Question

Bank Account Application using Python For this assignment, you will build a bank account application. Your application must be capable of the following: 1. Create

Bank Account Application using Python For this assignment, you will build a bank account application. Your application must be capable of the following: 1. Create a new account by collecting an individual's first name, last name, starting balance 2. Allow credits and debits to be taken against accounts 3. List all accounts and their balances 4. List all credits and debits for an account 5. Allow the user to continue to use the application until they decide to quit (Data does not need to persist once the application quits) Your application will need a main function and other functions to give your application the capabilities specified above.

Bank Account Examples Feel free to make your application interface look different. Just keep the user interface clean and readable. Bank account application 1) Create new account 2) Credit/Debit an account 3) List all accounts 4) List account history 5) Quit What would you like to do: Figure 1 - Example bank account application user interface Creating a new account... Please enter the individuals First Name: Michael Last Name: Ghen Beginning Balance (USD): 1000 New account created for Michael Ghen (Account# 1) Figure 2 - Example creating a new account Crediting/Debiting an account... Please enter the account number: 1 Please enter the amount: -100 Michael Ghen (Account# 001) debited $100.00 New balance: $900.00 Figure 3 - Example crediting/debiting an account Listing accounts... 001 Michael Ghen $ 900.00 002 John Smith $1000.00 Figure 4 - Example listing all accounts Transaction history 001 Michael Ghen $1000.00 -$ 100.00 $ 900.00 +$1000.00 $1900.00 Figure 5 - Example listing transactions from an account

1. Provide an option for the user to view the sum or all account balances Your application must give the user the ability to check how much money the bank currently has in all accounts. This feature will then be used to help you simulate scenarios and answer questions.

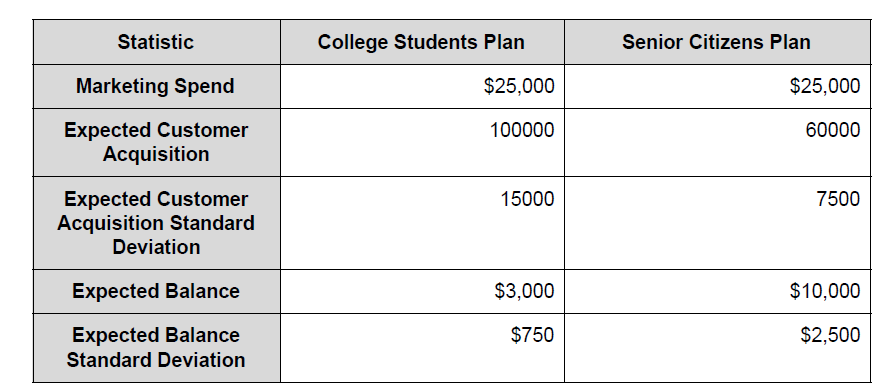

Bank Account Scenario and Questions The bank is trying to decide between two marketing plans. The first plan focuses on acquiring new accounts for college students while the second plan is focused on acquiring new accounts for senior citizens. The marketing analytics team has provided the following statistics and would like you to simulate these scenarios using your bank account application to determine the expected return on investment for both plans. The expected return on investment is defined as: Expected Return on Investment = ( Expected Total Deposits * 0.10) - Marketing Spend

In english, the expected return is 10% of the amount the bank holds for these new customers minus the marketing dollars spent to acquire these customers.

Simulate each scenario above 1000 times and use the results of each simulation to answer the following questions.

1. What is the Expected Total Deposits for: a. College Students Plan? b. Senior Citizens Plan?

2. What is the Expected Return on Investment for: a. College Students Plan? b. Senior Citizens Plan?

Statistic College Students Plan Senior Citizens Plan Marketing Spend $25,000 $25,000 100000 60000 Expected Customer Acquisition 15000 7500 Expected Customer Acquisition Standard Deviation Expected Balance $3,000 $10,000 $2,500 Expected Balance Standard Deviation $750 Statistic College Students Plan Senior Citizens Plan Marketing Spend $25,000 $25,000 100000 60000 Expected Customer Acquisition 15000 7500 Expected Customer Acquisition Standard Deviation Expected Balance $3,000 $10,000 $2,500 Expected Balance Standard Deviation $750Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started