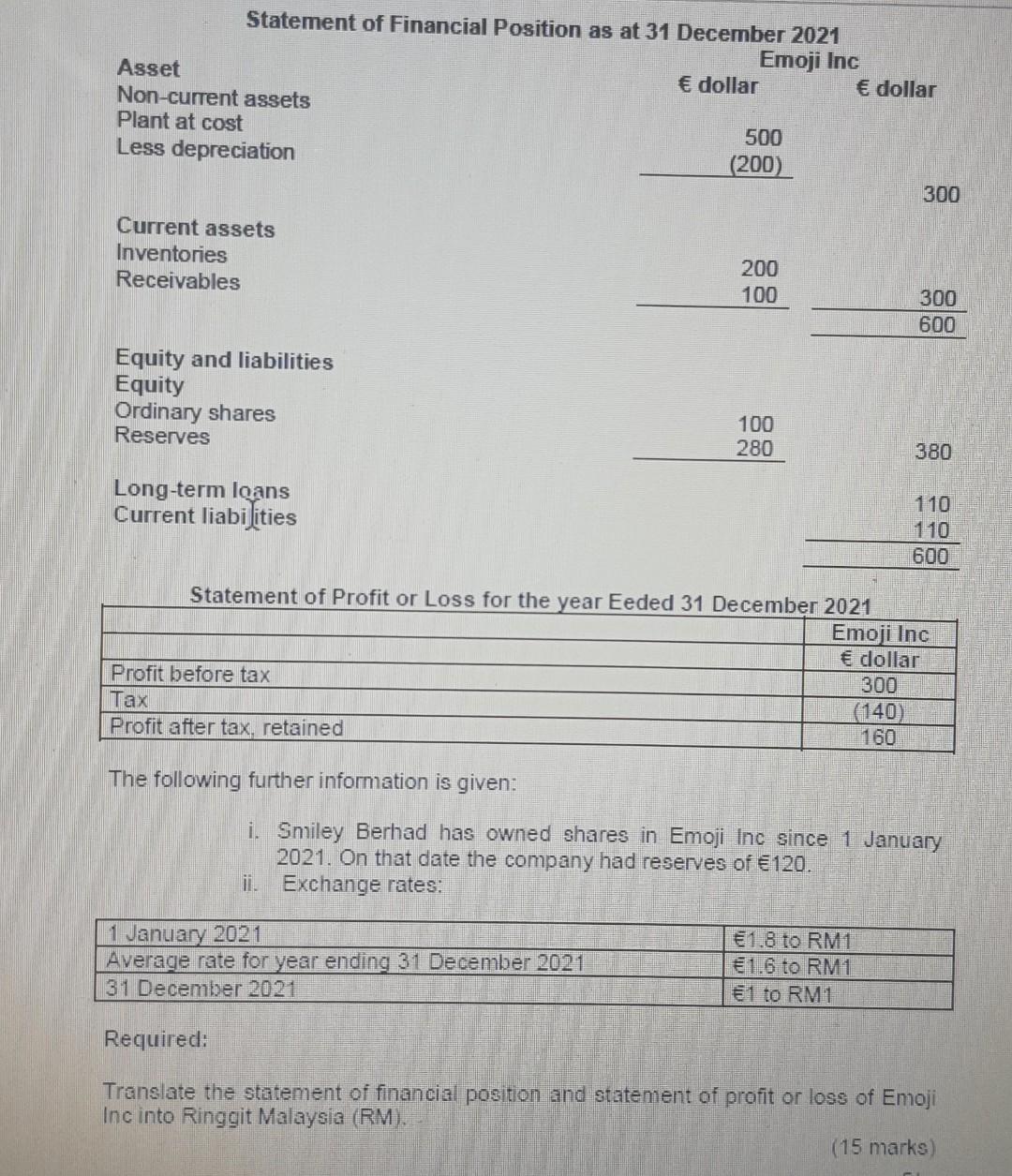

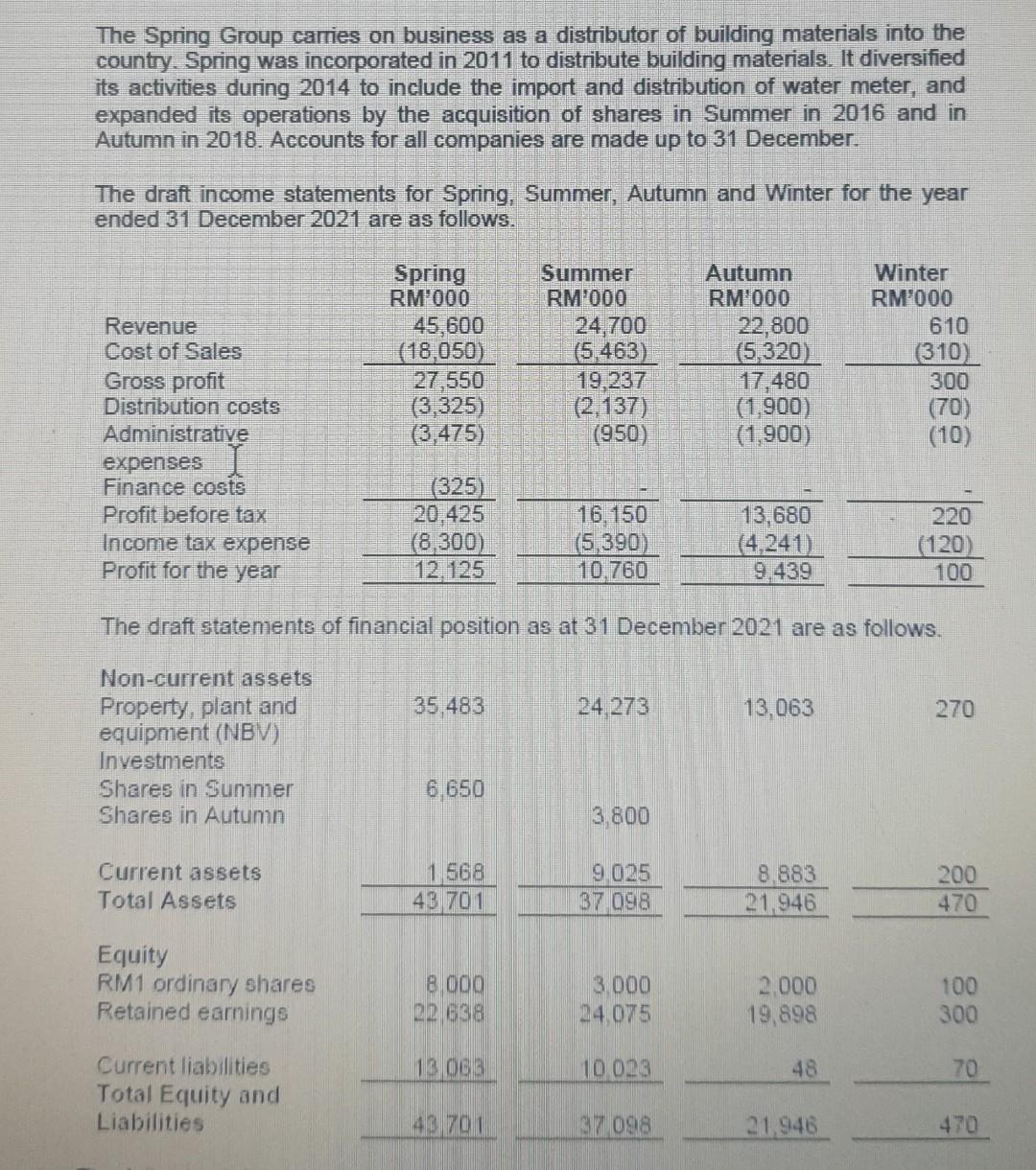

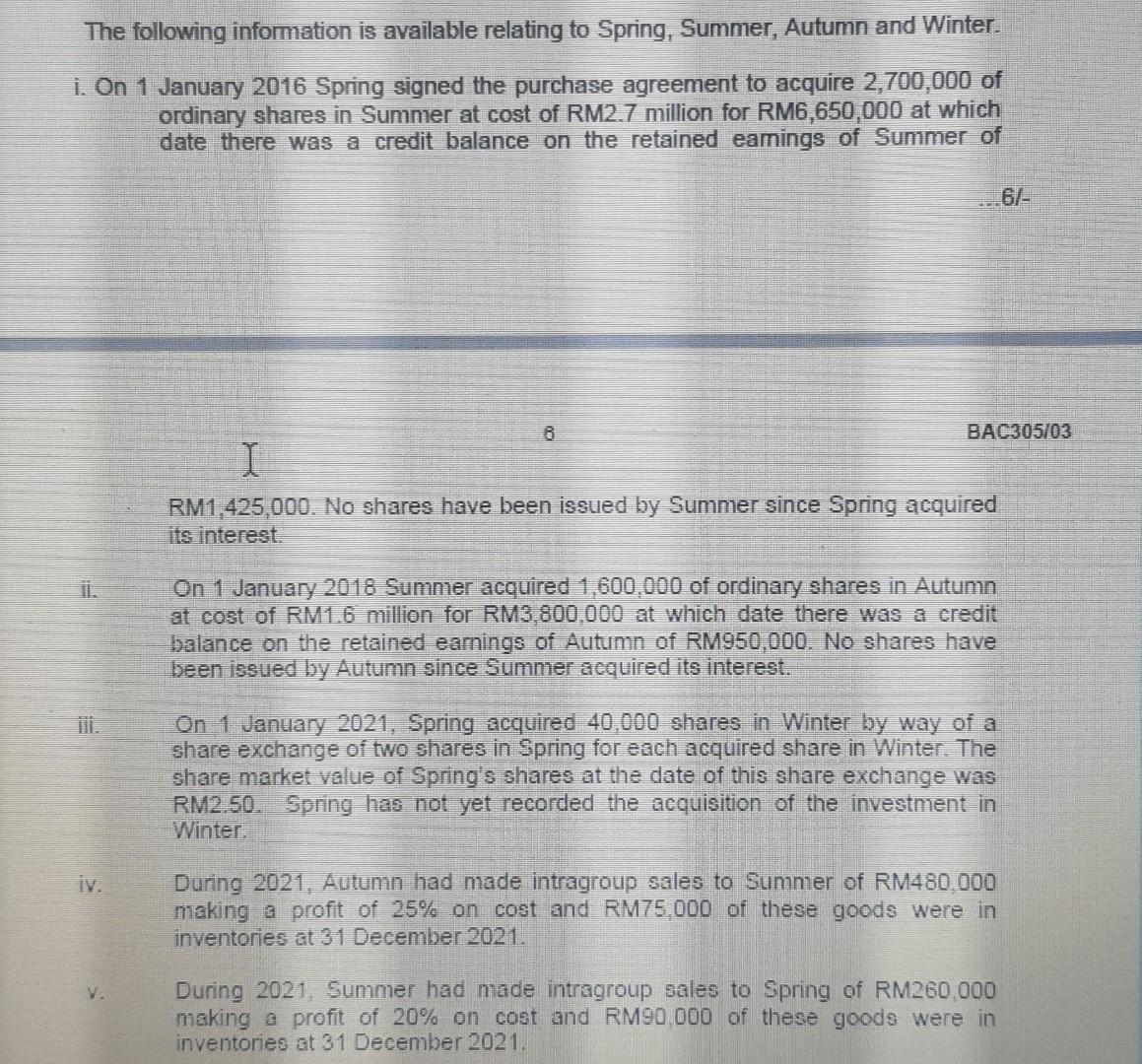

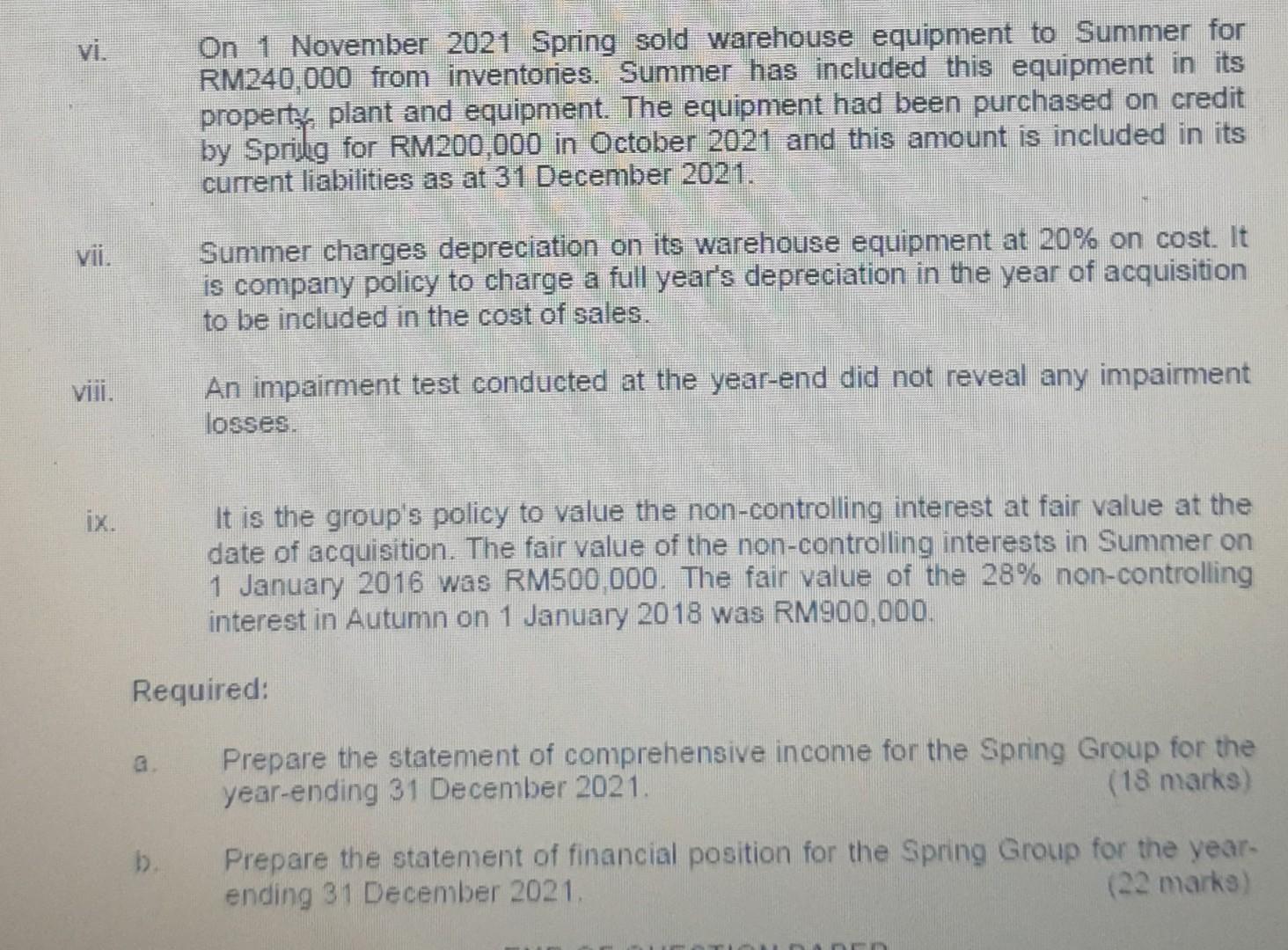

Banana Berhad is the parent of a listed group of companies which have a year end of 30 June 2021. Banana has made a number of acquisitions and disposals of investments during the current financial year and the directors require advice as to the correct accounting treatment of these acquisitions and disposals. Banana had purchased a 40% equity interest in Strawberry for RM18 million a number of years ago when the fair value of the identifiable net assets was RM44 million. Since acquisition, Banana had the right to appoint one of the five directors on the board of Strawberry. The investment has always been equity accounted for in the consolidated financial statements of Banana. Banana disposed of 75% of its 40% investment on 1 October 2021 for RM19 million when the fair values of the identifiable net assets of Strawberry were RM50 million. At that date, Banana lost its right to appoint one director to the board. Banana has stated that they have no intention to sell their remaining shares in Strawberry and wish to classify the remaining 10% interest as fair value through other comprehensive income in accordance with MFRS 9 Financial Instruments. Required: Explain whether equity accounting was the appropriate treatment for Strawberry in the consolidated financial statements up to the date of its disposal. (6 marks) Banana Berhad owns 45% of the voting shares