Question

Bank reconciliations and cash The bank reconciliation for Party Supplies at 31 July 2018 is shown below: The August 2018 bank statement appeared as follows:

Bank reconciliations and cash

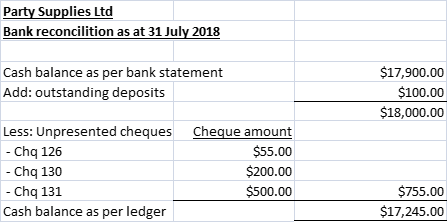

The bank reconciliation for Party Supplies at 31 July 2018 is shown below:

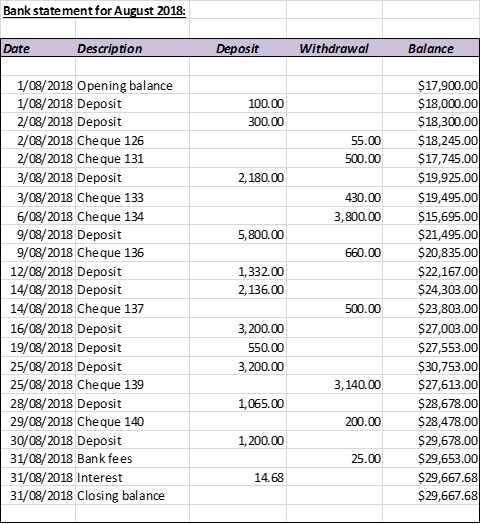

The August 2018 bank statement appeared as follows:

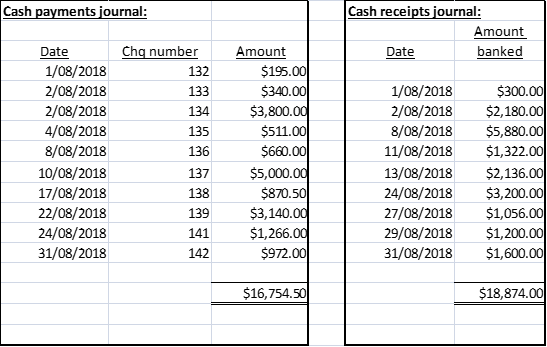

Party Supplies Ltd's accounting records for August 2018 showed the following:

The current balance in the bank ledger account (after the above receipts and payments have been entered) is: $17,245.00 + $18,874 deposits - $16,754.50 withdrawals = $19,364.50.

The companys bookkeeper has come to you for help, as she is having trouble reconciling the bank account on 31 August 2018.

Required:

i) Prepare the bank reconciliation for Party Supplies Ltd on 31 August 2018.

ii) Prepare the journal entries to correct any errors made by Party Supplies Ltd, and to record transactions that have not yet been entered into the companys accounting records. (Note: The correction of any errors relating to the recording of cheques should be made to Accounts payable. The correction of any errors relating to deposits (other than interest received) should be made to Accounts receivable.)

iii) Prepare the bank ledger account (using the T-Account format) for August 2018, in order to determine the balance in the account after the above journal entries have been recorded and posted.

What's missing now?

