Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Banks are finding more ways to charge fees, such as a $33.60 overdraft fee. Sue McVickers has an account in Fayetteville; she has received

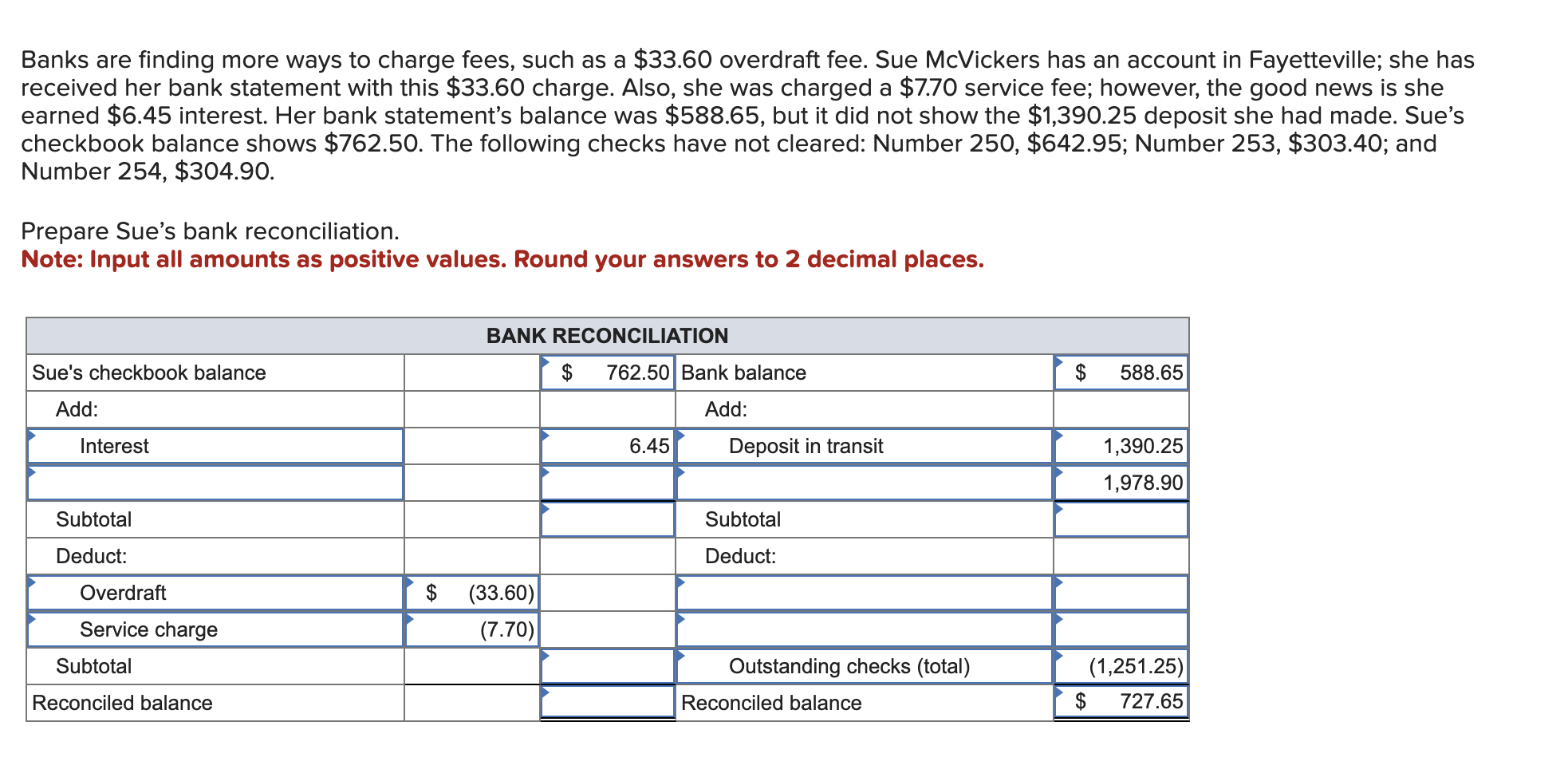

Banks are finding more ways to charge fees, such as a $33.60 overdraft fee. Sue McVickers has an account in Fayetteville; she has received her bank statement with this $33.60 charge. Also, she was charged a $7.70 service fee; however, the good news is she earned $6.45 interest. Her bank statement's balance was $588.65, but it did not show the $1,390.25 deposit she had made. Sue's checkbook balance shows $762.50. The following checks have not cleared: Number 250, $642.95; Number 253, $303.40; and Number 254, $304.90. Prepare Sue's bank reconciliation. Note: Input all amounts as positive values. Round your answers to 2 decimal places. Sue's checkbook balance Add: Interest Subtotal Deduct: BANK RECONCILIATION $ 762.50 Bank balance Add: 6.45 Deposit in transit Overdraft $ (33.60) Service charge (7.70) Subtotal Reconciled balance Subtotal Deduct: $ 588.65 1,390.25 1,978.90 Outstanding checks (total) (1,251.25) Reconciled balance $ 727.65

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To prepare Sues bank reconciliation we need to go through the information provided step by step 1 St...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started