Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bank Reconciliation: Identify whether the item should be added or subtracted from the bank balance or the company balance. Use the number (1-4) for

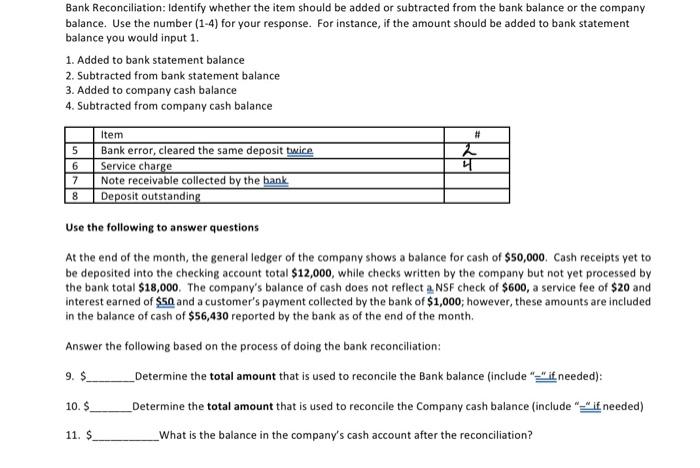

Bank Reconciliation: Identify whether the item should be added or subtracted from the bank balance or the company balance. Use the number (1-4) for your response. For instance, if the amount should be added to bank statement balance you would input 1. 1. Added to bank statement balance 2. Subtracted from bank statement balance 3. Added to company cash balance 4. Subtracted from company cash balance Item # 5 6 Bank error, cleared the same deposit twice Service charge 2 7 Note receivable collected by the bank 8 Deposit outstanding Use the following to answer questions At the end of the month, the general ledger of the company shows a balance for cash of $50,000. Cash receipts yet to be deposited into the checking account total $12,000, while checks written by the company but not yet processed by the bank total $18,000. The company's balance of cash does not reflect a NSF check of $600, a service fee of $20 and interest earned of $50 and a customer's payment collected by the bank of $1,000; however, these amounts are included in the balance of cash of $56,430 reported by the bank as of the end of the month. Answer the following based on the process of doing the bank reconciliation: 9. $ 10. $ 11. $ Determine the total amount that is used to reconcile the Bank balance (include "" if needed): Determine the total amount that is used to reconcile the Company cash balance (include "-"if needed) What is the balance in the company's cash account after the reconciliation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started