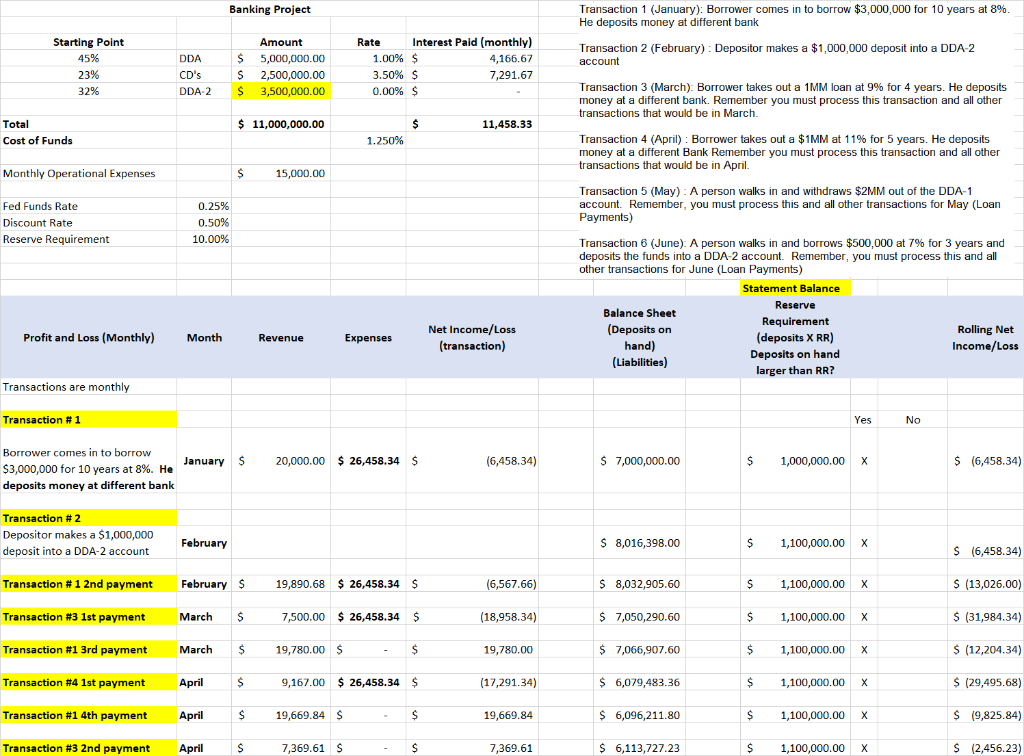

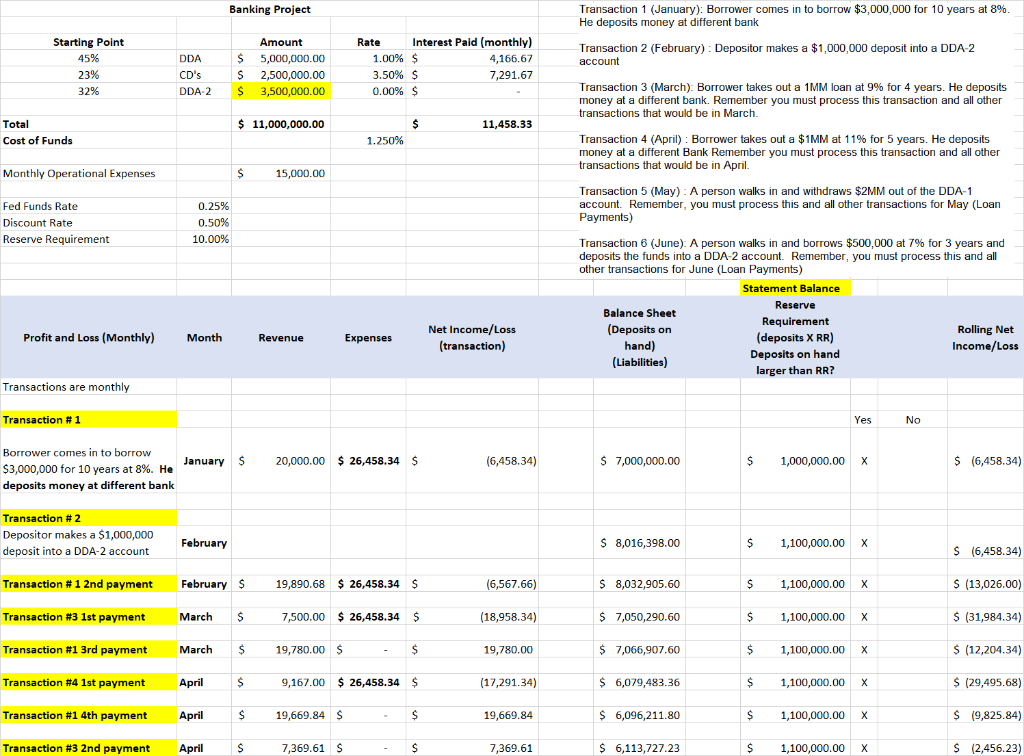

Banking Project Transaction 1 (January): Borrower comes in to borrow $3,000,000 for 10 years at 8%. He deposits money at different bank Starting Point 45% 23% 32% DDA Transaction 2 (February) : Depositor makes a $1,000,000 deposit into a DDA-2 account Rate Interest Paid (monthly) 1.00% $ 4,166.67 3.50% $ 7,291.67 0.00% $ Amount $ 5,000,000.00 $ 2,500,000.00 S 3,500,000.00 CD's DDA 2 Transaction 3 (March). Borrower takes out a 1MM loan at 9% for 4 years. He deposits money at a different bank. Remember you must process this transaction and all other transactions that would be in March. $ 11,000,000.00 $ 11,458.33 Total Cost of Funds 1.250% Transaction 4 (April) : Borrower takes out a $1MM at 11% for 5 years. He deposits money at a different Bank Remember you must process this transaction and all other transactions that would be in April. Monthly Operational Expenses $ 15,000.00 Transaction 5 (May): A person walks in and withdraws $2MM out of the DDA-1 account. Remember, you must process this and all other transactions for May (Loan Payments) Fed Funds Rate Discount Rate Reserve Requirement 0.25% 0.50% 10.00% Transaction 6 (June). A person walks in and borrows $500,000 at 7% for 3 years and deposits the funds into a DDA-2 account. Remember, you must process this and all other transactions for June (Loan Payments) Statement Balance Balance Sheet Requirement (Deposits on Rolling Net (deposits X RR) hand) Income/Loss Deposits on hand (Liabilities) larger than RR? Reserve Profit and Loss (Monthly) Month Revenue Expenses Net Income/Loss (transaction) Transactions are monthly Transaction #1 Yes No January $ 20,000.00 $ 26,458.34 $ (6,458.34) $ 7,000,000.00 $ 1,000,000.00 $ 16,458.34) Borrower comes in to borrow $3,000,000 for 10 years at 8%. He deposits money at different bank Transaction # 2 Depositor makes a $1,000,000 deposit into a DDA-2 account February $ 8,016,398.00 $ 1,100,000.00 X $ 16,458.34) Transaction # 1 2nd payment February $ 19,890.68 $ 26,458.34 $ (6,567.66) $ 8,032,905.60 $ 1,100,000.00 X S (13,026.00) Transaction #3 1st payment March $ 7,500.00 $ 26,458.34 $ (18,958.34) $ 7,050,290.60 $ 1.100,000.00 X $ (31,984.34) Transaction #1 3rd payment March $ 19,780.00 $ $ 19,780.00 $ 7,066,907.60 $ 1,100,000.00 $ (12,204.34) Transaction #4 1st payment April $ 9,167.00 $ 26,458.34 $ (17,291.34) $ 6,079,483.36 $ 1,100,000.00 $ (29,495.68) Transaction #1 4th payment April $ 19,669.84 $ $ 19,669.84 $ 6,096,211.80 $ 1,100,000.00 X $ 19,825.84) Transaction #3 2nd payment April S 7,369.61 S $ 7,369.61 $ 