Answered step by step

Verified Expert Solution

Question

1 Approved Answer

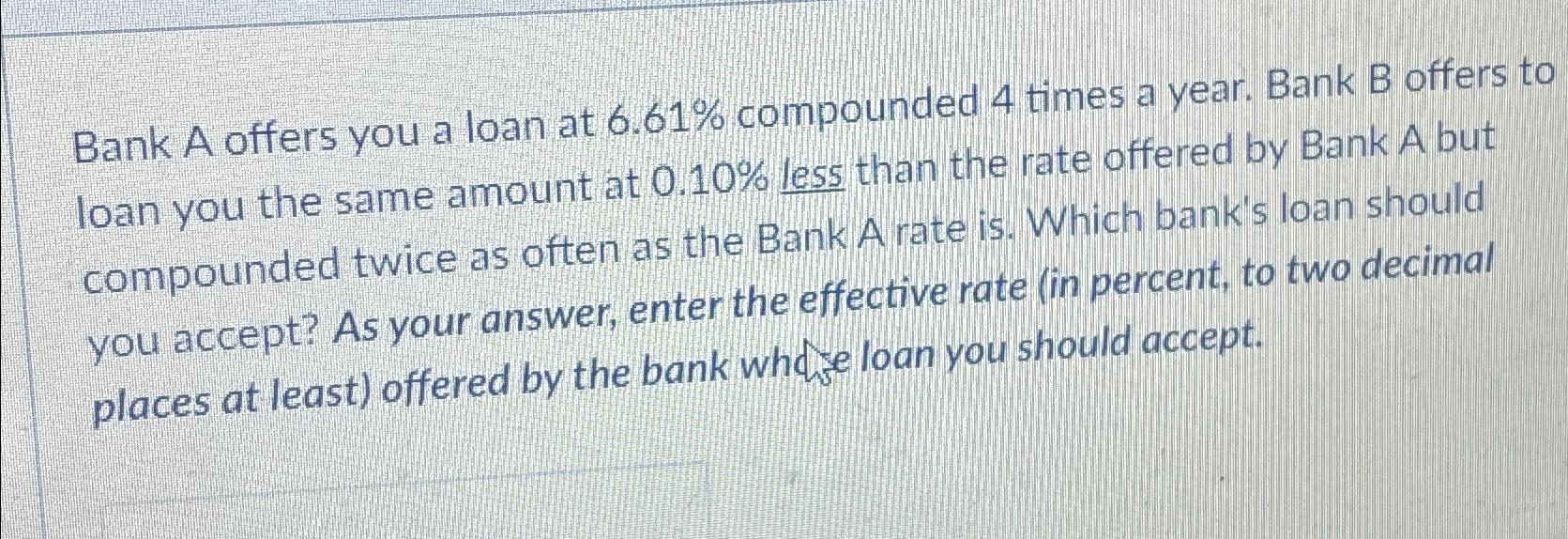

Bank A offers you a loan at 6.61% compounded 4 times a year. Bank B offers to loan you the same amount at 0.10% less

Bank A offers you a loan at

6.61%compounded 4 times a year. Bank B offers to loan you the same amount at

0.10%less than the rate offered by Bank A but compounded twice as often as the Bank A rate is. Which bank's loan should you accept? As your answer, enter the effective rate (in percent, to two decimal places at least) offered by the bank whd fe loan you should accept.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started