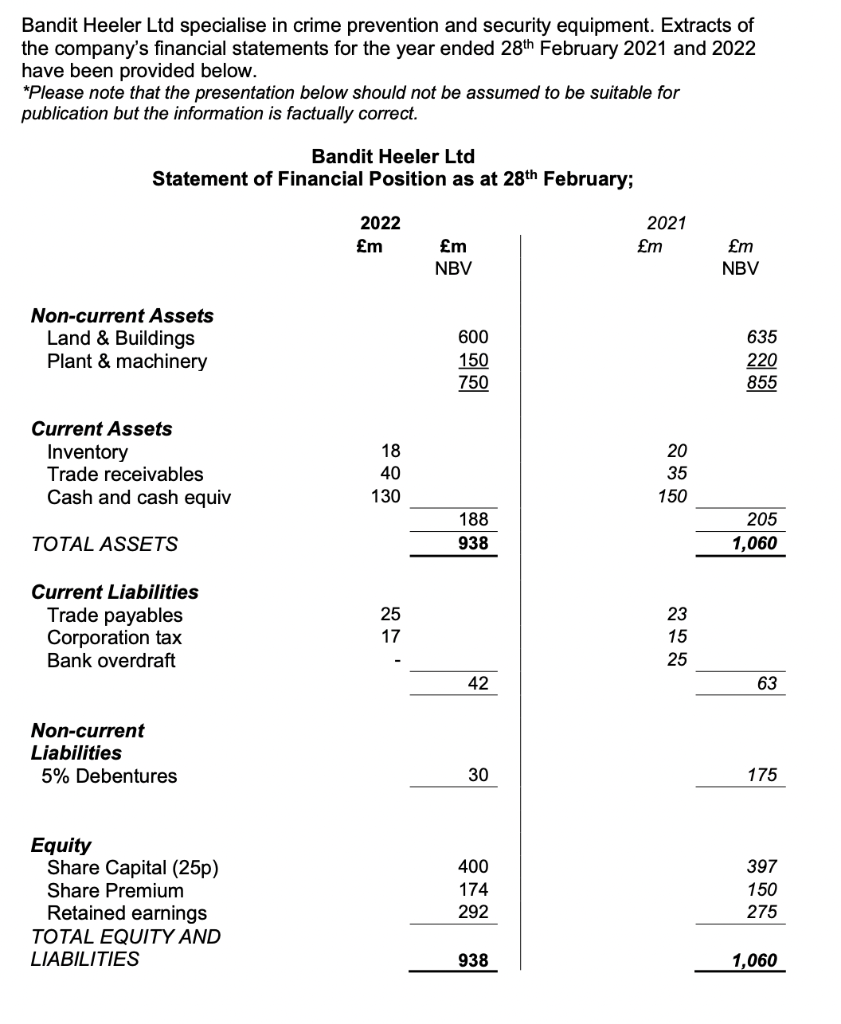

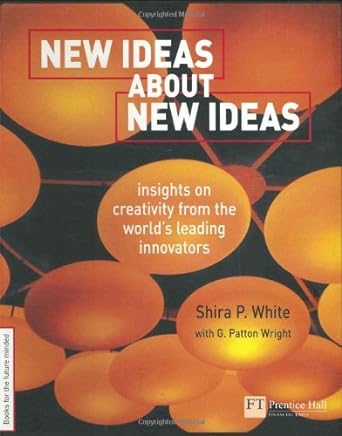

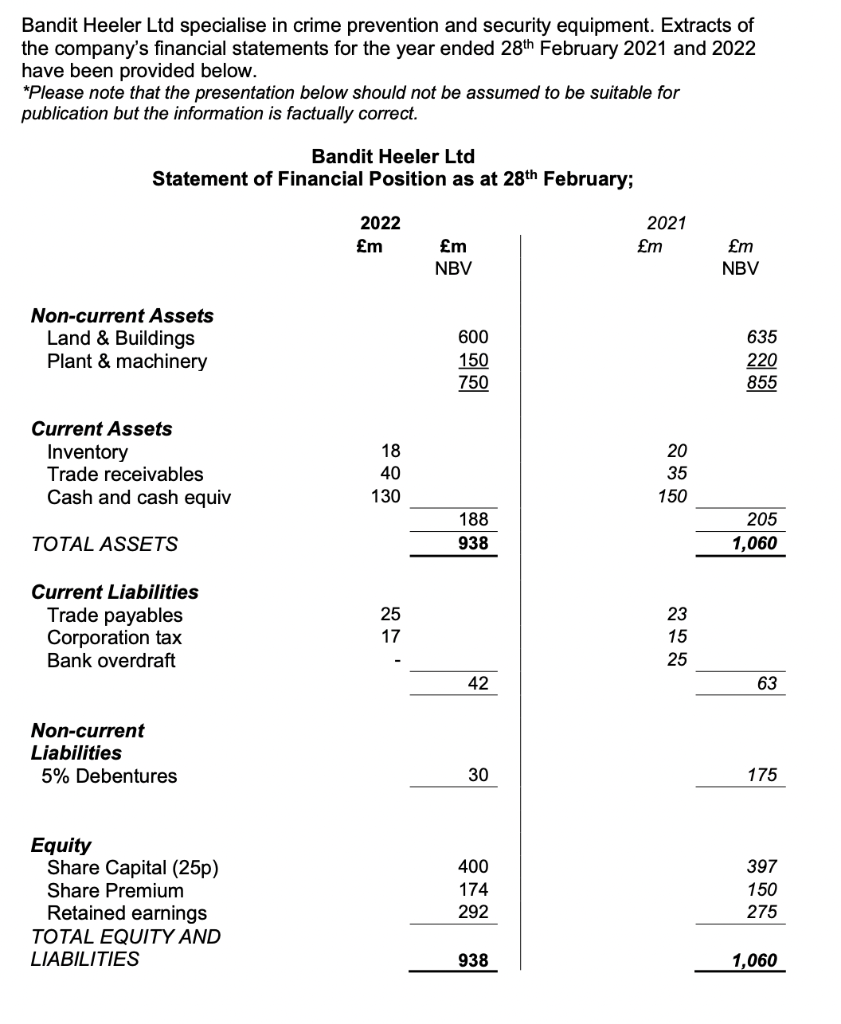

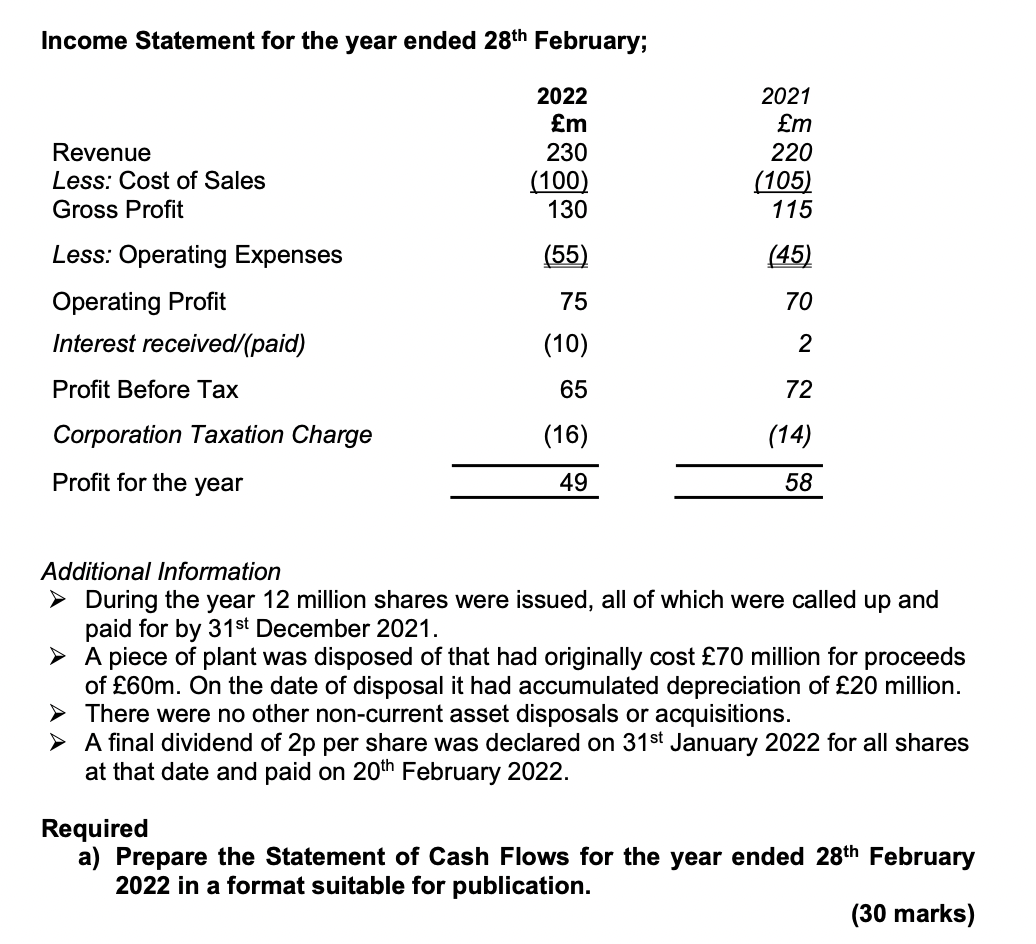

Bandit Heeler Ltd specialise in crime prevention and security equipment. Extracts of the company's financial statements for the year ended 28th February 2021 and 2022 have been provided below. *Please note that the presentation below should not be assumed to be suitable for publication but the information is factually correct. Bandit Heeler Ltd Statement of Financial Position as at 28th February; 2022 m 2021 m m NBV m NBV Non-current Assets Land & Buildings Plant & machinery 600 150 635 220 855 750 Current Assets Inventory Trade receivables Cash and cash equiv 18 40 130 20 35 150 188 938 205 1,060 TOTAL ASSETS Current Liabilities Trade payables Corporation tax Bank overdraft 25 17 23 15 25 42 63 Non-current Liabilities 5% Debentures 30 175 400 174 Equity Share Capital (25p) Share Premium Retained earnings TOTAL EQUITY AND LIABILITIES 397 150 275 292 938 1,060 Income Statement for the year ended 28th February; Revenue Less: Cost of Sales Gross Profit 2022 m 230 (100) 130 2021 m 220 (105) 115 (55) (45) 75 70 Less: Operating Expenses Operating Profit Interest received/(paid) Profit