in Orange Berhad, Orange has four other investors which own the remaining 55% of its voting shares and are all technology companies. The largest of these holdings is 18%. Orange is a property developer and build both residential and commercial properties. Banana has no expertise in this area and is not involved in the renovation or disposal of the property. The board of directors of Orange makes all of the major decisions but Banana can nominate up to four of the eight board members. Each of the remaining four board members are nominated by each of the other investors. Any major decisions require all board members to vote and for there to be a clear majority. Thus, Banana has effectively the power of veto on any major decision. There is no shareholder agreement as to how Orange should be operated or who will make the operating decisions for Orange. The directors of Banana believe that Banana has joint control over Orange because it is the major shareholder and holds the power of veto over major decisions. Required: Explain whether Banana Berhad has joint control over Orange Berhad. (9 marks) Question 2 I Thank U Berhad acquired 80% of the five million equity shares at the cost of RM5 millions of Welcome Berhad on 1 July 2021 for cash of RM88 million. The fair value of the non-controlling interest (NCI) at acquisition was RM17 million. The fair value of the identifiable net assets at acquisition was RM49 million, excluding a factory site acquired many years prior to the date of acquisition. Land and property prices in the area had increased significantly in the years immediately prior to 1 July 2021. Nearby sites had been acquired and converted into residential use. A market report indicated that if Welcome Berhad has converted the site into residential use, the factory site would have a market value of RM24 million. RM1 million of costs are estimated to be required to demolish the factory and to obtain planning permission for the conversion. Welcome Berhad was not intending to convert the site at the acquisition date and had not sought planning permission at that date. Required: Calculate the goodwill arising on the acquisition of Welcome Berhad measuring the non-controlling interest at: a. Fair value. b. Proportionate share of the net assets. (15 marks) Neste Berhad has offered to public for subscription 20,000 ordinary shares of RM100 each payable as RM30 per share on application, RM30 per share on allotment and the balance on call. Applications were received for 30,000 shares. Applications for 5,000 shares were rejected all together and application money was retumed. Remaining applicants were allotted the offered shares. Their excess application money was adjusted towards some due on allotment. Calls were made and duly received Required: Show the journal entries to record the issuance of shares. (15 marks) Statement of Financial Position as at 31 December 2021 Emoji Inc Asset dollar dollar Non-current assets Plant at cost 500 Less depreciation (200) 300 Current assets Inventories Receivables 200 100 300 600 Equity and liabilities Equity