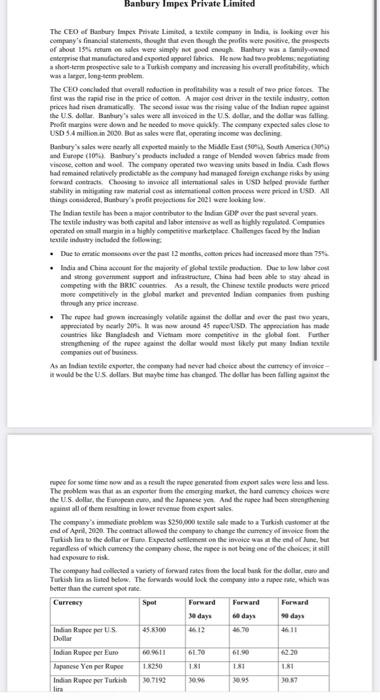

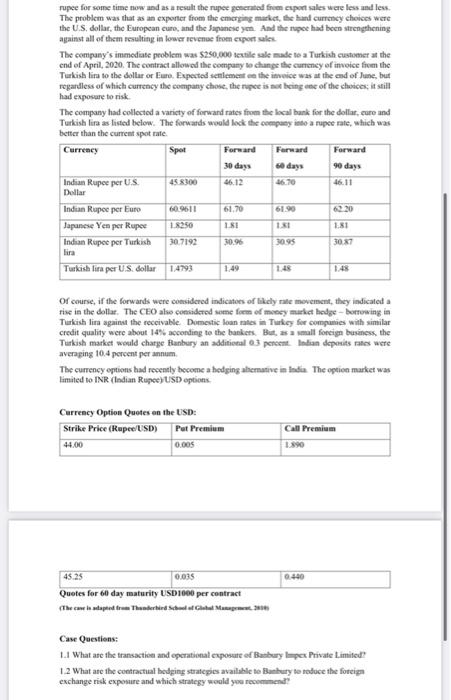

Banbury Impex Private Limited The CEO of Banbury Impex Private Limited este company in India is looking over his company's financial statements, thought that even though the profits were positive, the prospects of about 15 rumoe sales were simply not good enough anbary was a family owned enterprise that manufactured and exported apparel fabrics. He w had two probleme potating short-term prospective sletea Turkish company and increasing his netail profitability, which was a larger, long-term problem The CEO concluded that overall reduction in profitability was a result of we price forces. The first was the rapid rise in the price of cotton. A major cost driver in the textile industry, prices halen dramatically. The second in the rising value of the Indian Rupee the US dollar, Battery's les were all inced the US dollar, and the dollars falling Profit margins were in and the needed to move quickly. The company expected sales close to USD 54 million in 2000. But as sales were flat operating income was declining Banbury's slawe eatly all exported mainly to the Middle E (50, South America 000 und Europe (10Bashury's products included a range of ended ween fabesis made from viscose, cotton and wool. The company operated two weaving units based in India Cashows had remained relatively predictable as the company had managed foreign exchange risks by ning forward contracts. Choosing to invoice all intentional sales in USD helped provide further stability in miting raw material coastematical cole proces were priced in USD All things caderod, Bunbury's profit projections for 2001 were looking low The Indian textile has bem a major contributor to the Indian GDP over the past several years The textile industry was both capital and laberinters well as highly regulated Companies operated on all margin in a highly competitive marketplace Challenges faced by the Indian textile industry included the following . Due to cratie moescons over the past 12 months, cotton prices had increased meet 75% India and China account for the majority of global textile perfection. Due to wober.com indig gove support and infrastructure, China had been able to stay ahead in competing with the BRIC countries. As a result, the Chinese textile products were poed more competitively in the global market and prevented Indian companies trumping through any price increase . The rupee had increasingly volatile against the doll and medical two year, appreciated by early 2018 www.around 45 pe USD The police has made countries ke Bangladesh and Vietnam more compete in the global font. Further strengthening of the roper against the delle would most likely po many Indian textile companies out of business As an Indian textile exporter, the company had never load choice about the ceny of imice it would be the US dollars. But maybe time has changed. The dollar has been falling in the pe for some time and a result the new generated from export sales were less and less The problem was that as an experter from the emerging market the hand cummy choices were the US dollar, the European cure, and the Japanese yen And the rupee had been strengthening against all of the resulting in lower revenue from expertsales The company's immediate problem was $250,000 textile sale made to a Turkish customer at the end of April, 2020. The contract allowed the company change the currency of voice from the Turkish lita to the dollar Euro Expected selement on the invoice was at the end of June, but regardless of which currency the company chese, the rupee is not being one of the choices it still had exposure to sisk The company had collected a variety of forward rates from the local bunk for the dollar, and Turkish listed below. The forwards would lock the company into a rupee rute, which was better than the current sporte Currency Spol Forward Forward Forward 30 days days 90 days Indian Rupee per US 45.300 16.12 16.70 4611 Dollar lodian Rupee per Euro 6.70 61.90 4220 Japanese Yen per Rupee 1.x250 1X1 181 1.1 Indian Rupee por Turkish 107192 10.95 30.95 07 tira rupee for some time now and as a result the rupee generated from sport sales were less and less. The problem was that as an exporter from the emerging market, the