Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bank Assets Cash Repurchase agreements Muncipal bonds Single Family Home Mortgages CMOS Commercial loans Agricultural loans Allowance for loan loss Bank buildings Total I. II.

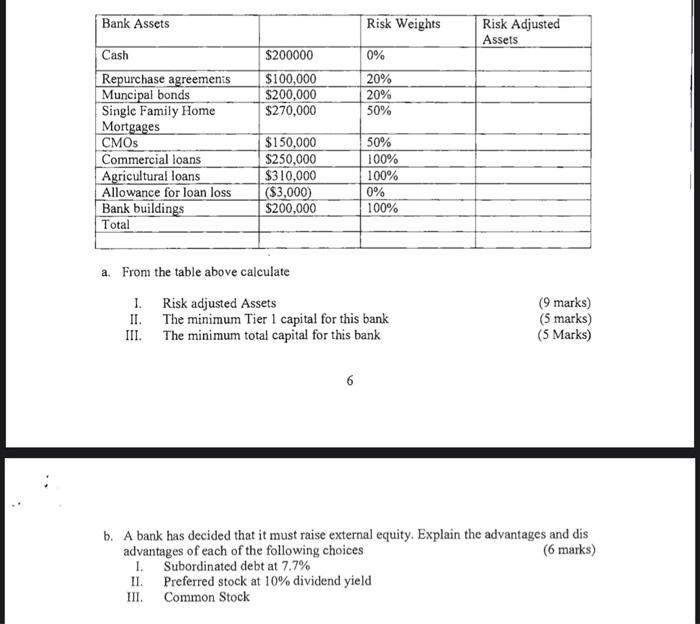

Bank Assets Cash Repurchase agreements Muncipal bonds Single Family Home Mortgages CMOS Commercial loans Agricultural loans Allowance for loan loss Bank buildings Total I. II. III. $200000 $100,000 $200,000 $270,000 a. From the table above calculate $150,000 $250,000 $310,000 ($3,000) $200,000 I. II. III. Risk Weights 6 0% 20% 20% 50% 50% 100% 100% 0% 100% Risk adjusted Assets The minimum Tier 1 capital for this bank The minimum total capital for this bank Risk Adjusted Assets (9 marks) (5 marks) (5 Marks) b. A bank has decided that it must raise external equity. Explain the advantages and dis advantages of each of the following choices (6 marks) Subordinated debt at 7.7% Preferred stock at 10% dividend yield Common Stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started