Ordinary shares Reserves 100 280 380 Long-term loans Current liabilities 110 110 600 Statement of Profit or Loss for the year Eeded 31 December 2021 Emoji Inc dollar Profit before tax 300 Tax (140) Profit after tax, retained 160 The following further information is given: i. Smiley Berhad has owned shares in Emoji Inc since 1 January 2021. On that date the company had reserves of 120. ii. Exchange rates: 1 January 2021 Average rate for year ending 31 December 2021 31 December 2021 1.8 to RM1 1.6 to RM1 1 to RM1 Required: Translate the statement of financial position and statement of profit or loss of Emoji Inc into Ringgit Malaysia (RM). (15 marks) The Spring Group camies on business as a distributor of building materials into the country. Spring was incorporated in 2011 to distribute building materials. It diversified its activities during 2014 to include the import and distribution of water meter, and expanded its operations by the acquisition of shares in Summer in 2016 and in Autumn in 2018. Accounts for all companies are made up to 31 December. The draft income statements for Spring, Summer, Autumn and Winter for the year ended 31 December 2021 are as follows. Spring RM'000 45,600 (18.050) 27,550 (3,325) (3,475) Summer RM'000 24,700 (5.463) 19,237 (2,137) (950) Autumn RM'000 22,800 (5,320) 17,480 (1,900) (1,900) Winter RM'000 610 (310) 300 (70) Revenue Cost of Sales Gross profit Distribution costs Administrative expenses Finance costs Profit before tax Income tax expense Profit for the year (10) (325) 20.425 (8.300) 12.125 16,150 (5,390) 10.760 13,680 (4,241 9.439 220 (120) 100 The draft statements of financial position as at 31 December 2021 are as follows. 