Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 [20 marks] Orange Bottle Coffee & Co. is considering opening a new store. The project requires an upfront investment of $8,300,000 and is

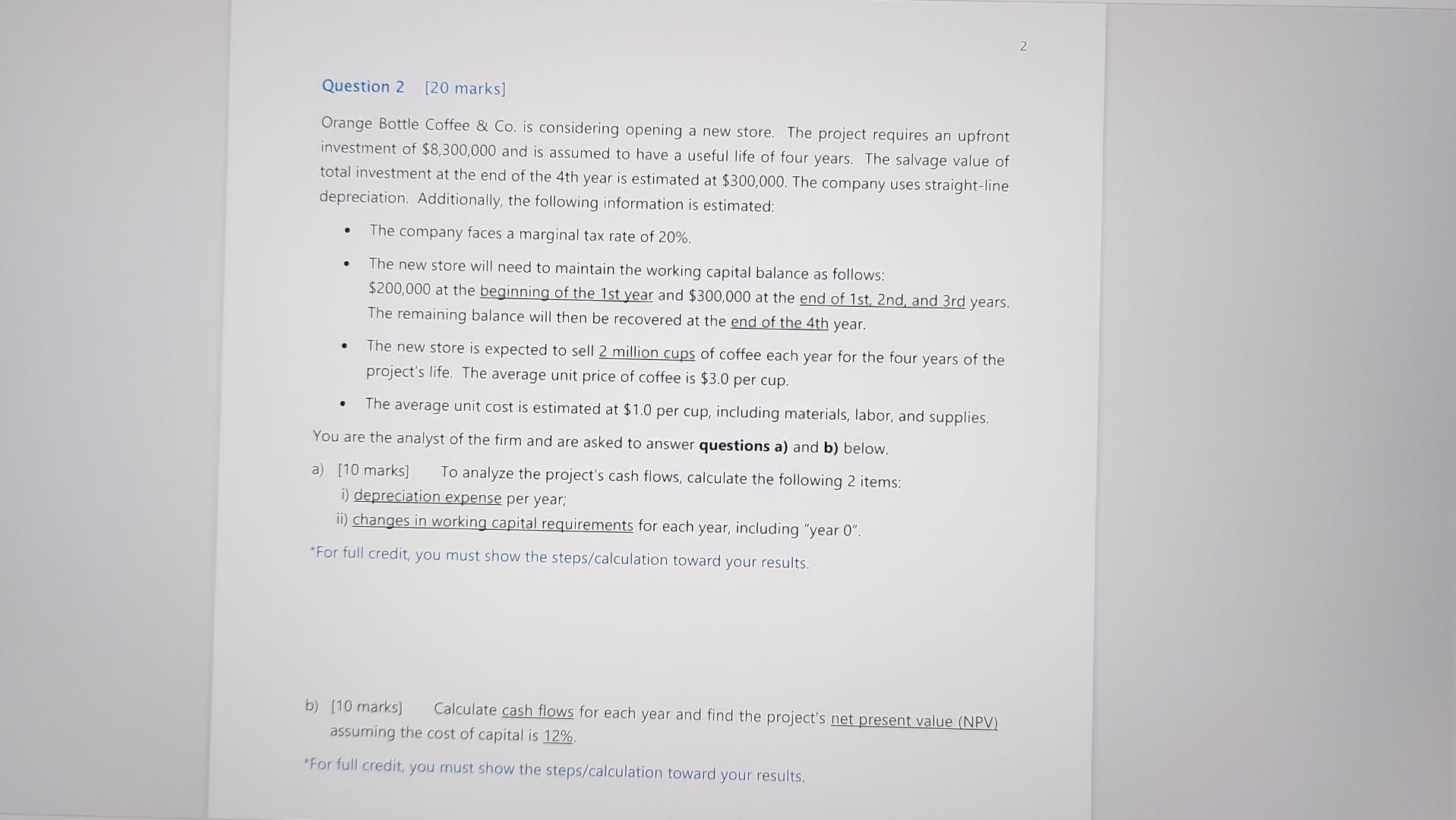

Question 2 [20 marks] Orange Bottle Coffee \& Co. is considering opening a new store. The project requires an upfront investment of $8,300,000 and is assumed to have a useful life of four years. The salvage value of total investment at the end of the 4 th year is estimated at $300,000. The company uses straight-line depreciation. Additionally, the following information is estimated: - The company faces a marginal tax rate of 20%. - The new store will need to maintain the working capital balance as follows: $200,000 at the beginning of the 1st year and $300,000 at the end of 1st, 2nd, and 3rd years. The remaining balance will then be recovered at the end of the 4th year. - The new store is expected to sell 2 million cups of coffee each year for the four years of the project's life. The average unit price of coffee is $3.0 per cup. - The average unit cost is estimated at $1.0 per cup, including materials, labor, and supplies. You are the analyst of the firm and are asked to answer questions a) and b) below. a) [10 marks] To analyze the project's cash flows, calculate the following 2 items: i) depreciation expense per year; ii) changes in working capital requirements for each year, including "year 0". *For full credit, you must show the steps/calculation toward your results. b) [10 marks] Calculate cash flows for each year and find the project's net present value (NPV) assuming the cost of capital is 12%. 'For full credit, you must show the steps/calculation toward your results

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started