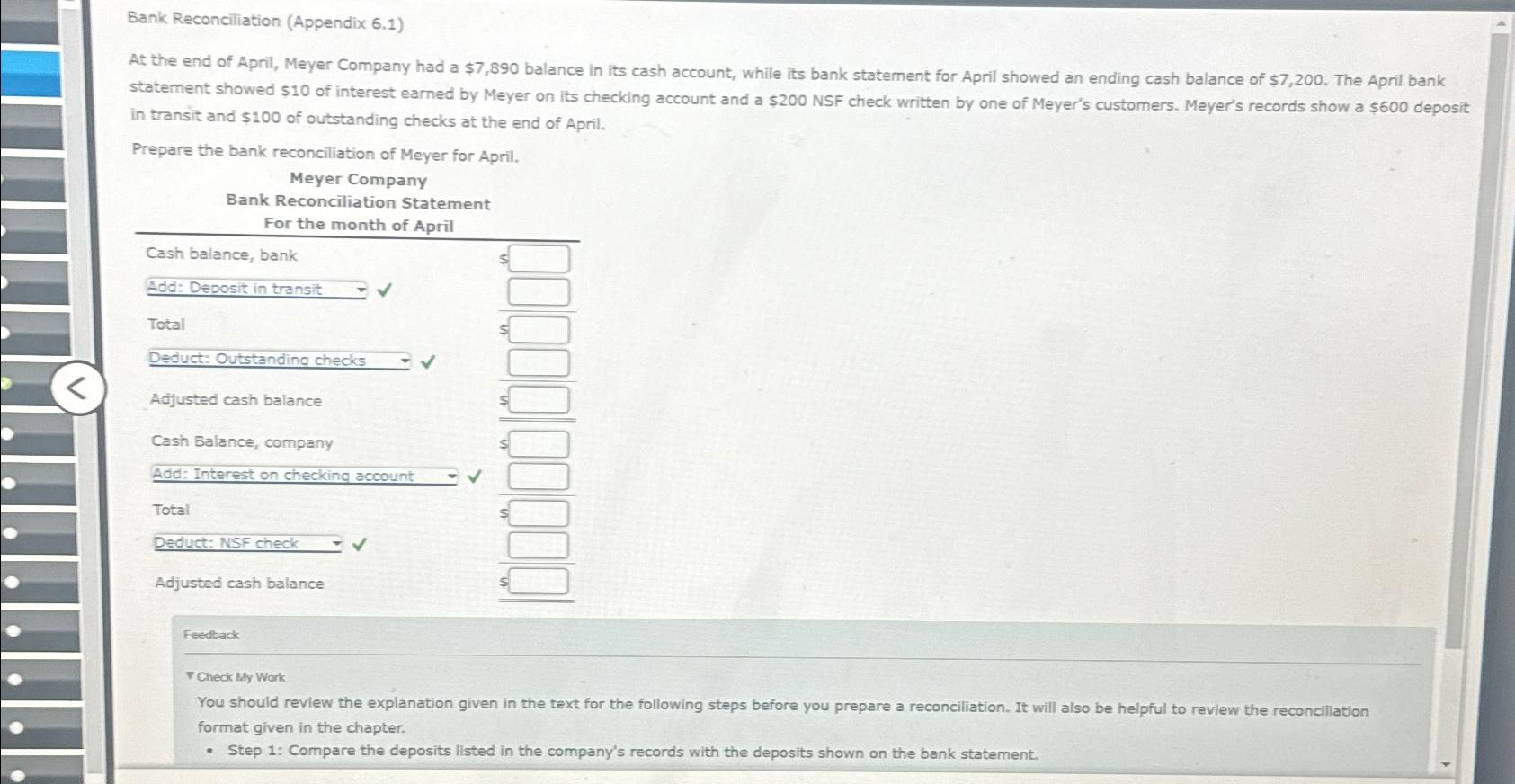

Bank Reconciliation (Appendix 6.1) in transit and $100 of outstanding checks at the end of April. Prepare the bank reconciliation of Meyer for April. Meyer

Bank Reconciliation (Appendix 6.1) in transit and

$100of outstanding checks at the end of April.\ Prepare the bank reconciliation of Meyer for April.\ Meyer Company\ Bank Reconciliation Statement\ For the month of April\ Cash balance, bank\ s\ Total\ s\ Deduct: Outstanding checks

\ Adjusted cash balance\ s\ Cash Balance, company\ s\ Add: Interest on checkina account

\ Total\ 5\ Deduct: NSF check

\ Adjusted cash balance\ s\ Feedback\ TCheak My Work format given in the chapter.\ Step 1: Compare the deposits listed in the company's records with the deposits shown on the bank statement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started