35,483 24,273 13.063 270 Non-current assets Property, plant and equipment (NBV) Investments Shares in Summer Shares in Autumn 6,650 3 800 Current assets Total Assets 1 568 43701 9.025 37098 8.883 21.946 200 470 Equity RM1 ordinary shares Retained earnings 8.000 22 638 3.000 24 075 2,000 19,898 100 300 13 063 10 023 48 70 Current liabilities Total Equity and Liabilities 43701 37 098 21.946 470 The following information is available relating to Spring, Summer, Autumn and Winter. i. On 1 January 2016 Spring signed the purchase agreement to acquire 2,700,000 of ordinary shares in Summer at cost of RM2.7 million for RM6,650,000 at which date there was a credit balance on the retained eamings of Summer of .6/- 8 BAC305/03 I RM1,425,000. No shares have been issued by Summer since Spring acquired its interest On 1 January 2018 Summer acquired 1,600,000 of ordinary shares in Autumn at cost of RM1.6 million for RM3,800,000 at which date there was a credit balance on the retained eamings of Autumn of RM950,000. No shares have been issued by Autumn since Summer acquired its interest. On 1 January 2021, Spring acquired 40.000 shares in Winter by way of a share exchange of two shares in Spring for each acquired share in Winter. The share market value of Spring's shares at the date of this share exchange was RM2.50. Spring has not yet recorded the acquisition of the investment in Winter