hand currency choices were the US dollar, the European cure, and the Japanese yon. And the rupee had been strengthening against all of them resulting in lower revenue from cxport sales The company's immediate problem was $250,000 textile sale made to a Turkish customer at the end of April, 2020. The contract allowed the company to change the currency of invoice from the Turkish lira to the dollar or Euro. Expected seniement en the twice was at the end of June, but regardless of which currency the company chose the rupee is being one of the choices; it still had exposure to risk The company had collected a variety of forward rates from the local bank for the dollar, care and Turkish lira as listed below. The forwards would lock the company into a rupee rate, which was better than the current spot rate Currency Spot Forward Forward Forward 30 days 60 days 90 days Indian Rupee per US 458300 46.12 46.11 Dollar Indian Rupee per Euro 609611 61.70 61.90 6230 Japanese Yen per Rupee 1.8250 LI 11 1.81 Indian Rupee per Turkish 30.7192 30.96 3095 30.37 Turkish lira per US dollar 14793 1.45 1.48 Of course, if the forwards were considered indicates of likely rate movement, they indicated a rise in the dollar. The CEO also considered some form of money market hedge-borrowing in Turkish lins against the receivable Domestic loan mates in Turkey for companies with similar credit quality were about 14% according to the bankets. But as a small foreign business, the Turkish market would charge Bunbury an additional 3 percent. Indian deposits rates were averaging 10.4 percent per annum The currency options had recently become a hedging alternative in India The option market was limited to INR (Indian Rupee) USD options Currency Option Quotes on the USD: Strike Price (Rupee/USD) Pet Premium 44.00 0.005 Call Premium 1890 0.035 0.440 45.25 Quotes for 60 day maturity USD1000 per contract (the case in tapeedram Thunderbird Sched Glated Mp3 Case Questions: 1.1 What are the transaction and operational exposure of Banbury pex Private Limited 1.2 What are the contractual hedging strategies available to Bury to reduce the foreign exchange risk exposure and which strategy would you recommend Banbury Impex Private Limited The CEO of Banbury Impex Private Limited este company in India is looking over his company's financial statements, thought that even though the profits were positive, the prospects of about 15 rumoe sales were simply not good enough anbary was a family owned enterprise that manufactured and exported apparel fabrics. He w had two probleme potating short-term prospective sletea Turkish company and increasing his netail profitability, which was a larger, long-term problem The CEO concluded that overall reduction in profitability was a result of we price forces. The first was the rapid rise in the price of cotton. A major cost driver in the textile industry, prices halen dramatically. The second in the rising value of the Indian Rupee the US dollar, Battery's les were all inced the US dollar, and the dollars falling Profit margins were in and the needed to move quickly. The company expected sales close to USD 54 million in 2000. But as sales were flat operating income was declining Banbury's slawe eatly all exported mainly to the Middle E (50, South America 000 und Europe (10Bashury's products included a range of ended ween fabesis made from viscose, cotton and wool. The company operated two weaving units based in India Cashows had remained relatively predictable as the company had managed foreign exchange risks by ning forward contracts. Choosing to invoice all intentional sales in USD helped provide further stability in miting raw material coastematical cole proces were priced in USD All things caderod, Bunbury's profit projections for 2001 were looking low The Indian textile has bem a major contributor to the Indian GDP over the past several years The textile industry was both capital and laberinters well as highly regulated Companies operated on all margin in a highly competitive marketplace Challenges faced by the Indian textile industry included the following . Due to cratie moescons over the past 12 months, cotton prices had increased meet 75% India and China account for the majority of global textile perfection. Due to wober.com indig gove