Answered step by step

Verified Expert Solution

Question

1 Approved Answer

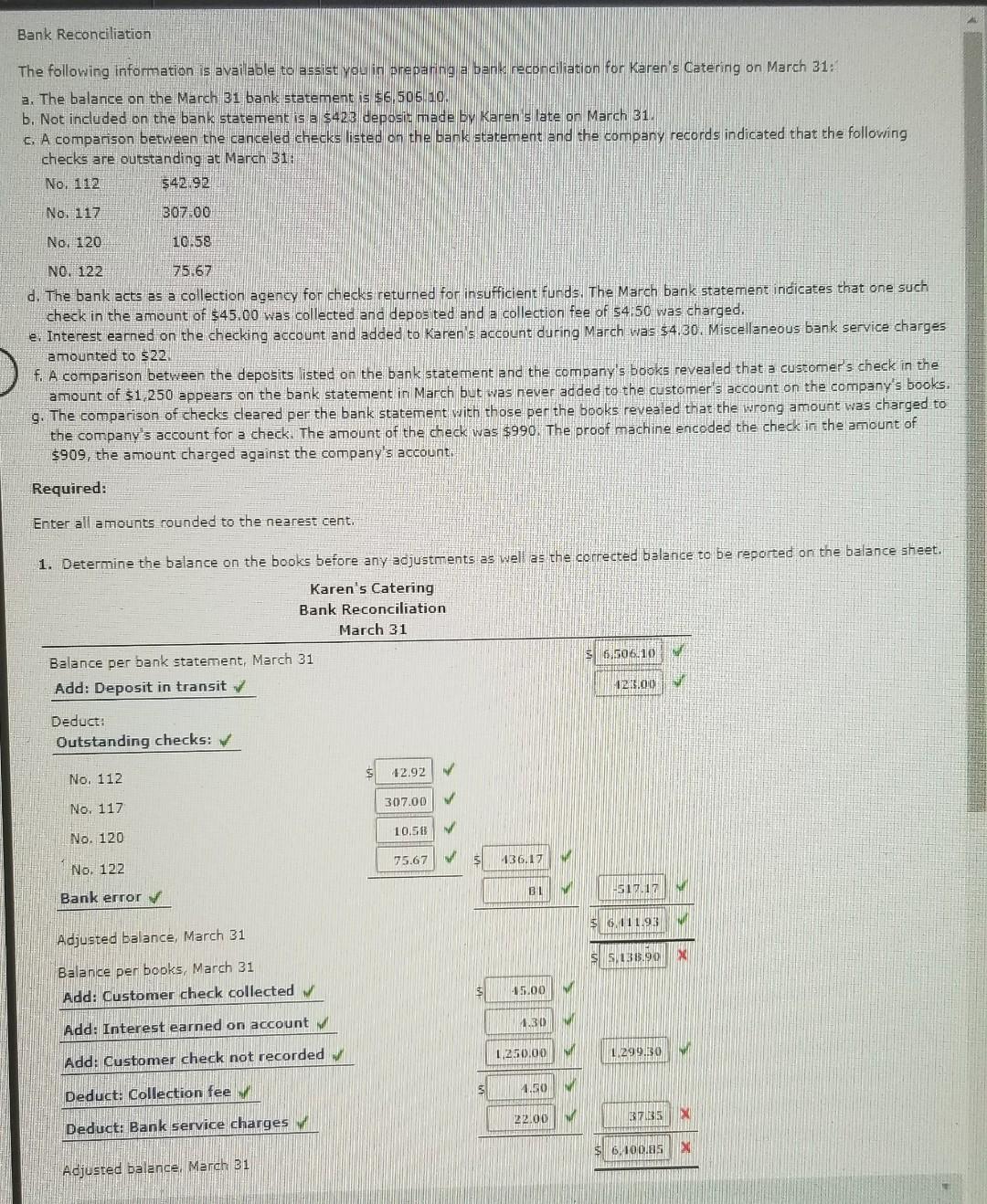

Bank Reconciliation The following information is available to assist you in preparing a bank reconciliation for Karen's Catering on March 31: a. The balance on