6,113,727.23 $ 1,100,000.00 X S (2,456.23) Banking Project Transaction 1 (January): Borrower comes in to borrow $3,000,000 for 10 years at 8%. He deposits money at different bank Starting Point 45% 23% 32% DDA Transaction 2 (February) : Depositor makes a $1,000,000 deposit into a DDA-2 account Rate Interest Paid (monthly) 1.00% $ 4,166.67 3.50% $ 7,291.67 0.00% $ Amount $ 5,000,000.00 $ 2,500,000.00 S 3,500,000.00 CD's DDA 2 Transaction 3 (March). Borrower takes out a 1MM loan at 9% for 4 years. He deposits money at a different bank. Remember you must process this transaction and all other transactions that would be in March. $ 11,000,000.00 $ 11,458.33 Total Cost of Funds 1.250% Transaction 4 (April) : Borrower takes out a $1MM at 11% for 5 years. He deposits money at a different Bank Remember you must process this transaction and all other transactions that would be in April. Monthly Operational Expenses $ 15,000.00 Transaction 5 (May): A person walks in and withdraws $2MM out of the DDA-1 account. Remember, you must process this and all other transactions for May (Loan Payments) Fed Funds Rate Discount Rate Reserve Requirement 0.25% 0.50% 10.00% Transaction 6 (June). A person walks in and borrows $500,000 at 7% for 3 years and deposits the funds into a DDA-2 account. Remember, you must process this and all other transactions for June (Loan Payments) Statement Balance Balance Sheet Requirement (Deposits on Rolling Net (deposits X RR) hand) Income/Loss Deposits on hand (Liabilities) larger than RR? Reserve Profit and Loss (Monthly) Month Revenue Expenses Net Income/Loss (transaction) Transactions are monthly Transaction #1 Yes No January $ 20,000.00 $ 26,458.34 $ (6,458.34) $ 7,000,000.00 $ 1,000,000.00 $ 16,458.34) Borrower comes in to borrow $3,000,000 for 10 years at 8%. He deposits money at different bank Transaction # 2 Depositor makes a $1,000,000 deposit into a DDA-2 account February $ 8,016,398.00 $ 1,100,000.00 X $ 16,458.34) Transaction # 1 2nd payment February $ 19,890.68 $ 26,458.34 $ (6,567.66) $ 8,032,905.60 $ 1,100,000.00 X S (13,026.00) Transaction #3 1st payment March $ 7,500.00 $ 26,458.34 $ (18,958.34) $ 7,050,290.60 $ 1.100,000.00 X $ (31,984.34) Transaction #1 3rd payment March $ 19,780.00 $ $ 19,780.00 $ 7,066,907.60 $ 1,100,000.00 $ (12,204.34) Transaction #4 1st payment April $ 9,167.00 $ 26,458.34 $ (17,291.34) $ 6,079,483.36 $ 1,100,000.00 $ (29,495.68) Transaction #1 4th payment April $ 19,669.84 $ $ 19,669.84 $ 6,096,211.80 $ 1,100,000.00 X $ 19,825.84) Transaction #3 2nd payment April S 7,369.61 S $ 7,369.61 $ 6,113,727.23 $ 1,100,000.00 X S (2,456.23)