Answered step by step

Verified Expert Solution

Question

1 Approved Answer

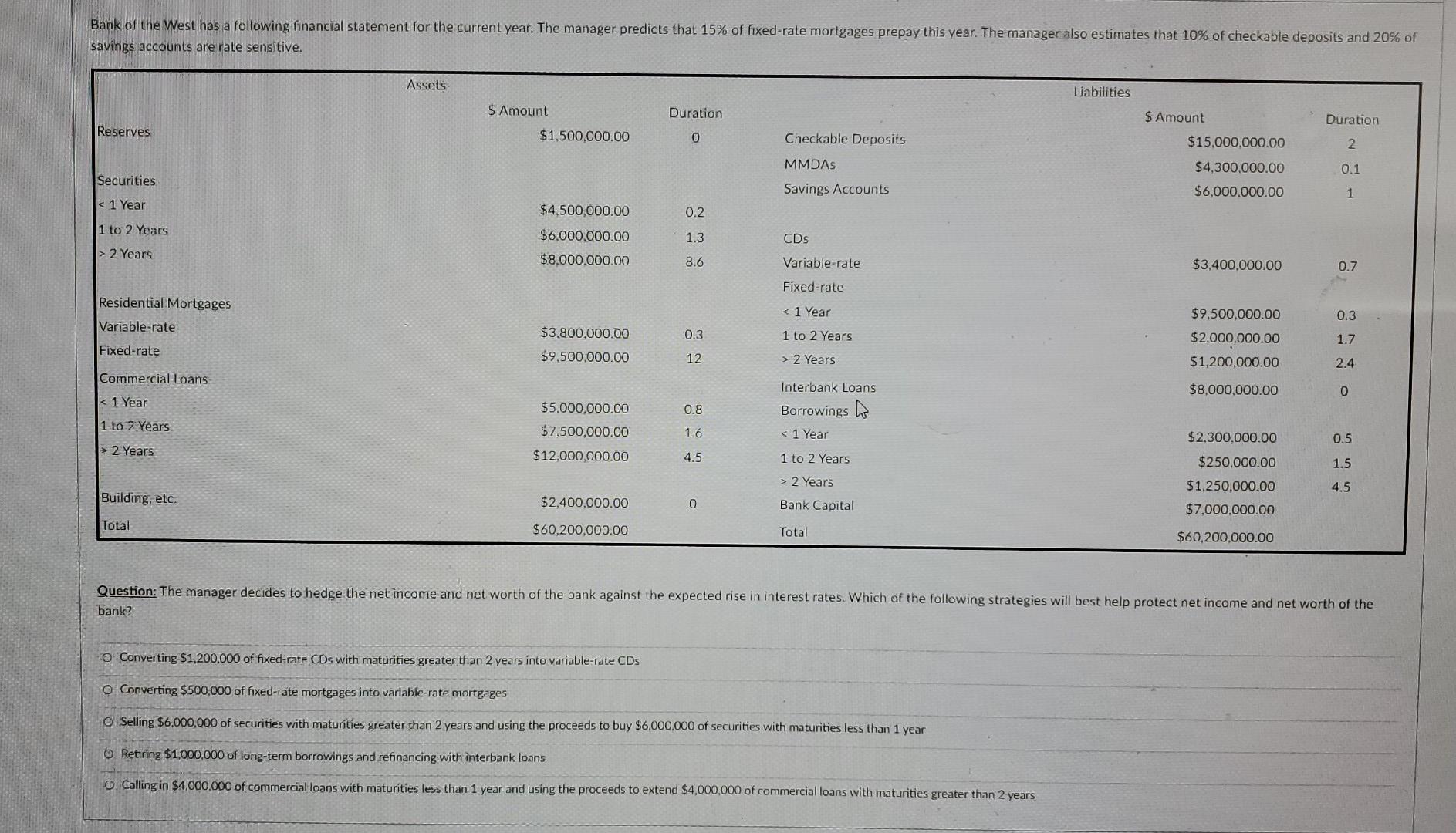

Bank of the West has a following financial statement for the current year. The manager predicts that 15% of fixed-rate mortgages prepay this year. The

Bank of the West has a following financial statement for the current year. The manager predicts that 15% of fixed-rate mortgages prepay this year. The manager also estimates that 10% of checkable deposits and 20% of savings accounts are rate sensitive, Assets Liabilities $ Amount Duration $ Amount Duration Reserves $1,500,000.00 0 Checkable Deposits 2 MMDAS $15,000,000.00 $4,300,000.00 $6,000.000.00 0.1 Securities Savings Accounts 1 2 Years 8.6 Variable-rate $3,400,000.00 Fixed-rate Residential Mortgages Variable-rate 2 Years 2.4 Commercial Loans $8,000,000.00 0 2 Years 4.5 Building, etc. $2,400,000.00 0 Bank Capital $1,250,000.00 $7,000,000.00 Total $60,200,000.00 Total $60,200,000.00 Question: The manager decides to hedge the net income and net worth of the bank against the expected rise in interest rates. Which of the following strategies will best help protect net income and net worth of the bank? O Converting $1,200,000 of fixed-rate CDs with maturities greater than 2 years into variable-rate CDs Converting $500,000 of fixed-rate mortgages into variable-rate mortgages Selling $6,000,000 of securities with maturities greater than 2 years and using the proceeds to buy $6,000,000 of securities with maturities less than 1 year o Retiring $1,000,000 of long-term borrowings and refinancing with interbank loans o Calling in $4,000,000 of commercial loans with maturities less than 1 year and using the proceeds to extend $4,000,000 of commercial loans with maturities greater than 2 years Bank of the West has a following financial statement for the current year. The manager predicts that 15% of fixed-rate mortgages prepay this year. The manager also estimates that 10% of checkable deposits and 20% of savings accounts are rate sensitive, Assets Liabilities $ Amount Duration $ Amount Duration Reserves $1,500,000.00 0 Checkable Deposits 2 MMDAS $15,000,000.00 $4,300,000.00 $6,000.000.00 0.1 Securities Savings Accounts 1 2 Years 8.6 Variable-rate $3,400,000.00 Fixed-rate Residential Mortgages Variable-rate 2 Years 2.4 Commercial Loans $8,000,000.00 0 2 Years 4.5 Building, etc. $2,400,000.00 0 Bank Capital $1,250,000.00 $7,000,000.00 Total $60,200,000.00 Total $60,200,000.00 Question: The manager decides to hedge the net income and net worth of the bank against the expected rise in interest rates. Which of the following strategies will best help protect net income and net worth of the bank? O Converting $1,200,000 of fixed-rate CDs with maturities greater than 2 years into variable-rate CDs Converting $500,000 of fixed-rate mortgages into variable-rate mortgages Selling $6,000,000 of securities with maturities greater than 2 years and using the proceeds to buy $6,000,000 of securities with maturities less than 1 year o Retiring $1,000,000 of long-term borrowings and refinancing with interbank loans o Calling in $4,000,000 of commercial loans with maturities less than 1 year and using the proceeds to extend $4,000,000 of commercial loans with maturities greater than 2 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started