support and infrastructure, China had been able to stay ahead in competing with the BRIC countries. As a result, the Chinese textile products were poed more competitively in the global market and prevented Indian companies trumping through any price increase . The rupee had increasingly volatile against the doll and medical two year, appreciated by early 2018 www.around 45 pe USD The police has made countries ke Bangladesh and Vietnam more compete in the global font. Further strengthening of the roper against the delle would most likely po many Indian textile companies out of business As an Indian textile exporter, the company had never load choice about the ceny of imice it would be the US dollars. But maybe time has changed. The dollar has been falling in the pe for some time and a result the new generated from export sales were less and less The problem was that as an experter from the emerging market the hand cummy choices were the US dollar, the European cure, and the Japanese yen And the rupee had been strengthening against all of the resulting in lower revenue from expertsales The company's immediate problem was $250,000 textile sale made to a Turkish customer at the end of April, 2020. The contract allowed the company change the currency of voice from the Turkish lita to the dollar Euro Expected selement on the invoice was at the end of June, but regardless of which currency the company chese, the rupee is not being one of the choices it still had exposure to sisk The company had collected a variety of forward rates from the local bunk for the dollar, and Turkish listed below. The forwards would lock the company into a rupee rute, which was better than the current sporte Currency Spol Forward Forward Forward 30 days days 90 days Indian Rupee per US 45.300 16.12 16.70 4611 Dollar lodian Rupee per Euro 6.70 61.90 4220 Japanese Yen per Rupee 1.x250 1X1 181 1.1 Indian Rupee por Turkish 107192 10.95 30.95 07 tira rupee for some time now and as a result the rupee generated from sport sales were less and less. The problem was that as an exporter from the emerging market, the hand currency choices were the US dollar, the European cure, and the Japanese yon. And the rupee had been strengthening against all of them resulting in lower revenue from cxport sales The company's immediate problem was $250,000 textile sale made to a Turkish customer at the end of April, 2020. The contract allowed the company to change the currency of invoice from the Turkish lira to the dollar or Euro. Expected seniement en the twice was at the end of June, but regardless of which currency the company chose the rupee is being one of the choices; it still had exposure to risk The company had collected a variety of forward rates from the local bank for the dollar, care and Turkish lira as listed below. The forwards would lock the company into a rupee rate, which was better than the current spot rate Currency Spot Forward Forward Forward 30 days 60 days 90 days Indian Rupee per US 458300 46.12 46.11 Dollar Indian Rupee per Euro 609611 61.70 61.90 6230 Japanese Yen per Rupee 1.8250 LI 11 1.81 Indian Rupee per Turkish 30.7192 30.96 3095 30.37 Turkish lira per US dollar 14793 1.45 1.48 Of course, if the forwards were considered indicates of likely rate movement, they indicated a rise in the dollar. The CEO also considered some form of money market hedge-borrowing in Turkish lins against the receivable Domestic loan mates in Turkey for companies with similar credit quality were about 14% according to the bankets. But as a small foreign business, the Turkish market would charge Bunbury an additional 3 percent. Indian deposits rates were averaging 10.4 percent per annum The currency options had recently become a hedging alternative in India The option market was limited to INR (Indian Rupee) USD options Currency Option Quotes on the USD: Strike Price (Rupee/USD) Pet Premium 44.00 0.005 Call Premium 1890 0.035 0.440 45.25 Quotes for 60 day maturity USD1000 per contract (the case in tapeedram Thunderbird Sched Glated Mp3 Case Questions: 1.1 What are the transaction and operational exposure of Banbury pex Private Limited 1.2 What are the contractual hedging strategies available to Bury to reduce the foreign exchange risk exposure and which strategy would you recommend