Question

Bank Peru was born on the basis of the experience of the non-profit association, Accin Comunitaria of Peru (ACP). Bank Per centralizes its operations in

Bank Peru was born on the basis of the experience of the non-profit association, Accin Comunitaria of Peru (ACP). Bank Per centralizes its operations in micro and small companies with the vision of transforming clients through financial inclusion, thus driving the growth of the Peru.

His project called "Customer I Am" not only deals with a segmentation of customers and forces commercial, but brings with it a comprehensive value proposition that contemplates providing its customers a variety of services, as well as receiving zoned care that allows them to be closer to your trusted advisor, with a range of differentiated products according to your needs.

Its loan system that it offers its clients is access to credit in a fast and easy way through the care provided by its highly qualified staff. For the business has developed a wide portfolio of products that allows satisfying the different financial needs of the MYPES, among the main ones are:

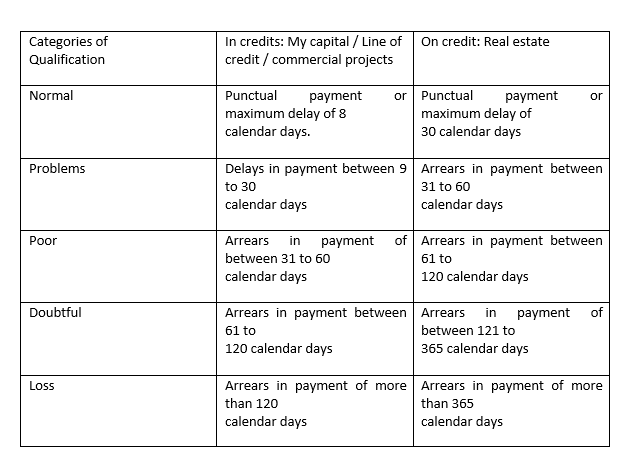

My capital, aimed at natural or legal persons seeking to finance the purchase of merchandise, inputs, raw materials, payment for business services, and others. Line of credit, for the bank's best clients (natural or legal persons) in order to finance business needs such as the purchase of merchandise and / or fixed assets, providing more agility in the disbursement. Real estate, credit intended to buy, expand, build or remodel commercial premises, with and without mortgage guarantee. Commercial projects, aimed at Micro and Small Entrepreneurs clients. Some results obtained in the 2018 campaign following its motto "Progress is for everyone", which reported by Bank Peru were: The average ticket of the credits granted for commercial projects was 1495 soles, for Real estate loans were 70540 soles, for loans my capital 5450 soles and for line of credit 40950 soles. The percentage of credits approved for line of credit 40.5%, my capital 6.5%, for projects commercial 17.0%, for real estate 11.5%, others 24.5% On the other hand, the classification of days of delinquency that is governed by Bank Peru is as follows:

To this end, the company has provided you with a sample of the 2019 campaign of its different bank loans in which the delinquency records in the 2018 campaign are included. information displayed helps general management determine if they have exceeded the goals achieved for the previous campaign.

On credit: Real estate Categories of Qualification In credits: My capital / Line of credit / commercial projects Normal or Punctual payment maximum delay of 8 calendar days. or Punctual payment maximum delay of 30 calendar days Problems Delays in payment between 9 Arrears in payment between to 30 31 to 60 calendar days calendar days Poor Arrears in payment between 31 to 60 calendar days of Arrears in payment between 61 to 120 calendar days Doubtful of Arrears in payment between Arrears in payment 61 to between 121 to 120 calendar days 365 calendar days Loss Arrears in payment of more Arrears in payment of more than 120 than 365 calendar days calendar days On credit: Real estate Categories of Qualification In credits: My capital / Line of credit / commercial projects Normal or Punctual payment maximum delay of 8 calendar days. or Punctual payment maximum delay of 30 calendar days Problems Delays in payment between 9 Arrears in payment between to 30 31 to 60 calendar days calendar days Poor Arrears in payment between 31 to 60 calendar days of Arrears in payment between 61 to 120 calendar days Doubtful of Arrears in payment between Arrears in payment 61 to between 121 to 120 calendar days 365 calendar days Loss Arrears in payment of more Arrears in payment of more than 120 than 365 calendar days calendar daysStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started