Party Supplies Ltd Bank reconcilition as at 31 July 2018 $17,900.00 $100.00 $18,000.00 Cash balance as per bank statement Add: outstanding deposits Less: Unpresented cheques Cheque amount $55.00 $200.00 $500.00 Chq 126 Chq 130 Chq 131 $755.00 $17,245.00 Cash balance as per ledger Bank statement for August 2018: Date Description osit Withdrawal Balance $17,900.00 $18,000.00 $18,300.00 55.00$18,245.00 $17,745.00 $19,925.00 $19,495.00 $15,695.00 $21,495.00 $20,835.00 $22,167.00 $24,303.00 $23,803.00 $27,003.00 $27,553.00 $30,753.00 $27,613.00 $28,678.00 $28,478.00 $29,678.00 $29,653.00 $29,667.68 $29,667.68 1/08/2018 Opening balance 1/08/2018 Deposit 2/08/2018 Deposit 2/08/2018 Cheque 126 2/08/2018 Cheque 131 3/08/2018 Deposit 3/08/2018 Cheque 133 6/08/2018 Cheque 134 9/08/2018 Deposit 9/08/2018 Cheque 136 12/08/2018 Deposit 14/08/2018 Deposit 14/08/2018 Cheque 137 16/08/2018 Deposit 19/08/2018 Deposit 25/08/2018 Deposit 25/08/2018 Cheque 139 28/08/2018 Deposit 29/08/2018 Cheque 140 30/08/2018 Deposit 31/08/2018 Bank fees 31/08/2018 Interest 31/08/2018 Closing balance 100.00 300.00 500.00 2,180.00 430.00 3,800.00 5,800.00 660.00 1,332.00 2,136.00 500.00 3,200.00 550.00 3,200.00 3,140.00 1,065.00 200.00 1,200.00 25.00 14.68 Cash payments journal Cash receipts iournal: Amount banked Cha number Date Amount Date 1/08/2018 2/08/2018 2/08/2018 4/08/2018 8/08/2018 10/08/2018 17/08/2018 22/08/2018 24/08/2018 31/08/2018 $195.00 $340.00 132 133 300.00 2/08/2018 $2,180.00 8/08/2018 $5,880.00 11/08/2018 $1,322.00 13/08/2018 $2,136.00 24/08/2018 $3,200.00 27/08/2018 $1,056.00 29/08/2018 $1,200.00 31/08/2018 $1,600.00 1/08/2018 $3,800 135 136 137 $511.00 $660.00 $5,000 $870.50 2 $3,140 $1,266 141 142 2 $972.00 516,754.50 $18,874.00 Party Supplies Ltd Bank reconcilition as at 31 July 2018 $17,900.00 $100.00 $18,000.00 Cash balance as per bank statement Add: outstanding deposits Less: Unpresented cheques Cheque amount $55.00 $200.00 $500.00 Chq 126 Chq 130 Chq 131 $755.00 $17,245.00 Cash balance as per ledger Bank statement for August 2018: Date Description osit Withdrawal Balance $17,900.00 $18,000.00 $18,300.00 55.00$18,245.00 $17,745.00 $19,925.00 $19,495.00 $15,695.00 $21,495.00 $20,835.00 $22,167.00 $24,303.00 $23,803.00 $27,003.00 $27,553.00 $30,753.00 $27,613.00 $28,678.00 $28,478.00 $29,678.00 $29,653.00 $29,667.68 $29,667.68 1/08/2018 Opening balance 1/08/2018 Deposit 2/08/2018 Deposit 2/08/2018 Cheque 126 2/08/2018 Cheque 131 3/08/2018 Deposit 3/08/2018 Cheque 133 6/08/2018 Cheque 134 9/08/2018 Deposit 9/08/2018 Cheque 136 12/08/2018 Deposit 14/08/2018 Deposit 14/08/2018 Cheque 137 16/08/2018 Deposit 19/08/2018 Deposit 25/08/2018 Deposit 25/08/2018 Cheque 139 28/08/2018 Deposit 29/08/2018 Cheque 140 30/08/2018 Deposit 31/08/2018 Bank fees 31/08/2018 Interest 31/08/2018 Closing balance 100.00 300.00 500.00 2,180.00 430.00 3,800.00 5,800.00 660.00 1,332.00 2,136.00 500.00 3,200.00 550.00 3,200.00 3,140.00 1,065.00 200.00 1,200.00 25.00 14.68 Cash payments journal Cash receipts iournal: Amount banked Cha number Date Amount Date 1/08/2018 2/08/2018 2/08/2018 4/08/2018 8/08/2018 10/08/2018 17/08/2018 22/08/2018 24/08/2018 31/08/2018 $195.00 $340.00 132 133 300.00 2/08/2018 $2,180.00 8/08/2018 $5,880.00 11/08/2018 $1,322.00 13/08/2018 $2,136.00 24/08/2018 $3,200.00 27/08/2018 $1,056.00 29/08/2018 $1,200.00 31/08/2018 $1,600.00 1/08/2018 $3,800 135 136 137 $511.00 $660.00 $5,000 $870.50 2 $3,140 $1,266 141 142 2 $972.00 516,754.50 $18,874.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started