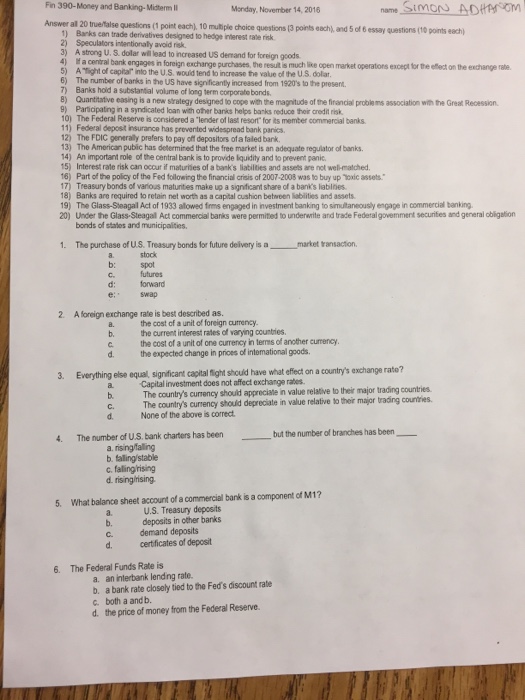

Banks can trade derivatives designed to hedge interest rate risk. Speculators intentionally avoid risk. A strong U.S. dollar will lead to increased US demand for foreign goods. If a central bank engages in foreign exchange purchases, the result is much like open market operations except for the effect on the exchange rate. A "flight of capital" into the U.S. would tend to increase the value of the U.S, dollar. The number of banks in the U.S. have significantly increased from 1920's to the present. Banks hold a substantial volume of long term corporate bonds. Quantitative easing is a new strategy designed to cope with the magnitude of the financial problems with the Great Recession. Participating in a syndicated loan with other banks helps banks reduce their credit risk. The federal Reserve is considered a "lender of last resort" for its member commercial banks. Federal deposit insurance has prevented widespread bank panics. The FDIC generally prefers to pay off depositors of a failed bank. The American public has determined that the free market is an adequate regulator of banks. An important role of the central bank is to provide liquidity and to prevent panic Interest rate risk can occur if maturities of a bank's liabilities and assets are not well-matched Part of the policy of the Fed following the financial crisis of 2007-2003 was to buy up "toxic assets." Treasury bonds of various maturities make up a significant share of a bank's liabilities. Banks are required to retain net worth as a capital cushion between liabilities and assets The Glass-Steagall Act of 1933 allowed firms engaged in investment banking to simultaneously engage in commercial banking Under the Glass-Steagall Act commercial banks were permitted to underwrite and trade Federal government securities and general obligation bonds of states and municipalities. The purchase of U.S. Treasury bonds for future delivery is a ___ market transaction. stock spot futures forward swap A foreign exchange rate is best described as. the cost of a unit of foreign currency the current interest rates of varying countries the cost of unit of one currency in terms of another currency. the expected change in prices of international goods Everything else equal, significant capital flight should have what effect on a country's exchange ratio? Capital investment does not affect exchange rates The country's currency should appreciate in value relative to their major trading countries The country's currency should depreciate in value relative to their major trading countries None of the above is correct. The number of U, S. bank charters has been ___ but the number of branches has been _____ rising/falling falling/stable falling/rising rising/rising What balance sheet account of a commercial bank is a component of M1? U.S. Treasury deposits deposits in other banks demand deposits certificates deposit The Federal Funds Rate is an interbank lending rate a bank rate closely tied to the Fed's discount rate both a and b the price of money from the Federal Reserve. Banks can trade derivatives designed to hedge interest rate risk. Speculators intentionally avoid risk. A strong U.S. dollar will lead to increased US demand for foreign goods. If a central bank engages in foreign exchange purchases, the result is much like open market operations except for the effect on the exchange rate. A "flight of capital" into the U.S. would tend to increase the value of the U.S, dollar. The number of banks in the U.S. have significantly increased from 1920's to the present. Banks hold a substantial volume of long term corporate bonds. Quantitative easing is a new strategy designed to cope with the magnitude of the financial problems with the Great Recession. Participating in a syndicated loan with other banks helps banks reduce their credit risk. The federal Reserve is considered a "lender of last resort" for its member commercial banks. Federal deposit insurance has prevented widespread bank panics. The FDIC generally prefers to pay off depositors of a failed bank. The American public has determined that the free market is an adequate regulator of banks. An important role of the central bank is to provide liquidity and to prevent panic Interest rate risk can occur if maturities of a bank's liabilities and assets are not well-matched Part of the policy of the Fed following the financial crisis of 2007-2003 was to buy up "toxic assets." Treasury bonds of various maturities make up a significant share of a bank's liabilities. Banks are required to retain net worth as a capital cushion between liabilities and assets The Glass-Steagall Act of 1933 allowed firms engaged in investment banking to simultaneously engage in commercial banking Under the Glass-Steagall Act commercial banks were permitted to underwrite and trade Federal government securities and general obligation bonds of states and municipalities. The purchase of U.S. Treasury bonds for future delivery is a ___ market transaction. stock spot futures forward swap A foreign exchange rate is best described as. the cost of a unit of foreign currency the current interest rates of varying countries the cost of unit of one currency in terms of another currency. the expected change in prices of international goods Everything else equal, significant capital flight should have what effect on a country's exchange ratio? Capital investment does not affect exchange rates The country's currency should appreciate in value relative to their major trading countries The country's currency should depreciate in value relative to their major trading countries None of the above is correct. The number of U, S. bank charters has been ___ but the number of branches has been _____ rising/falling falling/stable falling/rising rising/rising What balance sheet account of a commercial bank is a component of M1? U.S. Treasury deposits deposits in other banks demand deposits certificates deposit The Federal Funds Rate is an interbank lending rate a bank rate closely tied to the Fed's discount rate both a and b the price of money from the Federal Reserve