Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bandile received the right to use of a company owned vehicle for the first time on 30 May 2022. The actual retail market value of

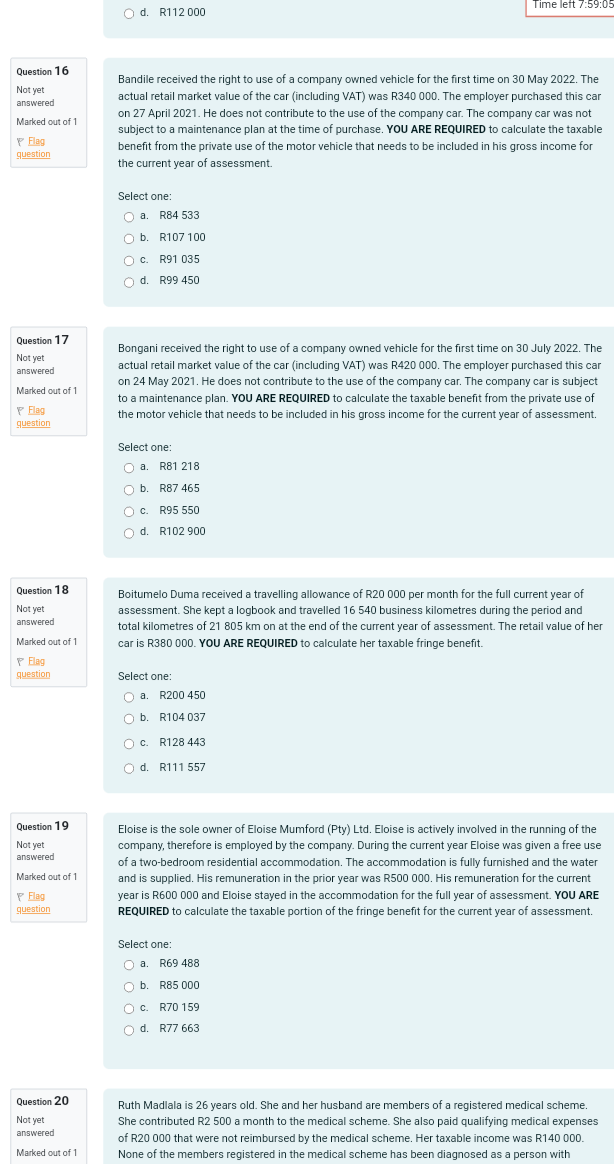

Bandile received the right to use of a company owned vehicle for the first time on 30 May 2022. The actual retail market value of the car (including VAT) was R340 000. The employer purchased this car on 27 April 2021. He does not contribute to the use of the company car. The company car was not subject to a maintenance plan at the time of purchase. YOU ARE REQUIRED to calculate the taxable benefit from the private use of the motor vehicle that needs to be included in his gross income for the current year of assessment. Select one: a. R84 533 b. R107 100 c. R91035 d. R99 450 Bongani received the right to use of a company owned vehicle for the first time on 30 July 2022 . The actual retail market value of the car (including VAT) was R420 000. The employer purchased this car on 24 May 2021. He does not contribute to the use of the company car. The company car is subject to a maintenance plan. YOU ARE REQUIRED to calculate the taxable benefit from the private use of the motor vehicle that needs to be included in his gross income for the current year of assessment. Select one: a. R81218 b. R87465 C. R95 550 d. R102 900 Boitumelo Duma received a travelling allowance of R20 000 per month for the full current year of assessment. She kept a logbook and travelled 16540 business kilometres during the period and total kilometres of 21805km on at the end of the current year of assessment. The retail value of her car is R380 000. YOU ARE REQUIRED to calculate her taxable fringe benefit. Select one: a. R200 450 b. R104 037 c. R128 443 d. R111557 Eloise is the sole owner of Eloise Mumford (Pty) Ltd. Eloise is actively involved in the running of the company, therefore is employed by the company. During the current year Eloise was given a free use of a two-bedroom residential accommodation. The accommodation is fully furnished and the water and is supplied. His remuneration in the prior year was R500 000. His remuneration for the current year is R600 000 and Eloise stayed in the accommodation for the full year of assessment. YOU ARE REQUIRED to calculate the taxable portion of the fringe benefit for the current year of assessment. Select one: a. R69488 b. R85000 C. R70 159 d. R77 663 Ruth Madlala is 26 years old. She and her husband are members of a registered medical scheme. She contributed R2 500 a month to the medical scheme. She also paid qualifying medical expenses of R20 000 that were not reimbursed by the medical scheme. Her taxable income was R140 000. None of the members registered in the medical scheme has been diagnosed as a person with

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started