Before Tax (10) 2 65 72 Corporation Taxation Charge (16) (14) Profit for the year 49 58 Additional Information During the year 12 million shares were issued, all of which were called up and paid for by 31st December 2021. A piece of plant was disposed of that had originally cost 70 million for proceeds of 60m. On the date of disposal it had accumulated depreciation of 20 million. There were no other non-current asset disposals or acquisitions. A final dividend of 2p per share was declared on 31st January 2022 for all shares at that date and paid on 20th February 2022. Required a) Prepare the Statement of Cash Flows for the year ended 28th February 2022 in a format suitable for publication. (30 marks) Bandit Heeler Ltd specialise in crime prevention and security equipment. Extracts of the company's financial statements for the year ended 28th February 2021 and 2022 have been provided below. *Please note that the presentation below should not be assumed to be suitable for publication but the information is factually correct. Bandit Heeler Ltd Statement of Financial Position as at 28th February; 2022 m 2021 m m NBV m NBV Non-current Assets Land & Buildings Plant & machinery 600 150 635 220 855 750 Current Assets Inventory Trade receivables Cash and cash equiv 18 40 130 20 35 150 188 938 205 1,060 TOTAL ASSETS Current Liabilities Trade payables Corporation tax Bank overdraft 25 17 23 15 25 42 63 Non-current Liabilities 5% Debentures 30 175 400 174 Equity Share Capital (25p) Share Premium Retained earnings TOTAL EQUITY AND LIABILITIES 397 150 275 292 938 1,060 Income Statement for the year ended 28th February; Revenue Less: Cost of Sales Gross Profit 2022 m 230 (100) 130 2021 m 220 (105) 115 (55) (45) 75 70 Less: Operating Expenses Operating Profit Interest received/(paid) Profit Before Tax (10) 2 65 72 Corporation Taxation Charge (16) (14) Profit for the year 49 58 Additional Information During the year 12 million shares were issued, all of which were called up and paid for by 31st December 2021. A piece of plant was disposed of that had originally cost 70 million for proceeds of 60m. On the date of disposal it had accumulated depreciation of 20 million. There were no other non-current asset disposals or acquisitions. A final dividend of 2p per share was declared on 31st January 2022 for all shares at that date and paid on 20th February 2022. Required a) Prepare the Statement of Cash Flows for the year ended 28th February 2022 in a format suitable for publication. (30 marks)