iv. During 2021, Autumn had made intragroup sales to Summer of RM480,000 making a profit of 25% on cost and RM75,000 of these goods were in inventories at 31 December 2021. V. During 2021. Summer had made intragroup sales to Spring of RM260,000 making a profit of 20% on cost and RM90.000 of these goods were in inventories at 31 December 2021. vi. On 1 November 2021 Spring sold warehouse equipment to Summer for RM240.000 from inventories. Summer has included this equipment in its property, plant and equipment. The equipment had been purchased on credit by Sprilg for RM200,000 in October 2021 and this amount is included in its current liabilities as at 31 December 2021. V. Summer charges depreciation on its warehouse equipment at 20% on cost. It is company policy to charge a full year's depreciation in the year of acquisition to be included in the cost of sales. viii. An impairment test conducted at the year-end did not reveal any impairment losses. It is the group's policy to value the non-controlling interest at fair value at the date of acquisition. The fair value of the non-controlling interests in Summer on 1 January 2016 was RM500,000. The fair value of the 28% non-controlling interest in Autumn on 1 January 2018 was RM900,000. Required: G Prepare the statement of comprehensive income for the Spring Group for the year-ending 31 December 2021. (18 marks) b. Prepare the statement of financial position for the Spring Group for the year- ending 31 December 2021. (22 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started