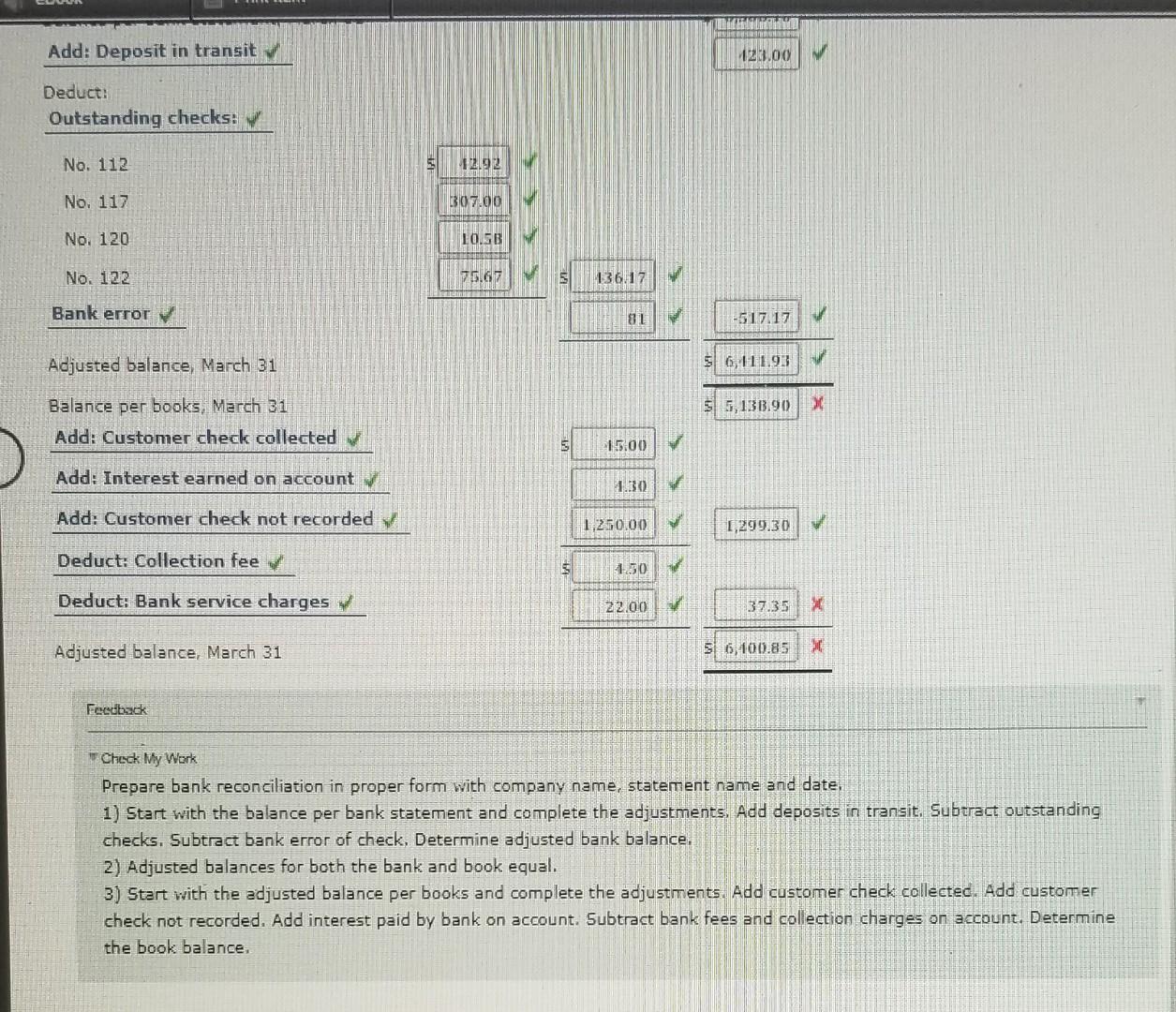

Bank Reconciliation The following information is available to assist you in preparing a bank reconciliation for Karen's Catering on March 31: a. The balance on the March 31 bank statement is $6,505.10. b. Not included on the bank statement is a $423 deposit made by Karen s late on March 31. 6. A comparison between the canceled checks listed on the bank statement and the company records indicated that the following checks are outstanding at March 31: No. 112 542.92 No. 117 307.00 No. 120 10:58 NO. 122 75.67 d. The bank acts as a collection agency for checks returned for insufficient Funds. The March bank statement indicates that one such check in the amount of $45.00 was collected and deposted and a collection fee of 54:50 was charged. e. Interest earned on the checking account and added to Karen's account during March was $4.30. Miscellaneous bank service charges amounted to $ 22 f. A comparison between the deposits listed on the bank statement and the company's books revealed that a customer's check in the amount of $1,250 appears on the bank statement in March but was never added to the customer's account on the company's books. 9. The comparison of checks deared per the bank statement with those per the books revealed that the wrong amount was charged to the company's account for a check. The amount of the check was $990. The proof machine encoded the check in the amount of $909, the amount charged against the company's account. Required: Enter all amounts rounded to the nearest cent, 1. Determine the balance on the books before any adjustments as well as the corrected balance to be reported on the balance sheet. Karen's Catering Bank Reconciliation March 31 Balance per bank statement, March 31 6.506.10 Add: Deposit in transit 1215.00 Deduct: Outstanding checks: No. 112 42.92 307.00 No. 117 10.50 No. 120 75.67 136.17 No. 122 BI -517.17 Bank error 5.11.93 Adjusted balance, March 31 136.90 Balance per books, March 31 Add: Customer check collected $ -15.00 1.30 Add: Interest earned on account 1,250.00 1.299.30 Add: Customer check not recorded 4.50 Deduct: Collection fee 22.00 37135 Deduct: Bank service charges $ 6,100.85 Adjusted balance, March 31 Add: Deposit in transit 120.00 Deduct: Outstanding checks: v No. 112 12.92 No. 117 307.00 No. 120 10.5B No. 122 73.GE 136.17 Bank error 01 -517.17 Adjusted balance, March 31 $ 6, 111.93 55,131.90 X Balance per books, March 31 Add: Customer check collected 15.00 Add: Interest earned on account Add: Customer check not recorded 1.250.00 1,299.30 Deduct: Collection fee 100 Deduct: Bank service charges you 22.00 37.35 Adjusted balance, March 31 56,100.85 Feedback Check My Work Prepare bank reconciliation in proper form with company name, statement name and date. 1) Start with the balance per bank statement and complete the adjustments. Add deposits in transit. Subtract outstanding checks. Subtract bank error of check, Determine adjusted bank balance. 2) Adjusted balances for both the bank and book equal. 3) Start with the adjusted balance per books and complete the adjustments. Add customer check collected. Add customer check not recorded. Add interest paid by bank on account. Subtract bank fees and collection charges on account. Determine the book balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started